Market Sentiment Indicator How It s Used in Analysis and Types

Contents

- 1 Market Sentiment Indicator: How It’s Used in Analysis and Types

- 1.1 What Is a Sentiment Indicator?

- 1.2 What Do Sentiment Indicators Tell You?

- 1.3 Market Sentiment Indicators and Behavioral Finance

- 1.4 Types of Market Sentiment Indicators

- 1.5 Sentiment Indicators vs. Technical Indicators

- 1.6 Limitations of Using a Sentiment Indicator

- 1.7 Example of Market Sentiment and Investing

- 1.8 How Do Sentiment Indicators Differ From Technical Indicators?

- 1.9 How Can Sentiment Indicators Impact Trading Strategies?

- 1.10 Are Sentiment Indicators More Effective in Short-Term or Long-Term Trading?

- 1.11 Can Sentiment Indicators Predict Market Crashes?

- 1.12 The Bottom Line

Market Sentiment Indicator: How It’s Used in Analysis and Types

What Is a Sentiment Indicator?

A sentiment indicator represents how a group feels about the market or economy. These indicators attempt to quantify sentiment to predict how beliefs and positions may affect future market behavior.

Sentiment indicators analyze how bullish or bearish market actors are, which may help forecast investors’ future behavior. When sentiment readings are unusually high or low, they may act in a contrarian way. For example, when investors are extremely bearish, that is often a contrary signal to sentiment indicator traders that market prices could start heading higher soon.

Key Takeaways

- Sentiment indicators gauge market psychology and beliefs that may influence the market.

- When a sentiment indicator moves in the same direction as what it is analyzing, that typically confirms the trend.

- Extreme readings on a sentiment indicator may cause contrarian views.

- Sentiment indicators analyze trends, assets, and the economy from the perspective of participants.

What Do Sentiment Indicators Tell You?

Sentiment indicators can be used to see how optimistic or pessimistic people are about the current market or economic conditions. For example, a consumer sentiment indicator shows pessimism may make companies less likely to stock up on inventory because they fear consumers will not spend.

The data is subject to interpretation. A high reading shows consumers are upbeat, but it may head lower over time. A low reading shows consumers are downtrodden, but from there, things are likely to improve.

Sentiment indicators are one piece of data and not a timing signal for taking action. For example, a sentiment indicator with a very high reading indicates investors are expecting stock market prices to decline. The contrary aspect indicates that prices will likely rise because there are few people left to keep pushing prices lower. What the indicator doesn’t tell us is when that will happen. Traders use the data to watch for turning points in prices when sentiment levels hit extremes.

When sentiment indicators aren’t near extremes, they help confirm the current trend. For example, a rising put/call ratio signals investors are pessimistic, which confirms a downtrend in price. Similarly, a falling put/call ratio confirms a rising price.

Policymakers may also use sentiment indicators with other economic data to help determine the future direction of interest rates.

Market Sentiment Indicators and Behavioral Finance

Investor biases and emotions play a significant role in shaping investment decisions. Emotions and bias may lead to suboptimal outcomes and financial losses.

One cognitive bias is overconfidence, where investors tend to overestimate their ability to predict market movements and make successful investment decisions. People may feel overconfident, leading to excessive trading, increased risk-taking, and a failure to adequately diversify their portfolio.

Another common emotional factor impacting investment decisions is fear. Investors often react strongly to market downturns or negative news, leading to panic selling and hasty decision-making.

Last, the herd mentality where investors follow the crowd without conducting independent analysis can lead to groupthink and market bubbles.

Contrarian investors intentionally do opposite of what market sentiment indicators show, deciding to swim upstream from the popular investment choice.

Types of Market Sentiment Indicators

Investors can use sentiment indicators to gain insight into the stock market’s mood. Extreme readings from these indicators can indicate impending reversals. Here is a sample of the sentiment indicators that traders and analysts might use:

CBOE Volatility Index (VIX)

Investors often view this indicator as the "fear index" because it spikes when investors purchase a significant amount of put options to protect their portfolios.

