Upside Tasuki Gap What it is How it Works Example

Contents

Upside Tasuki Gap: What it is, How it Works, Example

Tim Smith has over 20 years of experience in the financial services industry as both a writer and trader.

What Is an Upside Tasuki Gap?

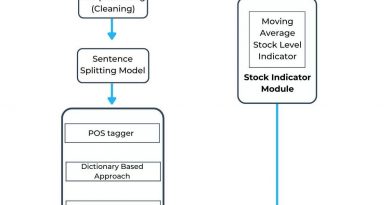

An Upside Tasuki Gap is a three-bar candlestick formation used to signal the continuation of the current trend.

- The first bar is a large white/green candlestick in an uptrend.

- The second bar is another white/green candlestick with an opening price that has gapped above the previous close.

- The third bar is a black/red candlestick that partially closes the gap between the first two bars.

Key Takeaways

- The Upside Tasuki Gap signals the continuation of the current uptrend.

- The third candle partially closes the gap between the first two bars.

- Traders often use other gap patterns along with the Upside Tasuki Gap to confirm bullish price action.

Understanding the Upside Tasuki Gap

The Upside Tasuki Gap demonstrates an uptrend’s strength through the pattern’s second candle gap open and escalating price. The third candle indicates a pause in the trend as bears attempt to move the price lower but cannot close the gap between the first and second candle. The bears’ inability to close the gap suggests the uptrend will continue.

Traders may also refer to the pattern as a Bullish Tasuki Gap or the Upward Gap Tasuki. Its adverse counterpart, in a bearish market, is known as a Downward Tasuki Gap. Both patterns likely originated from Japanese technical analysis.

The Upside Tasuki Gap is one of many gap patterns that can form during a bullish trend. Supporting uptrend gap patterns are usually used with the Upside Tasuki Gap to add confirmation to a bullish trading strategy.

Gaps are significant price changes that typically occur from one trading day to the next. Typical gap patterns form over two to three days. It is not uncommon to see the price of an asset close a previously created price gap. Sometimes traders push the price higher too quickly, resulting in a slight pullback. The black/red candlestick that forms the Upside Tasuki Gap acts as a period of minor consolidation before the bulls continue to send the price higher.

Upside Tasuki Gap Within an Uptrend

Upside Tasuki Gaps can occur at any time during a bullish trending pattern. Bullish patterns typically follow a cycle that begins with a breakaway gap confirming a reversal and then several runaway gaps followed by an exhaustion gap. As the price of a security trends higher, it often forms an ascending channel. Traders construct the pattern by drawing upward sloping lines at the peak and trough levels of price action. An Upside Tasuki Gap can occur within an ascending channel that also includes one or several of the gaps mentioned above.

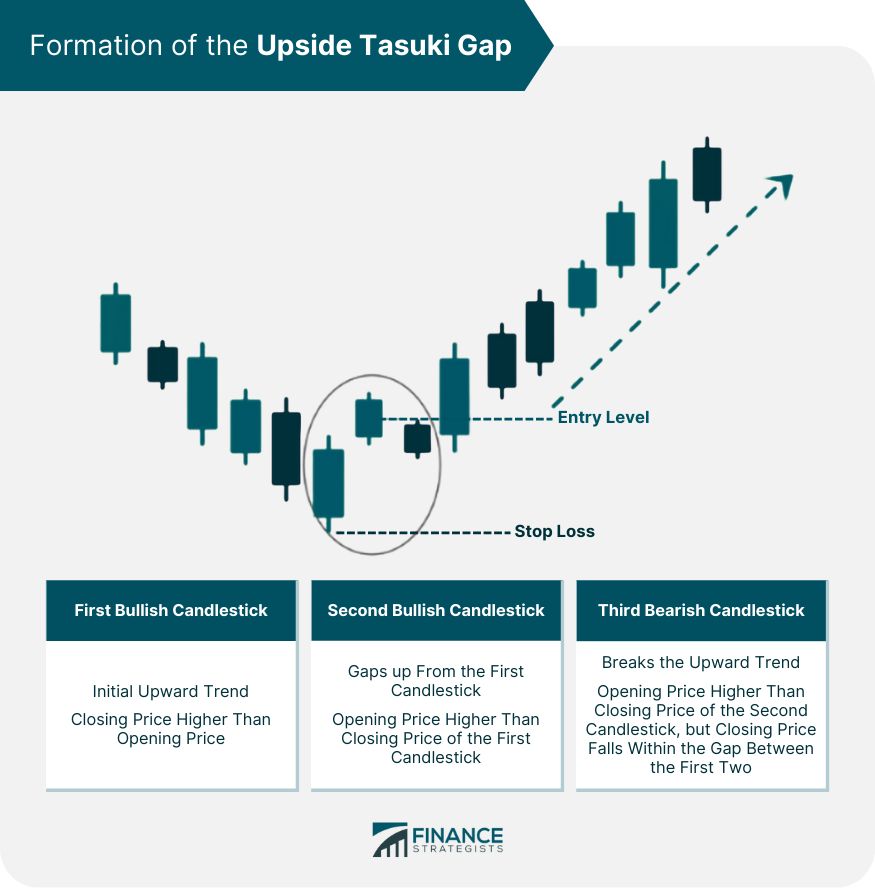

Practical Example of Trading the Tasuki Gap

David spots an Upside Tasuki Gap on the iShares 10+ Year Investment Grade Corporate Bond ETF chart and wants to use the pattern to enter a trade and set risk parameters. He could enter on the close of the third red candle at $62.97 and place his stop-loss order beneath the low of the first candlestick at $62.08. Alternatively, David could place a buy stop order slightly above the pattern’s second candlestick high at $63.39 to confirm the uptrend has resumed and set his stop under the third candlestick’s low at $62.93.