Moody s Corporation What It Does and How Its Credit Ratings Work

Contents

- 1 Moody’s Corporation: What It Does and How Credit Ratings Work

- 1.1 What Is Moody’s?

- 1.2 What Does Moody’s Investors Service Do?

- 1.3 Moody’s History

- 1.4 Moody’s and the 2007-2008 Financial Crisis

- 1.5 How Moody’s Credit Ratings Work

- 1.6 How Moody’s Ratings Are Used

- 1.7 Are Credit Ratings the Same Thing as Credit Scores?

- 1.8 Does Moody’s Provide Credit Scores for Consumers?

- 1.9 What Is a Mortgage-Backed Security?

- 1.10 The Bottom Line

Moody’s Corporation: What It Does and How Credit Ratings Work

What Is Moody’s?

Moody’s Corporation (MCO) is a New York-based company that owns Moody’s Investors Service, which rates the creditworthiness of companies, governments, and debt securities, and Moody’s Analytics, which provides software and research for economic analysis and risk management. It also owns other companies.

Key Takeaways

- Moody’s Corporation owns Moody’s Investors Service and Moody’s Analytics.

- Moody’s Investors Service provides credit ratings for companies, governments, and securities.

- Moody’s Analytics develops software and tools for risk management and economic research.

- During the 2007-2008 financial crisis, Moody’s and other rating agencies were criticized for giving high ratings to mortgage-backed securities consisting of risky subprime loans.

What Does Moody’s Investors Service Do?

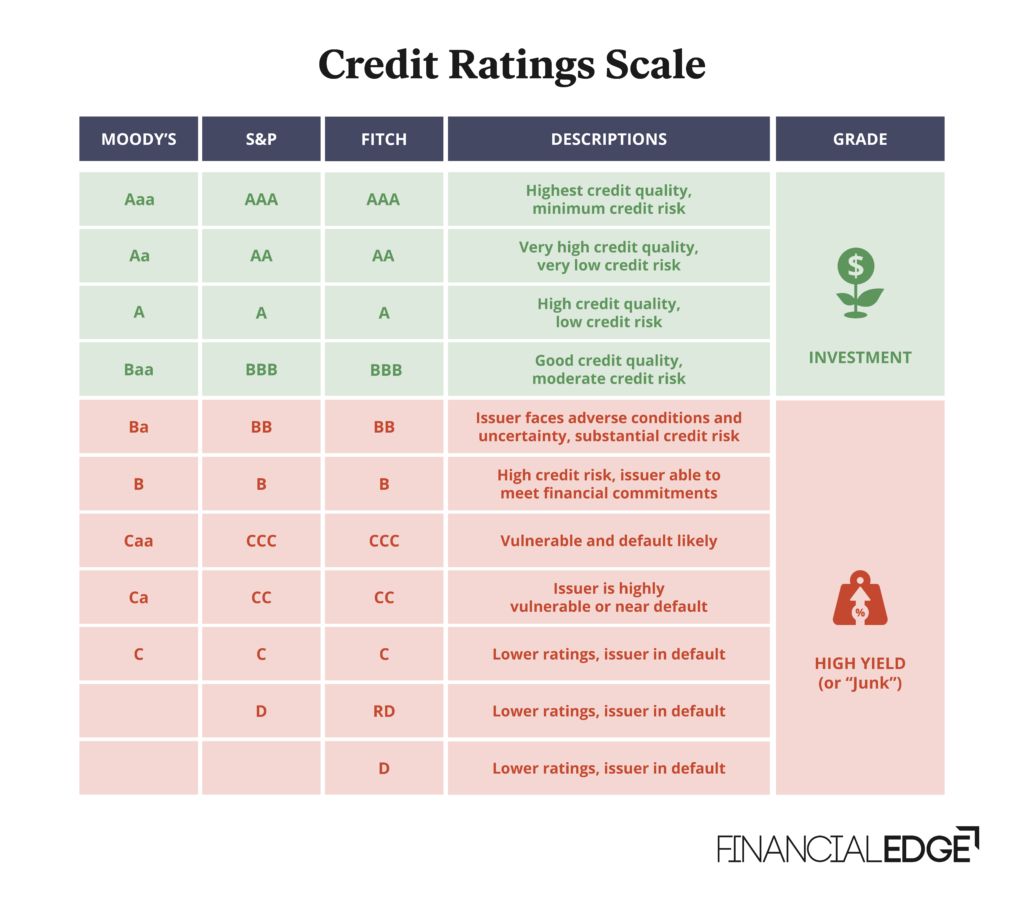

Investors worldwide pay close attention to Moody’s ratings of corporate and government securities. Moody’s ratings of long-term corporate obligations, for example, go from Aaa, the highest grade for top-quality issuers believed to pose the lowest risk, down to C, a grade given to defaulted securities.

