Risk Averse What It Means Investment Choices and Strategies

Risk Averse: What It Means, Investment Choices, and Strategies

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling, and both the Retirement Income Certified Professional® and Certified Retirement Counselor designations for advanced retirement planning.

Contents

- 1 What Is Risk Averse?

- 2 Understanding Risk Averse

- 3 Risk-Averse Investment Products

- 4 Risk Averse Investment Strategies

- 5 Advantages and Disadvantages of Being Risk Averse

- 6 Which Types of People Are More Risk Averse?

- 7 Is It Good to Be Risk Averse?

- 8 How Can I Tell If I Am a Risk Averse Investor?

- 9 Is Risk Aversion the Same As Loss Aversion?

- 10 The Bottom Line

What Is Risk Averse?

Risk aversion is the tendency to avoid risk. The term risk-averse describes an investor who chooses capital preservation over higher-than-average returns. In investing, risk equals price volatility. A conservative investment grows slowly and steadily over time.

Low-risk means more stability. A low-risk investment guarantees a reasonable return, with a near-zero chance of losing the original investment. The return on a low-risk investment matches or slightly exceeds inflation over time. A high-risk investment may gain or lose a significant amount of money.

Risk averse can be contrasted with risk seeking.

Key Takeaways

- Risk aversion is the tendency to avoid risk and have a low risk tolerance.

- Risk-averse investors prioritize the safety of principal over higher returns.

- They prefer liquid investments that can be accessed regardless of market conditions.

- Risk-averse investors generally favor municipal and corporate bonds, CDs, and savings accounts.

Understanding Risk Averse

The term risk-neutral describes an individual who evaluates investment alternatives solely on potential gains, ignoring the risk. However, the risk-averse investor chooses safety over a large gain.

Risk-Averse Investment Choices

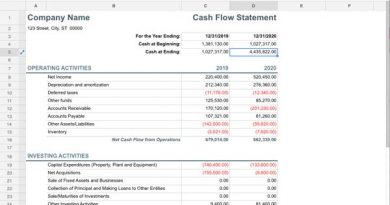

Risk-averse investors typically choose savings accounts, CDs, municipal and corporate bonds, and dividend growth stocks. These investments guarantee the preservation of the original amount invested.

Dividend growth stocks are shares of mature companies with a steady flow of income that regularly pay dividends. These stocks have less volatility than stocks purchased for capital appreciation.

Risk-Averse Attributes

Risk-averse investors, also known as conservative investors, avoid volatility in their portfolios and prioritize high liquidity. This is particularly true for older investors and retirees who do not want to risk their decades-long nest eggs.

Risk-Averse Investment Products

Savings Accounts

High-yield savings accounts from banks or credit unions provide stable returns with no investment risk. These accounts are insured by the Federal Deposit Insurance Corp. (FDIC) and the National Credit Union Administration (NCUA) up to generous limits.

Certificates of Deposit (CDs)

Risk-averse investors choose CDs for long-term investments. While they pay slightly more than savings accounts, early withdrawals come with penalties. Reinvestment risk and bank failure risk are potential downsides of investing in CDs.

Money Market Funds

Money market funds invest in low-risk debt instruments and cash equivalents. These funds are very low-risk and tend to pay lower interest rates to investors.

Bonds

Treasury securities, or U.S. federal government debt, are considered the safest. Municipal and corporate bonds also pay a steady interest income stream, with municipal bonds offering tax advantages. Investors prefer bonds issued by stable governments and healthy corporations.

Dividend Growth Stocks

Dividend growth stocks provide predictable dividend payments that help offset losses during stock price downturns. These stocks belong to companies in defensive sectors that are less affected by economic downturns.

Permanent Life Insurance

Permanent life insurance provides cash accumulation features, tax advantages, and living benefits that attract risk-averse investors. The cash value in a policy grows over time and can be withdrawn or borrowed against.

Risk Averse Investment Strategies

Diversification and income investing are common risk-averse investment strategies. Diversification reduces overall portfolio risk by spreading investments across assets and asset classes. Income investing focuses on holding fixed-income securities that generate regular cash flows. Saving is low risk, but not investing.

Advantages and Disadvantages of Being Risk Averse

Risk-averse investors minimize the risk of losses and enjoy steady income and guaranteed cash flows. However, they tend to experience lower total returns and miss out on potentially greater returns.

Pros and Cons of Being Risk Averse

- Minimizes risk of losses

- Generates steady income

- Guaranteed cash flows

- Lower expected returns, especially over time

- Missed opportunities (opportunity cost)

- Inflation erodes buying power of savings

Which Types of People Are More Risk Averse?

Research shows that risk aversion varies among people. Older individuals, lower-income individuals, and women tend to be more risk-averse.

Is It Good to Be Risk Averse?

Being risk averse has advantages and disadvantages. While it reduces the chances of losses, it can also lead to missed opportunities and lower returns. Money kept idle may lose buying power due to inflation.

How Can I Tell If I Am a Risk Averse Investor?

You can assess your risk tolerance by taking online risk profiling questionnaires or evaluations offered by brokerage firms or financial advisors.

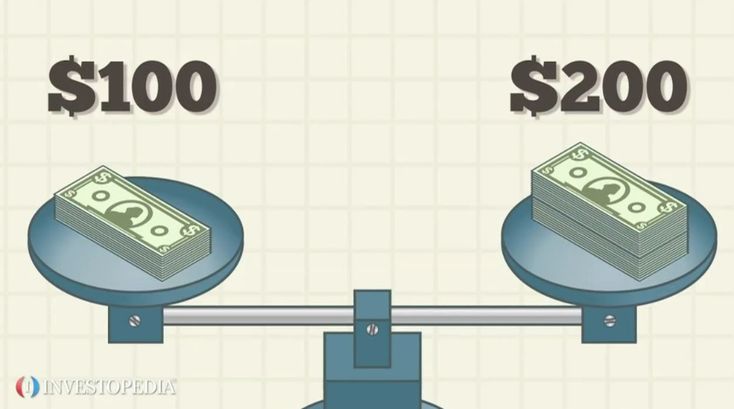

Is Risk Aversion the Same As Loss Aversion?

No, risk aversion and loss aversion are different. Risk aversion refers to avoiding risk, while loss aversion is the tendency to feel the pain of a loss more than the pleasure of an equivalent gain. Risk aversion can be rational, while loss aversion is an irrational tendency.

The Bottom Line

Risk-averse investors prioritize capital preservation and choose conservative investments. While this reduces the risk of losses, it also limits expected returns and may result in missed opportunities. Being risk-averse requires finding a balance between minimizing risk and seeking appropriate returns.