Risk Assessment Definition Methods Qualitative Vs Quantitative

Risk assessment is a term used in many industries to determine the likelihood of loss on an asset, loan, or investment. It helps determine the rate of return needed for an investment to be worthwhile.

Key Takeaways:

– Risk assessment analyzes potential events that may lead to loss.

– Risk assessments are conducted by companies, governments, and investors.

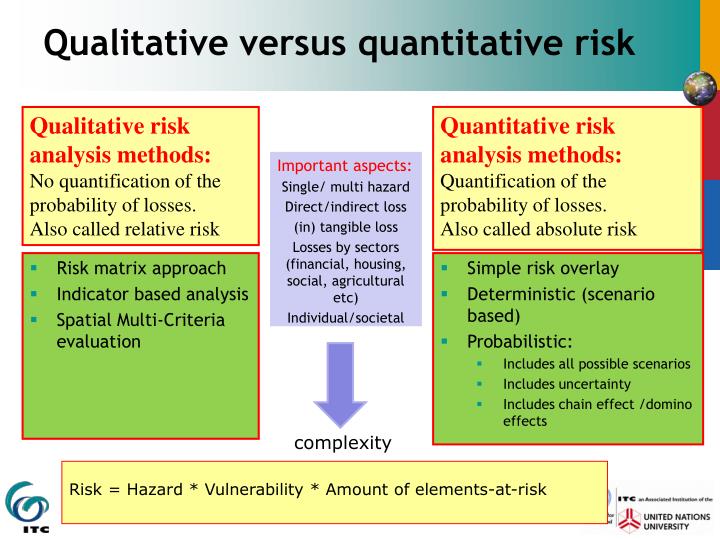

– Quantitative risk analysis assigns numerical values to risk.

– Qualitative risk analysis relies on subjective judgment.

Understanding Risk Assessment:

Risk assessment predicts the impact of adverse events on a business, economy, project, or investment. Quantitative analysis uses models and simulations, while qualitative analysis relies on subjective judgment.

Quantitative Analysis:

Quantitative analysis builds risk models and simulations to assign numerical values to risk.

Qualitative Analysis:

Qualitative analysis builds a theoretical risk model using subjective judgment and experience.

Other Risk Assessment Methods:

Examples of risk assessment techniques include conditional value at risk (CVaR) and credit analysis.

Risk Assessments for Investments:

Non-guaranteed investments like stocks, bonds, mutual funds, and ETFs have expected amounts of risk. High volatility indicates a riskier investment, but past volatility does not predict future returns.

Risk Assessments for Lending:

Lenders conduct credit checks to assess the risk of lending to borrowers. Credit analysis considers factors like credit scores, assets, and income.

Risk Assessments for Business:

Business risks include entry of new competitors, data breaches, and natural disasters. Effective risk management balances risk mitigation and growth. Investors prefer companies with a good risk management history.