Market Portfolio Definition Theory and Examples

Contents

Market Portfolio: Definition, Theory, and Examples

What is a Market Portfolio?

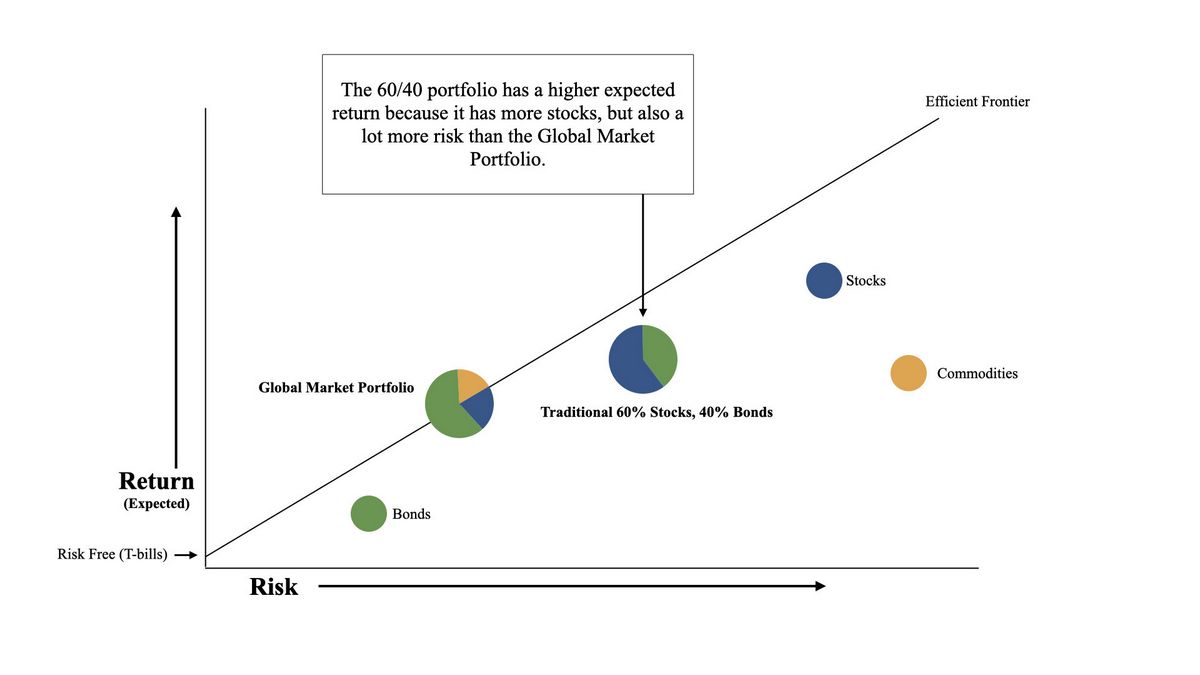

A market portfolio includes every type of asset available in the investment universe, weighted in proportion to their total presence in the market. The expected return of a market portfolio is identical to the expected return of the market as a whole.

The Basics of Market Portfolio

A market portfolio is subject only to systematic risk, which affects the market as a whole, and not to unsystematic risk inherent to a particular asset class.

As an example, assume three companies exist in the stock market: Company A, Company B, and Company C. The market capitalization of Company A is $2 billion, Company B is $5 billion, and Company C is $13 billion. The total market capitalization is $20 billion. The market portfolio consists of these companies, with the following portfolio weights:

Company A portfolio weight = 10%

Company B portfolio weight = 25%

Company C portfolio weight = 65%

Key Takeaways

- A market portfolio is a diversified group of every type of investment in the world, weighted based on their presence in the market.

- Market portfolios are a key part of the capital asset pricing model (CAPM), which helps in choosing investments for a diversified portfolio.

- Roll’s Critique suggests that creating a truly diversified market portfolio is impossible in practice.

The Market Portfolio in the Capital Asset Pricing Model

The market portfolio is an essential component of the capital asset pricing model (CAPM). The CAPM shows an asset’s expected return based on its systematic risk. The relationship is expressed in an equation called the security market line:

R = Rf + βc ( Rm − Rf )

For example, if the risk-free rate is 3%, the expected return of the market portfolio is 10%, and the beta of the asset with respect to the market portfolio is 1.2, the expected return of the asset is:

Expected return = 3% + 1.2 x (10% – 3%) = 11.4%

Limitations of a Market Portfolio

Economist Richard Roll suggested that creating a truly diversified market portfolio in practice is impossible. This argument, known as "Roll’s Critique," suggests that even a broad-based market portfolio can only approximate full diversification.

Real World Example of a Market Portfolio

In a 2017 study, economists Ronald Q. Doeswijk, Trevin Lam, and Laurens Swinkels documented the performance of a global multi-asset portfolio from 1960 to 2017. Real compounded returns varied from 2.87% to 4.93%, depending on the currency used. In U.S. dollars, the return was 4.45%.