Model Risk Definition Management and Examples

Model Risk: Definition, Management, and Examples

Contents

What Is Model Risk?

Model risk occurs when a financial model used to measure quantitative information, such as a firm’s market risks or value transactions, fails or performs inadequately, leading to adverse outcomes.

Models rely on assumptions, economic, statistical, mathematical, or financial theories, and techniques to process data inputs into quantitative estimates.

Financial institutions and investors use models to identify stock prices and trading opportunities. However, models can be prone to risks from inaccurate data, programming errors, technical errors, and misinterpretation of outputs.

Key Takeaways

- Models are extensively used in finance to identify potential stock values, trading opportunities, and aid decision-making.

- Model risk arises from using inaccurate models for decision-making.

- Model risk can result from bad specifications, programming or technical errors, or data or calibration errors.

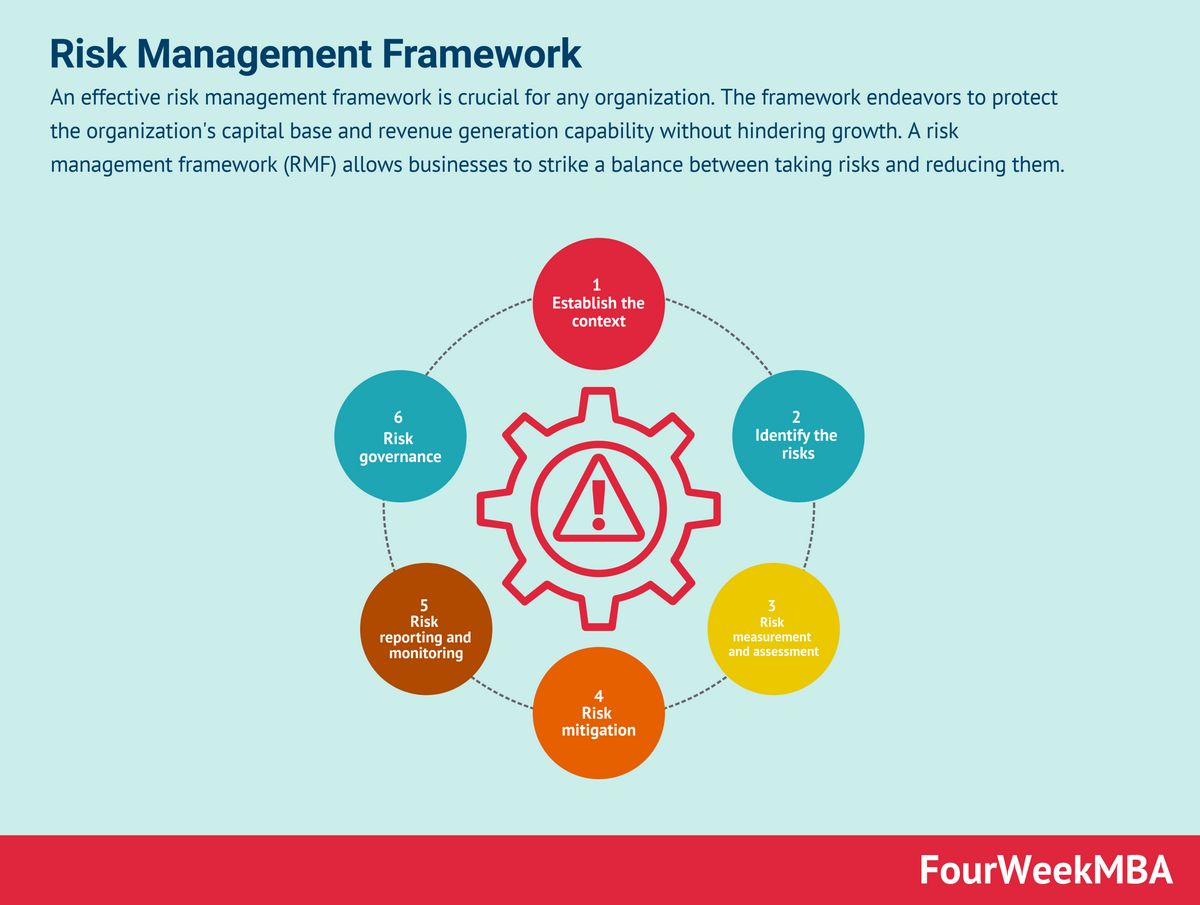

- Model risk can be mitigated through testing, governance policies, and independent review.

Understanding Model Risk

Model risk is a subset of operational risk and primarily affects the firm that creates and uses the model. Users of a model may not fully understand its assumptions and limitations, limiting its usefulness.

Model risk affects financial securities valuations and extends beyond the financial industry. It can impact predictions related to airline passenger security or fraudulent credit card transactions due to incorrect assumptions, programming errors, and other factors.

What Does Model Risk Tell You?

Models are simplified versions of reality and may fail to account for certain factors. Assumptions and inputs vary widely. Companies often conduct a financial forecast before developing models to determine future expectations.

Companies, like banks, have model risk officers and management programs to reduce financial losses. Programs include establishing governance and policies, and assigning roles and responsibilities for ongoing model development, testing, implementation, and management.

Real World Examples

Long-Term Capital Management

The 1998 Long-Term Capital Management (LTCM) debacle was attributed to model risk. The firm’s computer model error was magnified by a highly leveraged trading strategy.

LTCM managed over $100 billion in assets and reported annual returns of over 40%. Ultimately, the firm collapsed due to its model’s failure in that market environment.

JPMorgan Chase

JPMorgan Chase suffered massive trading losses in 2012 due to a value at risk (VaR) model with formula and operational errors. The VaR model helps estimate potential portfolio losses. Adjustments to the model led to a $6.2 billion loss in JPM’s synthetic credit portfolio.

VaR models have previously failed during the 2007 and 2008 global financial crisis, failing to predict extensive bank losses.