Unsterilized Foreign Exchange Intervention Overview

Unsterilized Foreign Exchange Intervention Overview

What Is an Unsterilized Foreign Exchange Intervention?

An unsterilized foreign exchange intervention refers to how a country’s monetary authorities influence exchange rates and its money supply—by not purchasing foreign or selling domestic currencies or assets. This approach allows for fluctuations in the monetary base.

Unsterilized foreign exchange interventions are also called nonsterilized interventions and can be contrasted with sterilized interventions.

Key Takeaways

– Unsterilized foreign exchange interventions take place when a country’s monetary authorities influence exchange rates and its money supply.

– This policy takes place when a central bank doesn’t offset the purchase or sale of foreign or domestic currencies or assets with another transaction.

– When central banks implement unsterilized foreign exchange intervention, they do not put insulation measures in place.

– Unsterilized interventions allow foreign exchange markets to function without manipulating the domestic currency supply, so a country’s monetary base can change.

How Unsterilized Foreign Exchange Interventions Work

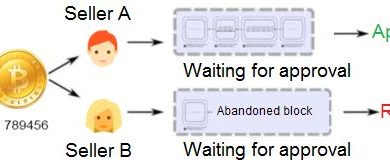

Central banks may weaken a currency by selling their own reserves on the market or strengthen it by buying more and selling their own currency. Sterilization happens when authorities offset the purchase of foreign currencies or securities by selling domestic ones, dropping its own money supply.

When central banks implement unsterilized foreign exchange intervention, they do not put insulation measures in place. Therefore, the transaction is one-sided—only purchasing or selling currencies or assets—without being offset. The policy allows foreign exchange markets to function without manipulating the supply of the domestic currency, allowing a country’s monetary base to change.

For example, the Federal Reserve may decide to strengthen the Japanese yen by buying Japanese government bonds, increasing its own reserves. The intervention is unsterilized if the Fed decides not to sell its own bonds on the open market.

Unsterilized vs. Sterilized Foreign Exchange Interventions

Central bank authorities use sterilized and nonsterilized methods of foreign exchange intervention to influence exchange rates and the money supply. If the central bank purchases domestic currency by selling foreign assets, the money supply shrinks. This is an example of a sterilized policy.

If a currency’s value weakens in the global market, a country’s central bank can create demand for the currency. The bank can buy its own currency using foreign currency in its reserves, cutting off the currency’s depreciation and controlling the money supply. The same is true if the central bank decides to sell its own currency if it appreciates too much.