Long-Short Ratio Definition How It s Used and What It Indicates

Contents

Long-Short Ratio: Definition, Usage, and Significance

Cierra Murry is an expert in banking, credit cards, investing, loans, mortgages, and real estate. With over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management, she serves as a banking consultant, loan signing agent, and arbitrator.

What is the Long-Short Ratio?

The long-short ratio compares the amount of a security available for short sale with the amount actually sold short. It can represent a specific security or indicate the value of short sales for a basket of securities or the entire market.

This ratio is influenced by the demand and supply of borrowed securities for shorting. Its primary use is as a market sentiment indicator. A high percentage of participants shorting the market suggests bearish sentiment and can gauge short interest in a security.

Key Takeaways

- The long-short ratio compares the amount of a security available for short sale with the amount actually sold short.

- Short sales involve selling borrowed securities, not directly owned, in hopes of buying them back later at a lower price.

- More shorts relative to available loaned securities indicate greater bearish sentiment.

Understanding the Long-Short Ratio

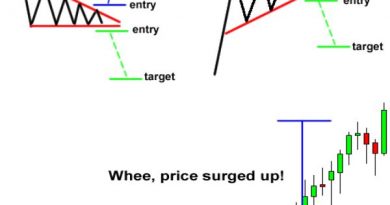

A short sale is a transaction where the seller borrows the stock from a broker-dealer to sell, without actual ownership. The seller has an obligation to repurchase the stock in the future. Short sales are margin transactions and have stricter equity reserve requirements than purchases.

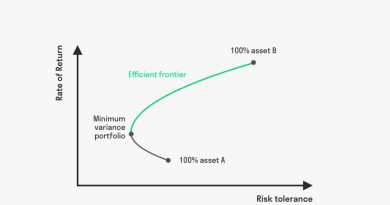

The long-short ratio represents the amount of a security available for short selling compared to the amount borrowed and sold. It serves as an indicator of investor expectations. An increasing long-short ratio suggests positive investor expectations. This may be due to uncertainty regarding new short sale regulations or increased volatility making short sales riskier investments.

As the ratio approaches its limit, a stock may become hard to borrow. Regulation SHO, implemented on January 3, 2005, introduced a "locate" condition for brokers to ensure the availability of borrowed equity for short selling.

Hedge funds are significant participants in the short sale market due to their long/short strategies. During the 2007-2008 financial crisis, a reduction in hedge funds’ short sale positions led to an increase in the long-short ratio. Regulators have increased scrutiny on the industry as short selling was identified as a factor contributing to the crisis.

Special Considerations

The ratio can be affected not only by investor demand for borrowing securities for short sale but also by the supply of securities available for short sale. Pension funds, for instance, typically hold securities long-term and may be unwilling to lend, rendering high demand from hedge funds ineffective.