Modified Internal Rate of Return MIRR

Modified Internal Rate of Return (MIRR):

The modified internal rate of return (MIRR) assumes positive cash flows are reinvested at the firm’s cost of capital and initial outlays are financed at the firm’s financing cost. In contrast, the traditional internal rate of return (IRR) assumes cash flows are reinvested at the IRR itself. MIRR provides a more accurate reflection of a project’s cost and profitability.

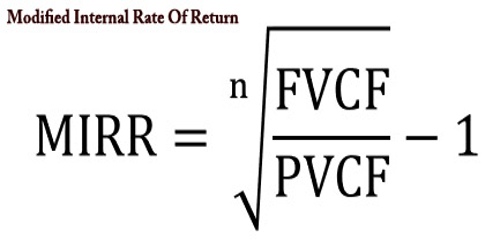

Formula and Calculation of MIRR:

The MIRR formula is expressed as: MIRR = FV (Positive cash flows x Cost of capital) / PV (Initial outlays x Financing cost)^(1/n)

In this formula:

– FVCF(c) represents the future value of positive cash flows at the cost of capital for the company.

– PVCF(fc) represents the present value of negative cash flows at the financing cost of the company.

– n represents the number of periods.

MIRR vs. IRR:

MIRR improves on IRR by assuming positive cash flows are reinvested at the firm’s cost of capital. It is used to rank investments or projects and provides a single solution, eliminating the issue of multiple IRRs.

What MIRR Can Tell You:

The MIRR is used to rank investments or projects of unequal size. It solves two major problems with IRR: multiple solutions and the impractical assumption of reinvesting positive cash flows at the IRR. MIRR offers a single solution and a more valid reinvestment rate.

The Difference Between MIRR and IRR:

IRR tends to overstate project profitability and can lead to capital budgeting mistakes. Cash flows are often reinvested at the cost of capital, not at the same rate they were generated. IRR assumes a constant growth rate across projects, which can overstate potential future value. Additionally, IRR produces multiple numbers when there are different periods of positive and negative cash flows, causing confusion. MIRR addresses these issues.

The Difference Between MIRR and FMRR:

The financial management rate of return (FMRR) is used to evaluate real estate investments. It adjusts for differences in assumed reinvestment rates and specifies cash outflows and inflows at different rates known as the "safe rate" and the "reinvestment rate."

Limitations of Using MIRR:

MIRR requires an estimate of the cost of capital, which can be subjective and vary based on assumptions. Like IRR, MIRR can lead to suboptimal decisions when considering multiple investment options simultaneously. MIRR may not provide optimal results in the case of capital rationing. It can also be difficult to understand for those without a financial background, and its theoretical basis is disputed among academics.

Example of How to Use MIRR:

To calculate MIRR, assume positive cash flows will be reinvested at the cost of capital. Divide the future value of cash flows by the present value of the initial outlay to find the geometric return for the given period. Adjust this ratio using the MIRR formula to obtain the MIRR percentage. In the provided example, IRR gives an overly optimistic picture of the project’s potential, while MIRR provides a more realistic evaluation.