Mortgage Cash Flow Obligation MCFO Meaning Risks Structure

Contents

Mortgage Cash Flow Obligation (MCFO): Meaning, Risks, Structure

What Is a Mortgage Cash Flow Obligation (MCFO)?

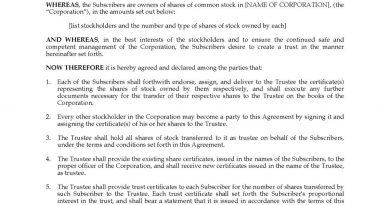

A mortgage cash flow obligation (MCFO) is a type of mortgage pass-through unsecured general obligation bond with multiple classes or tranches. MCFOs use cash flow from a pool of mortgages to repay investors their principal and interest. Payments are received from the mortgages in the pool and passed on to MCFO security holders.

Understanding Mortgage Cash Flow Obligation (MCFO)

Mortgage cash flow obligations (MCFOs) resemble collateralized mortgage obligations (CMOs) but are different. MCFOs do not hold a lien on the mortgages held by the security. They are only obligated by contract to use the income from the mortgages to pay investors. MCFO owners have no legal rights to the underlying mortgages, making MCFOs riskier than CMOs.

Like CMOs, MCFOs are mortgage-backed securities created through securitization of individual residential mortgages. They draw interest and principal payments from a specific pool of mortgages. Due to lack of legal protections, MCFOs typically offer higher coupon rates.

Risks and Structure of Mortgage Cash Flow Obligations

MCFOs, like CMOs, package mortgages into tranches with different payment characteristics and risk profiles. The tranches are paid back in a specified order, with the highest rated tranches having credit enhancement that protects against prepayment risk and repayment default. MCFO performance is influenced by changes in interest rates, foreclosure rates, refinance rates, and home sales pace.

The stated maturities of MCFO tranches are based on the expected date of final mortgage principal payment. However, these maturities do not account for prepayments of underlying mortgage loans and may not accurately represent MBS risks. Many loans are paid off earlier due to home sales or refinancings despite most mortgage pass-through securities being collateralized by 30-year fixed-rate mortgages.

CMOs, MCFOs, and other non-agency mortgage-backed securities were at the center of the financial crisis that led to the bankruptcy of Lehman Brothers in 2008. This crisis resulted in trillions of dollars in losses on mortgage loans and millions of homeowners losing their homes to default.

Following the financial crisis, government agencies increased regulation of mortgage-backed securities and forced lenders to improve transparency and qualifying standards for subprime loans. In December 2016, the SEC and FINRA introduced rules to mitigate MBS risk through margin requirements for CMO and related MBS transactions.