Modern Portfolio Theory What MPT Is and How Investors Use It

Contents

- 1 Modern Portfolio Theory: What MPT Is and How Investors Use It

- 1.1 What Is the Modern Portfolio Theory (MPT)?

- 1.2 Understanding the Modern Portfolio Theory (MPT)

- 1.3 Benefits of the MPT

- 1.4 Criticism of the MPT

- 1.5 What Is the Difference Between the Modern Portfolio Theory and the Post-Modern Portfolio Theory?

- 1.6 What Are the Benefits of the Modern Portfolio Theory?

- 1.7 What Is the Importance of the Efficient Frontier in the MPT?

Modern Portfolio Theory: What MPT Is and How Investors Use It

What Is the Modern Portfolio Theory (MPT)?

The modern portfolio theory (MPT) is a practical method for selecting investments to maximize overall returns within an acceptable level of risk. This mathematical framework is used to build a portfolio that maximizes expected return for the given level of risk.

American economist Harry Markowitz pioneered this theory in his 1952 paper "Portfolio Selection" published in the Journal of Finance. He later received a Nobel Prize for his work on modern portfolio theory.

A key component of the MPT theory is diversification. Markowitz argued that investors can achieve optimal results by choosing a mix of high-risk, high-return investments and low-risk, low-return investments based on their risk tolerance.

Key Takeaways

- The modern portfolio theory (MPT) is a method used by risk-averse investors to construct diversified portfolios that maximize returns without unacceptable levels of risk.

- The modern portfolio theory can be useful to investors constructing efficient and diversified portfolios using ETFs.

- Investors more concerned with downside risk might prefer the post-modern portfolio theory (PMPT) to MPT.

Understanding the Modern Portfolio Theory (MPT)

The modern portfolio theory argues that an investment’s risk and return characteristics should not be viewed in isolation but should be evaluated based on how it affects the overall portfolio’s risk and return. An investor can construct a portfolio of multiple assets that will result in greater returns without higher risk.

Starting with a desired level of expected return, the investor can construct a portfolio with the lowest possible risk that can produce that return.

A single investment’s performance is less important than how it impacts the entire portfolio, based on statistical measures such as variance and correlation.

Acceptable Risk

The MPT assumes that investors are risk-averse, preferring less risky portfolios for a given level of return. Risk aversion implies that most people should invest in multiple asset classes.

The portfolio’s expected return is calculated as a weighted sum of the returns of the individual assets. For a portfolio with four equally weighted assets with expected returns of 4%, 6%, 10%, and 14%, the portfolio’s expected return would be:

- (4% x 25%) + (6% x 25%) + (10% x 25%) + (14% x 25%) = 8.5%

The portfolio’s risk is determined by the variances of each asset and the correlations between pairs of assets. Calculating the risk of a four-asset portfolio requires the variances of each asset and the correlations of each pair of assets. The total portfolio risk, or standard deviation, is lower than what would be calculated by a weighted sum due to asset correlations.

Benefits of the MPT

The MPT is a useful tool for investors constructing diversified portfolios, especially with the growth of exchange-traded funds (ETFs) that provide easier access to a broader range of asset classes.

For example, stock investors can reduce risk by including government bond ETFs in their portfolios. Government bonds have a negative correlation with stocks, significantly lowering the portfolio’s variance. Adding a small investment in Treasuries to a stock portfolio has a minimal impact on expected returns due to this risk-reducing effect.

Looking for Negative Correlation

Similarly, the MPT can reduce the volatility of a U.S. Treasury portfolio by allocating 10% to a small-cap value index fund or ETF. Although small-cap value stocks are riskier than Treasuries individually, they perform well during periods of high inflation when bonds perform poorly. This lowers the portfolio’s overall volatility and increases expected returns.

