Unlevered Cost of Capital Definition Formula and Calculation

Contents

Unlevered Cost of Capital: Definition, Formula, and Calculation

Skylar Clarine is a fact-checker and expert in personal finance with experience in veterinary technology and film studies.

What Is Unlevered Cost of Capital?

Unlevered cost of capital is the analysis of a company’s cost to implement a capital project or assess the entire company, using a scenario with or without debt. It compares the cost of capital of the project using zero debt to a levered cost of capital investment, which includes debt as part of the total capital required.

Key Takeaways

- Unlevered cost of capital analyzes a company’s cost to implement a capital project.

- It compares the cost of capital of the project using zero debt to a levered cost of capital investment.

- The unlevered cost of capital is generally higher than the levered cost because debt has a lower cost than equity.

- To calculate the unlevered cost of capital, you need to consider factors such as unlevered beta, market risk premium, and the risk-free rate of return.

- If a company fails to meet the anticipated unlevered returns, investors may reject the investment.

- An investor may perceive a stock as high-risk if it has a higher unlevered cost of capital.

Understanding Unlevered Cost of Capital

When a company needs to raise capital for expansion or other reasons, it can choose between debt financing (borrowing money through loans or bond issuances) or equity financing (issuing stock).

The unlevered cost of capital is generally higher than the levered cost because borrowing money is cheaper than selling equity. This is due to the tax benefit associated with the interest expense paid on debt. However, levered projects have additional costs, such as underwriting costs, brokerage fees, and coupon payments.

Nevertheless, over the life of a capital project or a company’s ongoing business operations, these costs are marginal compared to the benefits of lower debt costs compared to equity costs.

Important

The unlevered cost of capital can be used to determine the cost of a specific project, separate from procurement costs.

It represents the cost of financing a project without incurring debt and provides an implied rate of return that helps investors make informed decisions. If a company fails to meet the anticipated unlevered returns, investors may reject the investment. In general, a higher unlevered cost of capital is associated with higher risk.

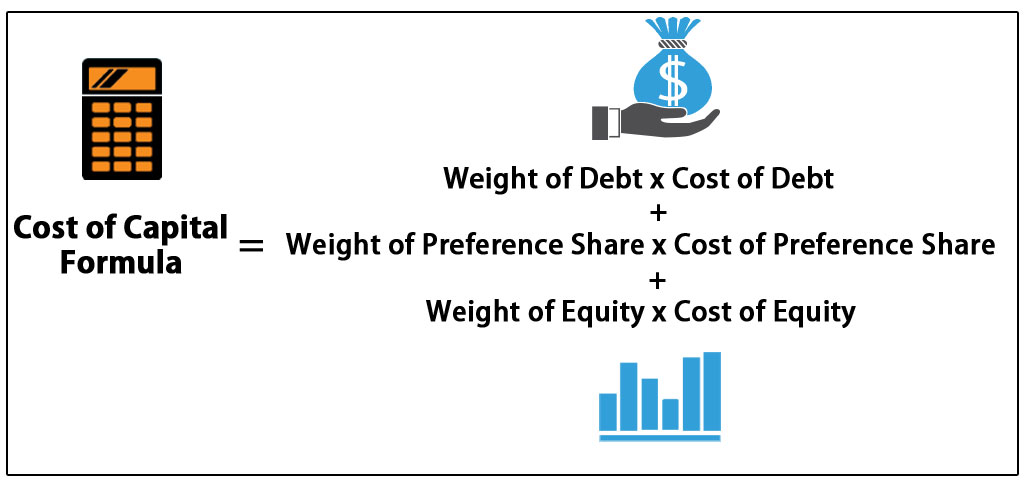

The weighted average cost of capital (WACC) is another formula used to determine the worthiness of an investment. WACC considers the entire capital structure, including common stock, preferred stock, bonds, and other long-term debt.

Formula and Calculation of Unlevered Cost of Capital

To calculate the unlevered cost of capital, you need to consider factors such as unlevered beta, market risk premium, and the risk-free rate of return. This calculation is used as a standard for assessing investment soundness.

The unlevered beta represents investment volatility compared to the market. It is determined by comparing the company to similar companies with known levered betas, often using an average of multiple betas to estimate it. The market risk premium is the difference between expected market returns and the risk-free rate of return.

Once all variables are known, the unlevered cost of capital can be calculated using the formula:

Unlevered Cost of Capital = Risk-Free Rate + Unlevered Beta * (Market Risk Premium)

If the calculated unlevered cost of capital is higher than the company’s return, further analysis should be conducted. Comparing the result to the cost of the company’s debt can determine the benefits of incurring debt and utilizing leverage to lower the total capital cost.