Marginal Revenue Explained With Formula and Example

Marginal Revenue Explained, With Formula and Example

What Is Marginal Revenue?

Marginal revenue is the increase in revenue that results from selling one additional unit of output. While marginal revenue can remain constant over a certain level of output, it follows the law of diminishing returns and will eventually slow down as the output level increases. In economic theory, perfectly competitive firms continue producing output until marginal revenue equals marginal cost.

Key Takeaways

-Marginal revenue refers to the incremental change in earnings resulting from the sale of one additional unit.

-Analyzing marginal revenue helps a company identify the revenue generated from each additional unit sold.

-Marginal revenue is often shown graphically as a downward-sloping line representing how a company usually has to decrease its prices to drive additional sales.

-A company looking to maximize its profits will produce up to the point where marginal cost equals marginal revenue.

-When marginal revenue falls below marginal cost, firms typically do a cost-benefit analysis and halt production as it may cost more to sell a unit than the company will receive as revenue.

Understanding Marginal Revenue

Marginal revenue is a financial and economic calculation that determines how much revenue a company earns for each additional unit sold. The price of a good is often tied to market supply and demand, and a company’s marginal revenue often varies based on how many units it has already sold.

Marginal revenue is useful in several contexts. Companies use historical marginal revenue data to analyze customer demand for products in the market. They also use the information to set the most effective and efficient prices. Lastly, companies rely on marginal revenue to better understand forecasts; this information is used to determine future production schedules, such as material requirements planning.

Ideally, the change in measurements captures the difference from a single quantity to the next available quantity. However, it can still be used to capture the average marginal revenue across a series of units.

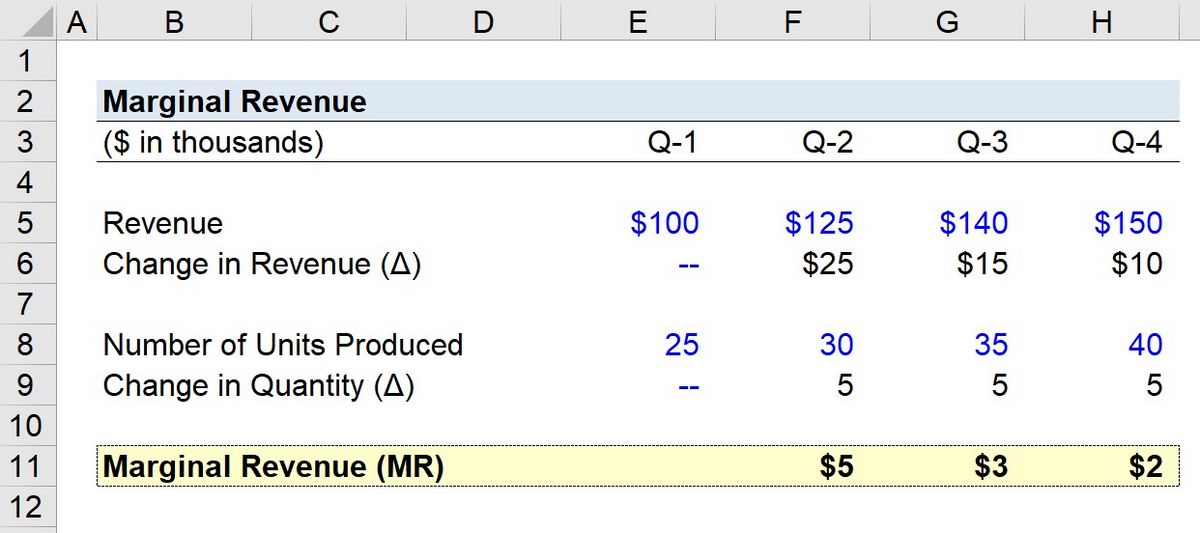

How to Calculate Marginal Revenue

A company calculates marginal revenue by dividing the change in total revenue by the change in total output quantity. The formula for marginal revenue can be expressed as: Marginal Revenue = Change in Revenue / Change in Quantity.

For example, if a company sold its first 100 items in one week for a total of $1,000 and sold a total of 115 units for $1,100 the next week, the marginal revenue for units 101 through 115 is $100, or $6.67 per unit.

Positive marginal revenue is informative but does not convey enough information to a company for smarter decision-making. Marginal transaction information should include expenses to garner the most insight.

Marginal Revenue Curve

Marginal revenue can be graphically depicted as a downward-sloping straight line on a chart capturing price on the y-axis and quantity on the x-axis. The marginal revenue curve is often downward sloping because there is often an inverse relationship between price and quantity. A company must often decrease its price to increase its market share. By decreasing the price, the company will receive less marginal revenue for each additional unit sold. At some point, the market demand for additional units will drive the product price so low that it becomes unprofitable to manufacture more.

Average Revenue Curve

Marginal revenue can be analyzed by comparing it to average revenue. Average revenue is the total amount of revenue received divided by the total quantity of goods sold. In a perfect competition, marginal revenue is most often equal to average revenue. In an imperfect competition, marginal revenue and average revenue will vary. Both lines tend to be downward sloping, with marginal revenue decreasing faster than average revenue.

Example of Marginal Revenue

To calculate marginal revenue, a revenue schedule outlines the total revenue earned, as well as the incremental revenue for each unit. The difference between the total projected revenues of two quantities demanded is the marginal revenue of producing at the quantity demanded on the second line.

Marginal Revenue vs. Marginal Cost

When marginal revenue exceeds marginal cost, a company receives a profit from selling additional items. The best results occur when production and sales continue until marginal revenue equals marginal cost. Beyond that point, the cost of producing an additional unit will exceed the revenue generated. When marginal revenue falls below marginal cost, firms typically halt production.

Competitive Firms vs. Monopolies

For perfectly competitive firms, marginal revenue is typically constant. For monopolies, the marginal benefit of selling an additional unit is less than the market price. Marginal revenue and average revenue work differently for each type of firm.

Is Marginal Revenue the Same As Profit?

Marginal revenue only considers income received and does not reflect any marginal expenses required to manufacture or sell goods. Therefore, marginal revenue is different from profit.

What Is Marginal Revenue and Marginal Cost?

Marginal revenue is the income gained from selling one additional unit, while marginal cost is the expense incurred for selling that unit. Both measures help determine the most efficient level of production and sales.

Why Is Marginal Revenue Important?

Marginal revenue is important because it indicates the most ideal level of activity a company should undertake. It is most efficient for a company to produce goods until marginal revenue equals marginal expenses.

What Does It Mean If Marginal Revenue Is Negative?

If marginal revenue is negative, it means total revenue falls as additional units are sold. This often happens when a company needs to lower prices to sell those additional units. In this case, strictly looking at marginal revenue, it is ideal for a company to have sold fewer goods for a higher average price.

The Bottom Line

Companies must be aware of how increasing sales quantities impact marginal revenue. If the company must decrease prices to generate additional sales, marginal revenue will slowly decrease to the point where it is no longer profitable to sell more goods.