MBA Purchase Index What it Means How it Works Example

Contents

MBA Purchase Index: What it Means, How it Works, Example

What Is an MBA Purchase Index?

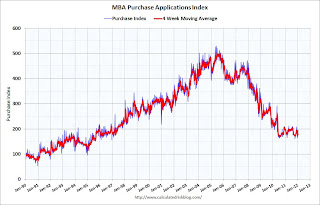

The MBA Purchase Index is The Mortgage Bankers Association’s weekly measurement of nationwide home loan applications based on a sample of about 75% of U.S. mortgage activity.

Contrary to its name, the MBA Purchase Index does not measure the number of homes purchased or mortgage loans closed. Instead, it is simply a report of mortgage loan applications, so the actual number of loans and sales will vary from the MBA Purchase Index. However, analysts consider the MBA Purchase Index to be a leading indicator of the housing market and can be helpful for real estate investors dealing in mortgage-backed securities.

Key Takeaways

- The MBA Purchase Index is a weekly report of mortgage loan applications based on a sample of 75% of U.S. mortgage activity.

- Analysts consider the report to be a leading indicator of housing market activity.

- Previous research has indicated that the index is a useful but imperfect measure in the long term.

Understanding the MBA Purchase Index

The MBA Purchase Index is a leading indicator of home sales by four to six weeks, meaning that it predicts housing activity. Real estate sales tend to be seasonal, so the MB Purchase Index is also adjusted for seasons.

Housing economists and home builders use the index to forecast new and existing home sales. Lenders use it to gauge application activity. The index is also a leading indicator of mortgage prepayment, which is important for investors in mortgage-backed securities, including REITs. The MBA Purchase Index is reported as a percentage increase or decrease from the previous week.

Previous research has indicated that the MBA purchase index can be a useful measure on its own. Its utility is mostly derived in making near-term forecasts. In some instances, the index was an inaccurate indicator of housing market activity. This was primarily due to severe weather conditions which led to homebuilders postponing construction activity and an unanticipated change in interest rates.

Example of the MBA Purchase Index

For example, a news report might announce that the MBA Purchase Index rose 2% for the week ending June 21, which provides insight into the number of potential home sales recorded for that week. Spring and summer tend to be popular times for real estate as most housing market activity occurs from spring through fall, with a peak in summer.

The relationship between the index’s activity levels and expected activity levels for the time of year tells analysts about the strength or weakness of the housing market. The weekly reports on the MBA Purchase Index describe factors influencing mortgage application activity, such as interest rates, home prices, credit availability, and the number of all-cash homebuyers. Because all-cash buyers make up a significant component of housing market activity, the MBA Purchase Index is said to understate housing market activity, especially considering how wealthy real estate investors purchasing luxury properties or buying low price point properties with cash could change the market.