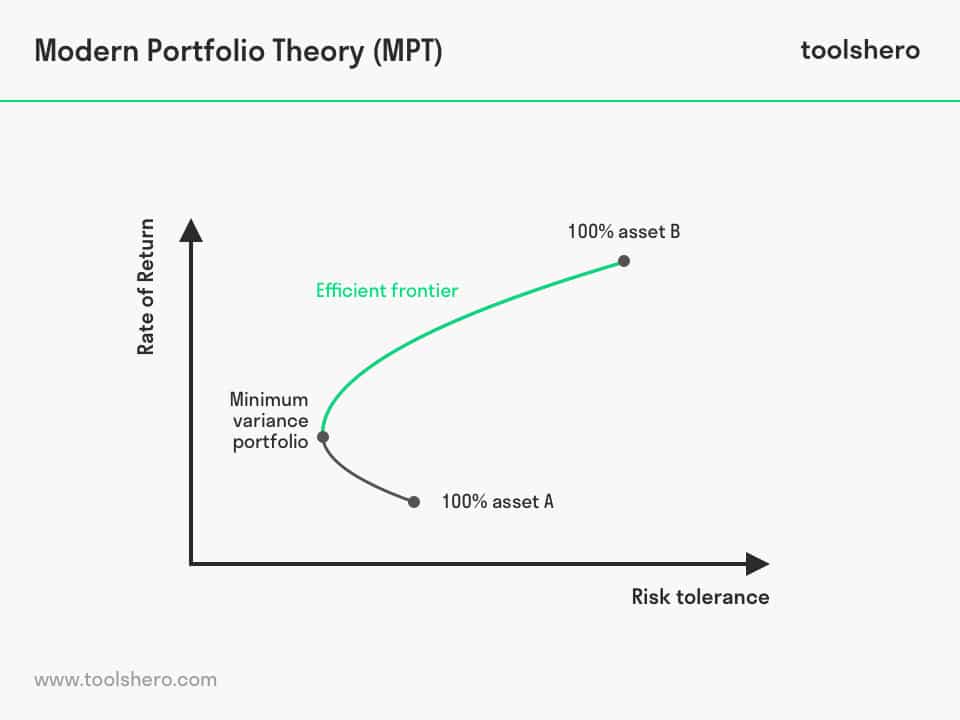

The modern portfolio theory allows investors to construct more efficient portfolios. Plotting every possible combination of assets on a graph with risk on the X-axis and expected return on the Y-axis reveals the most desirable combinations for a portfolio.

For example, if Portfolio A has an expected return of 8.5% and a standard deviation of 8%, and Portfolio B has an expected return of 8.5% and a standard deviation of 9.5%, Portfolio A is more efficient because it has the same expected return but lower risk.

An upward sloping curve can be drawn to connect the most efficient portfolios, called the efficient frontier.

Investing in a portfolio below the curve is not desirable because it does not maximize returns for a given level of risk.

Criticism of the MPT

The most serious criticism of the MPT is evaluating portfolios based on variance rather than downside risk.

Under modern portfolio theory, two portfolios with the same variance and returns are considered equally desirable. However, one portfolio may have that variance due to frequent small losses, while another may have that variance due to rare but spectacular declines. Most investors prefer frequent small losses, which are easier to endure.

The post-modern portfolio theory (PMPT) attempts to improve the MPT by minimizing downside risk instead of variance.

Frequently Asked Questions

What Is the Difference Between the Modern Portfolio Theory and the Post-Modern Portfolio Theory?

The MPT suggests that conservative investors can achieve better results by choosing a mix of low-risk and riskier investments rather than solely low-risk choices. The more rewarding option does not add additional overall risk, which is the key attribute of portfolio diversification.

The PMPT does not contradict these assumptions but changes the formula for evaluating risk to correct perceived flaws in the original theory.

Followers of both theories use software that relies on either MPT or PMPT to build portfolios aligned with their desired level of risk.

What Are the Benefits of the Modern Portfolio Theory?

The modern portfolio theory can diversify a portfolio to achieve better overall returns without increasing risk.

Another benefit is reducing volatility, which can be achieved by choosing assets with negative correlation, such as U.S. treasuries and small-cap stocks.

The goal of the modern portfolio theory is to create the most efficient portfolio possible.

What Is the Importance of the Efficient Frontier in the MPT?

The efficient frontier is a cornerstone of the MPT, indicating the combination of investments that offer the highest return for the lowest risk.

A portfolio to the right of the efficient frontier has greater risk compared to its predicted return, while a portfolio below the slope of the efficient frontier offers a lower return relative to risk.