Moody’s History

Moody’s Corporation began in 1900 with "Moody’s Manual of Industrial and Miscellaneous Securities," which provided information about stocks and bonds of financial institutions, government agencies, and companies in various industries. The company sold the publication after the Bank Panic of 1907.

In 1909, John Moody returned to financial publishing with "Moody’s Analyses of Railroad Investments," which offered investors his analysis of a railroad’s operations and finances. Moody’s Investors Service was established in 1914, providing ratings for industrial companies, utilities, and government bonds. It was later bought by Dun & Bradstreet and spun off in 2000.

Note

Moody’s Investor Services downgraded its outlook for the U.S. economy to "negative" from "stable" in November 2023, citing increased risks from growing fiscal deficits.

In 1975, the U.S. Securities and Exchange Commission (SEC) recognized Moody’s as a statistical rating organization, along with S&P and Fitch. Credit ratings from these organizations are required by many financial institutions and are considered in regulatory requirements.

Moody’s subsidiaries and affiliates employ over 14,000 people in more than 40 countries. Recent acquisitions focused on real estate, cybersecurity, and ESG expertise.

Moody’s and the 2007-2008 Financial Crisis

Moody’s and other rating agencies faced criticism for giving high ratings to mortgage-backed securities that consisted of risky subprime loans during the financial crisis. The agencies’ complex models failed to consider a nationwide decline in housing prices and its impact on bond performance.

In 2007, Moody’s downgraded 83% of Aaa-rated mortgage securities. Some observers blamed the conflict of interest caused by issuers paying for ratings. Moody’s competitor S&P paid fines to resolve allegations of misleading investors.

Moody’s was also criticized for downgrading sovereign credit ratings during the Eurozone debt crisis.

The Dodd-Frank Wall Street Reform and Consumer Protection Act established the Office of Credit Ratings within the SEC to supervise rating agencies and prevent conflicts of interest.

How Moody’s Credit Ratings Work

Moody’s analysts evaluate an entity’s financial health, management practices, industry trends, and economic conditions. They use quantitative and qualitative factors to assess credit risk.

Moody’s assigns credit ratings using a standardized scale that indicates the likelihood of default. The scale ranges from Aaa (highest credit quality) to C (default likely), with various grades in between. Factors considered include financial ratios, cash flow, market position, and management quality.

Higher risk ratings are not necessarily bad, as they may indicate higher earning potential for risk-seeking investors.

How Moody’s Ratings Are Used

Moody’s ratings are used by institutions and individuals for risk assessment and decision-making. Institutional investors, such as mutual funds and insurance companies, use ratings to diversify portfolios and manage risk. Retail investors rely on ratings when buying stocks and bonds.

Banks and lenders use ratings to evaluate creditworthiness and determine loan terms. Companies issuing debt consult ratings to understand credit risk assessment by potential investors.

Regulatory bodies and government agencies use ratings to assess financial stability and set regulatory requirements.

Are Credit Ratings the Same Thing as Credit Scores?

Credit ratings are assigned to entities and their debt, while credit scores are given to individual consumers. Both assess the likelihood of debt repayment.

Does Moody’s Provide Credit Scores for Consumers?

No, Moody’s does not provide credit scores for consumers. Credit scores are based on information in credit reports issued by major credit bureaus and scored by FICO and VantageScore.

What Is a Mortgage-Backed Security?

A mortgage-backed security is a pool of mortgages bundled and sold to investors.

The Bottom Line

Moody’s is a large corporation dating back to the 20th century, providing credit ratings for companies, governments, and debt issuance. Its ratings are widely used in financial markets and banking regulation.