Unrecaptured Section 1250 Gain What It Is How It Works and Example

Unrecaptured Section 1250 Gain: What It Is, How It Works, and Example

What Is an Unrecaptured Section 1250 Gain?

Unrecaptured section 1250 gain is a tax provision where recognized depreciation is recaptured into income upon the sale of depreciable real estate property.

Unrecaptured section 1250 gains are taxed at a maximum 25% tax rate and are calculated on a worksheet within the instructions for Schedule D, reported on Schedule D, and carried through to the taxpayer’s 1040.

Key Takeaways

– An unrecaptured section 1250 gain recaptures previously used depreciation allowances.

– It only applies to the sale of depreciable real estate.

– Unrecaptured section 1250 gains are usually taxed at a maximum 25% rate.

– Section 1250 gains can be offset by 1231 capital losses.

– Section 1250 applies to real property, whereas Section 1245 applies to personal property.

How Unrecaptured Section 1250 Gains Work

Section 1231 assets include all depreciable capital assets held for over one year. Section 1231 determines the tax rate for depreciation recapture.

Section 1250 specifically relates to real property, like buildings and land, while section 1245 applies to personal property, such as machinery and equipment.

Unrecaptured section 1250 gains are only realized with a net Section 1231 gain. Capital losses offset unrecaptured section 1250 gains on real estate, reducing the gain to zero.

A section 1250 gain recaptures depreciation upon the sale of real estate. Depreciation gains are taxed at the section 1250 recapture tax rate, while remaining gains are subject to the long-term capital gains rate.

Example of Unrecaptured Section 1250 Gains

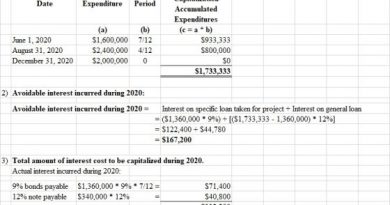

If a property was purchased for $150,000 and $30,000 of depreciation claimed, the adjusted cost basis would be $120,000. A sale for $185,000 results in an overall gain of $65,000.

The first $30,000 of profit is subject to the unrecaptured section 1250 gain, while the remaining $35,000 is taxed at the long-term capital gains rate.

Special Considerations

Unrecaptured section 1250 gains can be offset by capital losses, reported through Form 8949 and Schedule D.

Short-term losses can only offset short-term gains, and long-term losses can only offset long-term gains.

Examples of 1250 Property

Section 1250 property includes commercial buildings or residential rental property. Commercial buildings are MACRS 39-year real property, while residential rental property is 27.5-year property.

How Can You Avoid Paying Back Depreciation Recapture?

You can avoid paying tax on depreciation recapture by turning a residential property into a primary residence, conducting a 1031 tax-deferred exchange, or receiving the property on a stepped-up basis after the owner passes away.

How Much Tax Do I Pay on Unrecaptured Section 1250 Gain?

The maximum rate for unrecaptured section 1250 gains is 25%.

How Do I Calculate Section 1250 Recapture?

Section 1250 is calculated as the smaller of the excess of accelerated depreciation claimed on real property or the gain realized upon disposition.

What Triggers Depreciation Recapture?

Depreciation recapture occurs when there is a difference between the sale price and the adjusted cost basis. This difference is reported as ordinary income.

The Bottom Line

Section 1250 gain refers to the taxable gain from the sale of depreciable real property. Upon selling a depreciable asset, a portion of the claimed depreciation is recaptured at the section 1250 recapture rate, typically 25%.