Minimum Essential Coverage What it Means How it Works

Minimum Essential Coverage: What it Means, How it Works

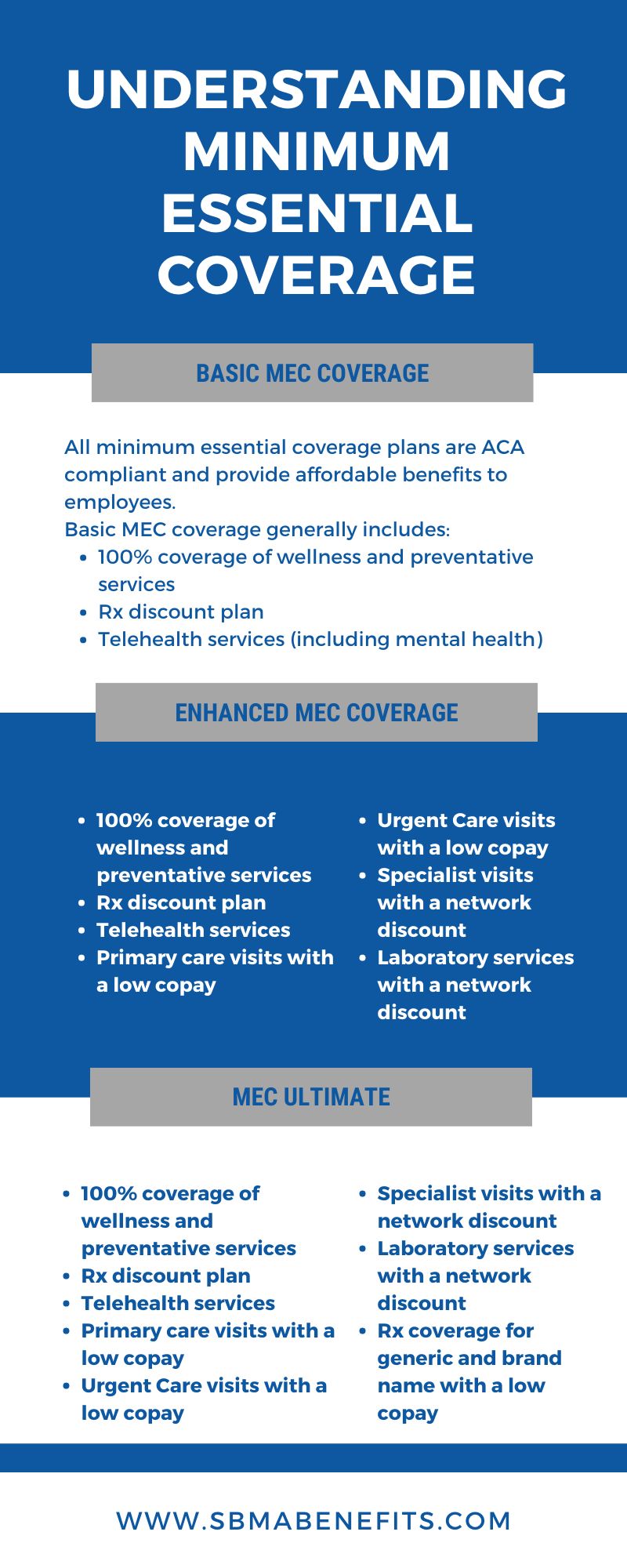

What Is Minimum Essential Coverage?

Minimum essential coverage is a health insurance policy required under the Affordable Care Act (ACA). Previously, individuals without this coverage were subject to a financial penalty. However, the Tax Cuts and Jobs Act of 2017 eliminated this penalty, making health insurance no longer mandatory at the federal level.

Most states adopted this change, but Massachusetts, New Jersey, Vermont, California, Rhode Island, and the District of Columbia still impose penalties for lacking health insurance.

Key Takeaways

– Minimum essential coverage is health insurance required by the ACA until penalties were removed.

– Some states may still impose a tax penalty for lacking this coverage.

– California has exemptions for its health insurance mandate.

Understanding Minimum Essential Coverage

You have minimum essential coverage if you have:

– An employer-sponsored plan (including COBRA)

– Health insurance from the Marketplace

– Medicare Part A or Medicare Advantage plans

– Most Medicaid coverage

– Children’s Health Insurance Program (CHIP)

– TRICARE

– Certain plans from the Veterans Administration

– Peace Corps volunteer plans

Employees whose employer-sponsored plans do not meet minimum value criteria can apply for a premium subsidy. However, coverage for only vision or dental care, workers’ compensation, specific disease or condition, and medical service discount plans do not count as minimum essential coverage under the ACA.

Marketplace Plans

Individuals in Massachusetts, New Jersey, Vermont, California, Rhode Island, and the District of Columbia may face penalties for lacking minimum essential coverage.

However, people with limited incomes may be exempt from the penalty. Some exemptions include being uninsured for less than three months, coverage costing more than 8.09% of household income, or not meeting tax return filing requirements due to low income. Other exemptions include hardships such as homelessness or facing foreclosure.

Certain products that help pay for medical services do not qualify as minimum essential coverage, such as coverage for vision care or dental care, workers’ compensation, accident or disability insurance, and some Medicaid plans.

Starting from the 2019 tax year, taxpayers are no longer required to pay a penalty for lacking minimum essential coverage. For prior years, penalties were calculated based on household income and per-person coverage. If coverage was only lacking for 1 or 2 months, there is no penalty.

Example of Minimum Essential Coverage

Ryan lives in New York and his employer provides health insurance coverage that satisfies minimum essential coverage requirements. After being laid off in 2019, he loses his coverage. New York does not impose a tax penalty for lacking coverage, so Ryan does not have to pay a penalty.

Raul has a similar situation in California. He also loses health insurance coverage after being laid off but finds a job within three months. California has a tax penalty for lacking coverage, but Raul applies for and is granted a short gap exemption, avoiding the penalty payment.