Macaulay Duration Definition Formula Example and How It Works

Macaulay Duration: Definition, Formula, Example, and How It Works

What Is the Macaulay Duration?

The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price. Macaulay duration is frequently used by portfolio managers who use an immunization strategy.

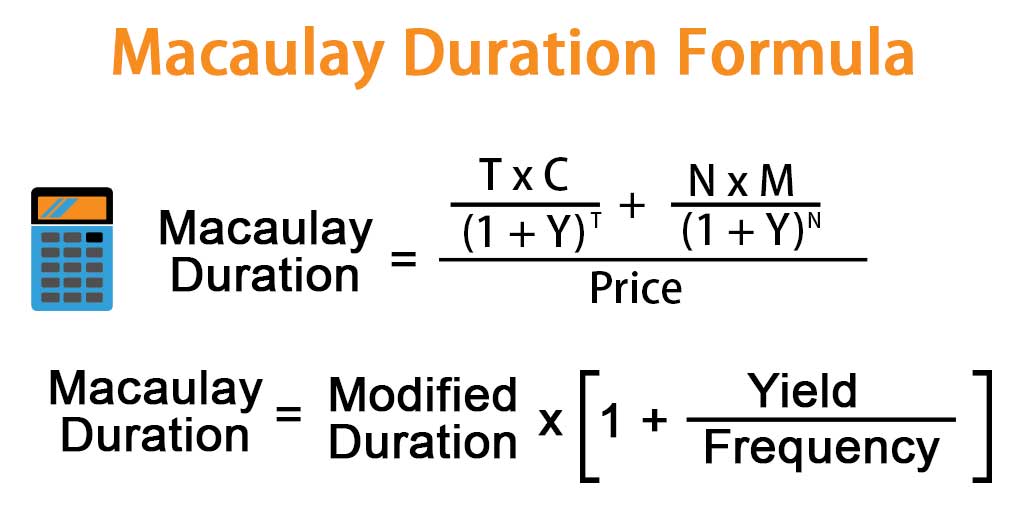

Macaulay duration can be calculated as follows:

Macaulay Duration = ∑ t = 1 n t × C ( 1 + y ) t + n × M ( 1 + y ) n Current Bond Price where:

t = Respective time period

C = Periodic coupon payment

y = Periodic yield

n = Total number of periods

M = Maturity value

Understanding the Macaulay Duration

The metric is named after its creator, Frederick Macaulay. Macaulay duration can be viewed as the economic balance point of a group of cash flows. Another way to interpret the statistic is that it is the weighted average number of years that an investor must maintain a position in the bond until the present value of the bond’s cash flows equals the amount paid for the bond.

Factors Affecting Duration

A bond’s price, maturity, coupon, and yield to maturity all factor into the calculation of duration. All else being equal, duration increases as maturity increases. As a bond’s coupon increases, its duration decreases. As interest rates increase, duration decreases, and the bond’s sensitivity to further interest rate increases goes down. Also, a sinking fund in place, a scheduled prepayment before maturity, and call provisions all lower a bond’s duration.

Calculation Example

The calculation of Macaulay duration is straightforward. Let’s assume that a $1,000 face-value bond pays a 6% coupon and matures in three years. Interest rates are 6% per annum, with semiannual compounding. The bond pays the coupon twice a year and pays the principal on the final payment. Given this, the following cash flows are expected over the next three years:

Period 1: $30

Period 2: $30

Period 3: $30

Period 4: $30

Period 5: $30

Period 6: $1,030

With the periods and the cash flows known, a discount factor must be calculated for each period. This is calculated as 1 ÷ (1 + r) n, where r is the interest rate and n is the period number in question. The interest rate, r, compounded semiannually is 6% ÷ 2 = 3%. Therefore, the discount factors would be:

Period 1 Discount Factor: 1 ÷ (1 + .03)^1 = 0.9709

Period 2 Discount Factor: 1 ÷ (1 + .03)^2 = 0.9426

Period 3 Discount Factor: 1 ÷ (1 + .03)^3 = 0.9151

Period 4 Discount Factor: 1 ÷ (1 + .03)^4 = 0.8885

Period 5 Discount Factor: 1 ÷ (1 + .03)^5 = 0.8626

Period 6 Discount Factor: 1 ÷ (1 + .03)^6 = 0.8375

Next, multiply the period’s cash flow by the period number and by its corresponding discount factor to find the present value of the cash flow:

Period 1: 1 × $30 × 0.9709 = $29.13

Period 2: 2 × $30 × 0.9426 = $56.56

Period 3: 3 × $30 × 0.9151 = $82.36

Period 4: 4 × $30 × 0.8885 = $106.62

Period 5: 5 × $30 × 0.8626 = $129.39

Period 6: 6 × $1,030 × 0.8375 = $5,175.65

∑ Period = 1-6 = $5,579.71 = numerator

Current Bond Price = ∑ PV Cash Flows = 1-6

Current Bond Price = 30 ÷ (1 + .03)^1 + 30 ÷ (1 + .03)^2

Current Bond Price = + ⋯ + 1030 ÷ (1 + .03)^6

Current Bond Price = $1,000

Current Bond Price = denominator

(Note that since the coupon rate and the interest rate are the same, the bond will trade at par.)

Macaulay Duration = $5,579.71 ÷ $1,000 = 5.58

A coupon-paying bond will always have its duration less than its time to maturity. In the example above, the duration of 5.58 half-years is less than the time to maturity of six half-years. In other words, 5.58 ÷ 2 = 2.79 years, which is less than three years.

A coupon-paying bond will always have its duration less than its time to maturity. In the example above, the duration of 5.58 half-years is less than the time to maturity of six half-years. In other words, 5.58 ÷ 2 = 2.79 years, which is less than three years.