Truth in Savings Act What it is How it Works Why it Exists

The Truth in Savings Act (TISA) is a federal law that promotes competition between depository institutions and simplifies comparisons of interest rates, fees, and terms. It was passed by Congress on December 19, 1991, as part of the Federal Deposit Insurance Corporation (FDIC) Improvement Act of 1991.

Key Takeaways:

– TISA promotes competition between depository institutions.

– TISA sets guidelines for banks to disclose information about deposit accounts.

– TISA helps consumers compare interest rates, fees, and terms.

TISA establishes uniform guidelines for banks and other financial institutions to disclose information about deposit accounts. These disclosures allow consumers to make informed decisions about the accounts offered.

TISA applies to personal accounts but not to business accounts or organizations opening business deposit accounts.

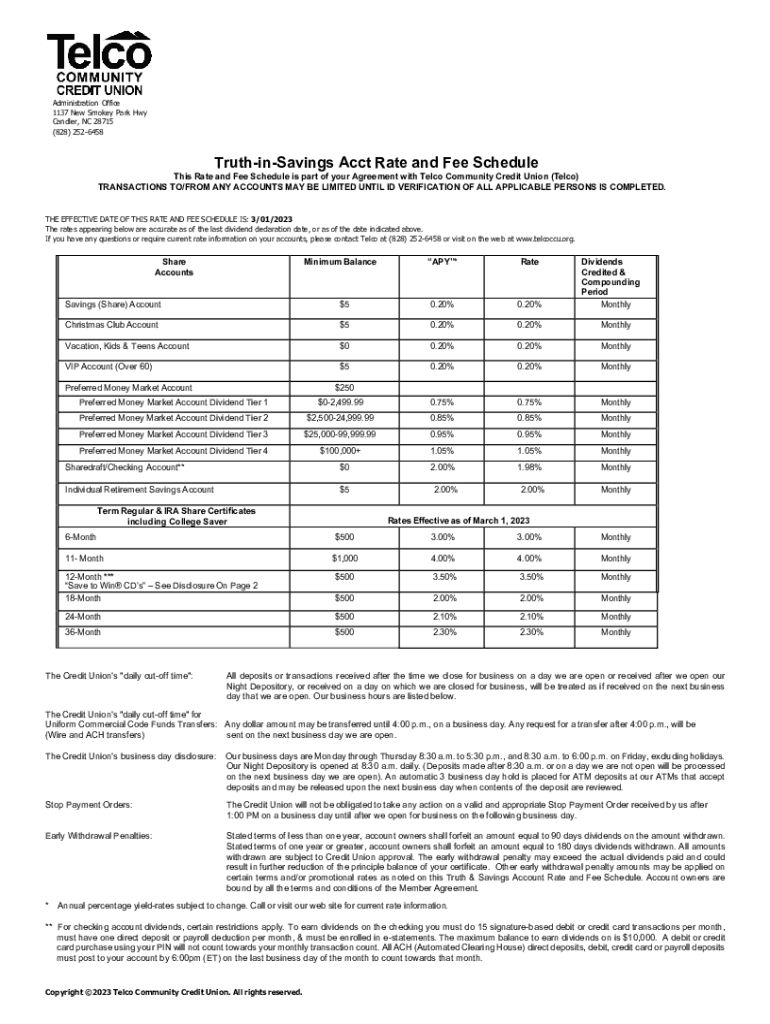

The law intends to protect and inform consumers about the terms of new savings and certificate of deposit accounts. It requires financial institutions to disclose fees, interest rates, balance requirements, withdrawal penalties, and changes to account terms.

Withdrawing interest impacts the annual percentage yield (APY), so both the interest rate and APY must be disclosed.

Banks must also provide clear communications to customers and update them on their accruing interest.

The law also covers bank advertising, ensuring that it is not misleading and that the interest rate and APY are disclosed.

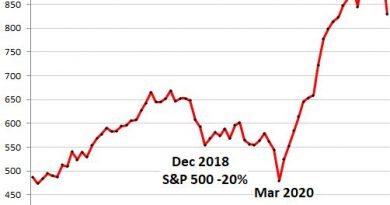

The Truth in Savings Act was established after the Savings and Loan Crisis to increase transparency for consumers and hold financial institutions accountable. Its purpose is to prevent a repeat of the crisis.