Mortgage Interest What it is How it Works

Betsy has a background in international finance and now works as a journalist, drawing on her academic and professional experience.

Mortgage interest refers to the interest charged on a loan used to buy property. It is calculated as a percentage of the total loan amount and can be either fixed or variable. In the early stages of a loan, the majority of the payment goes towards interest.

Here are the key takeaways:

– Mortgage interest is charged on property loans.

– Interest is calculated as a percentage of the loan amount.

– Mortgage interest can be fixed or variable and compounds.

– Taxpayers can claim a deduction for mortgage interest up to a certain amount.

When purchasing a home or property, most people need to take out a mortgage. Payments are made to the lender over an agreed-upon period of time, and each payment includes both principal and interest. Mortgage interest applies to primary and secondary loans, home equity loans, and lines of credit.

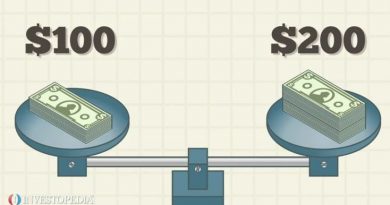

The interest on a mortgage loan is calculated as a percentage of the loan amount. Some mortgages have fixed interest rates, while others have variable rates. During the early stages of a mortgage, more of the payment goes towards interest, but as time goes on, more is applied to the principal balance.

Mortgage interest compounds, meaning it accrues on the principal balance along with any unpaid accumulated interest. Missing a mortgage payment results in paying interest on the outstanding interest.

It’s important to note that mortgage interest is a major tax deduction for individuals. To claim this deduction, taxpayers must itemize their deductions and meet certain conditions. For properties purchased after December 15, 2017, the deductible interest is limited to the first $750,000.

The homeowners can deduct the full amount of mortgage interest paid during the tax year as long as they meet the criteria set by the IRS. The mortgage must be a secured debt and the residence must be the owner’s primary or second home.

Now let’s discuss the types of mortgage interest:

– Fixed-rate interest remains the same for a particular period or the entire loan term. It provides predictability and is a popular choice when interest rates are low.

– Variable interest rates fluctuate based on the market and are commonly known as floating or adjustable rates. They are tied to an index and change as the index or rate changes. Variable rates are suitable for short-term financing or when refinancing is planned.