Minority Interest Definition Types and Examples

Contents

Minority Interest: Definition, Types, and Examples

Ariel Courage is an experienced editor, researcher, and former fact-checker. She has performed editing and fact-checking work for several leading finance publications, including The Motley Fool and Passport to Wall Street.

What Is a Minority Interest?

A minority interest refers to a stake in a company controlled by a parent company. This usually occurs in subsidiaries where the parent company owns more than 50% of the voting shares. Minority interests come with rights for stakeholders, such as participation in sales and certain audit rights.

Minority interests are also known as non-controlling interests. Under U.S. GAAP, non-controlling interests are listed on the equity section of the parent company’s consolidated balance sheet, separate from the parent company’s equity. This represents the proportion of the subsidiary owned by minority shareholders.

Key Takeaways

- A minority interest is a stake in a company controlled by a larger parent company.

- Minority interests generally range between 20% and 30% of the company’s equity, compared to the majority interest of over 50%.

- The term "non-controlling interest" is used as a synonym for minority interest, but also reflects situations where a controlling entity might not have majority ownership.

- Parent companies list the minority interests in their subsidiaries on the equity section of their consolidated balance sheet.

- Although minority interests cannot outvote the parent company, they do have some rights, such as audit rights.

Understanding Minority Interests

Minority interests refer to the portion of a company or stock not held by the parent company, which holds the majority interest. Most minority interests range between 20% and 30%.

While the majority stakeholder, usually the parent company, has voting rights to set policy and procedures, minority stakeholders generally have very little say or influence in the direction of the company. That’s why they are also called non-controlling interests (NCIs).

In some cases, a minority may have rights such as the ability to take part in sales. Laws also entitle minority interest holders to certain audit rights. They may also be able to attend shareholder or partnership meetings.

In the world of private equity, companies and investors with a minority interest may be able to negotiate control rights. For example, venture capitalists may ask to negotiate for a seat on the board of directors in exchange for their investment in a startup.

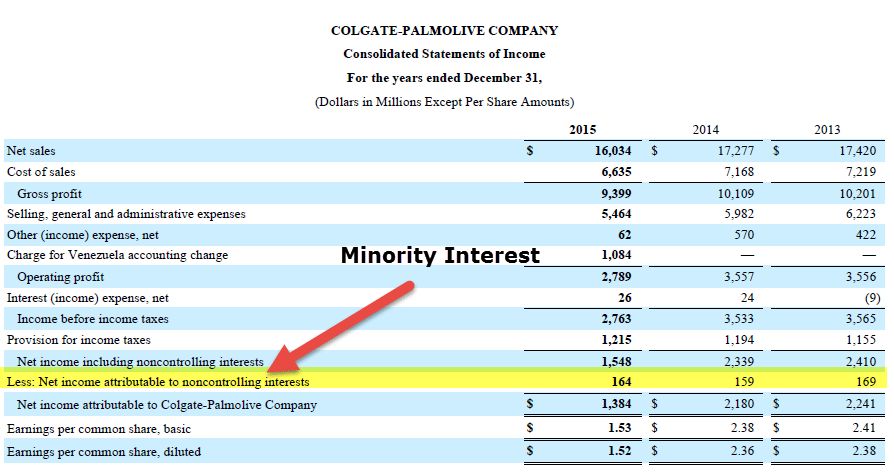

In the corporate world, a corporation lists minority ownership on its balance sheet. In addition to being reflected on the balance sheet, minority interest is reported on the consolidated income statement as a share of profit belonging to minority equity holders.

The consolidated income statement must have a clear distinction between the net income from the parent company and that of the minority interest.

Example of Minority Interest

ABC Corporation owns 90% of XYZ Inc., a $100 million company. In its consolidated balance sheet, ABC will record its $90 million shares in XYZ, as well as the $10 million non-controlling interest representing the shares of XYZ that ABC does not own.

XYZ Inc. generates $10 million in net income. As a result, ABC recognizes $1 million, or 10% of $10 million, of net income attributable to minority interest on its income statement. Correspondingly, ABC marks up the $10 million minority interest by $1 million on the balance sheet. The minority interest investors do not record anything unless they receive dividends, which are booked as income.

In 2007, the Financial Accounting Standards Board introduced the phrase "non-controlling interest" as a synonym for minority interest. Although they mean the same thing, the new phrase reflects the fact that there are situations where a non-majority shareholder can still act as a controlling interest.

Types of Minority Interests

A minority interest can be passive or active. Passive minority interests are those where a minority shareholder owns less than 20% of the equity in a subsidiary company, giving them no material influence on the company’s decisions.

In accounting terms, only the dividends received from the minority interest are recorded for those with minority passive interests. This is referred to as the cost method—the ownership stake is treated as an investment at cost, and any dividends received are treated as dividend income.

Active minority interests, owning 21% to 49%, are when a minority shareholder can materially influence the company where it holds a minority interest. Unlike passive interests, dividends received and a percentage of income are recorded for those with active minority interests. This is referred to as the equity method.

Dividends are treated as a return on capital, decreasing the value of the investment on the balance sheet. The percentage of income attributable to the minority interest is added to the investment account on the balance sheet, effectively increasing its equity share in the company.

Special Considerations

The most common examples of minority interests occur in subsidiaries where a parent company holds over 50% of voting shares. However, it is also possible for a parent company to exert a controlling interest without a majority stake. This may be the case with variable interest entities that exert control through a contractual obligation rather than ownership.

Regardless of the type of control, a parent company consolidates the financial results of the subsidiary with its own. As a result, a proportional share of income shows up on the parent company’s income statement attributable to the minority interest. Likewise, a proportional share of equity in the subsidiary company shows up on the parent’s balance sheet attributable to the minority interest.

Prior to 2008, minority interest could be reported as either equity or a noncurrent liability under the rules of U.S. Generally Accepted Accounting Principles (GAAP). This ambiguity was later eliminated by a requirement to report minority interests with the parent company’s equity. The International Financial Reporting Standards (IFRS) also require that minority interest be recorded in the equity section of the balance sheet.

Prior to 2008, minority interest could be reported as either equity or a noncurrent liability under the rules of U.S. Generally Accepted Accounting Principles (GAAP). This ambiguity was later eliminated by a requirement to report minority interests with the parent company’s equity. The International Financial Reporting Standards (IFRS) also require that minority interest be recorded in the equity section of the balance sheet.