New York Stock Exchange (NYSE) High/Low Indicator

Investors can keep track of this indicator to compare stocks making new 52-week highs relative to stocks making new 52-week lows.

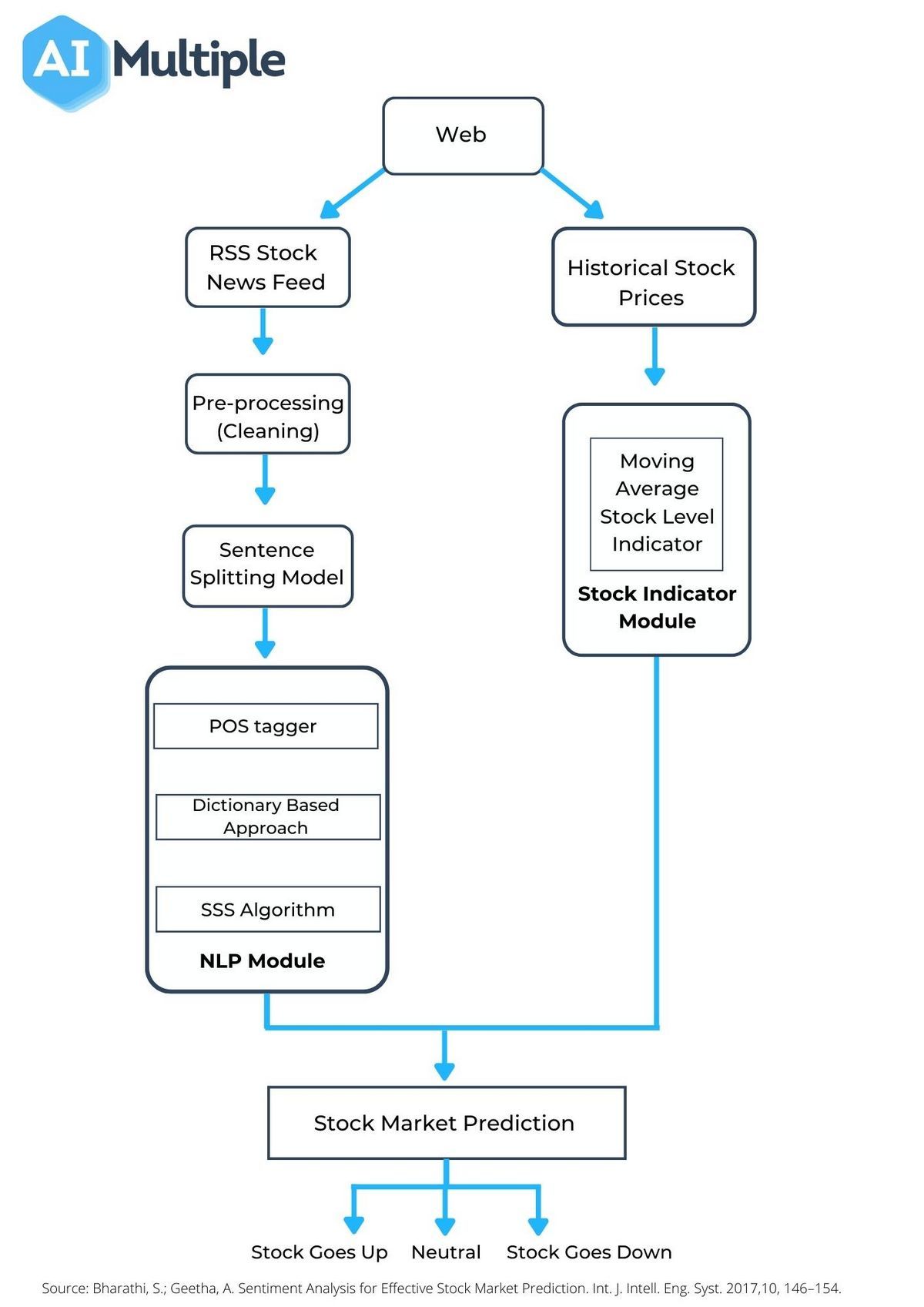

NYSE 200-day Moving Average

This indicator shows how many stocks are trading above their long-term moving average and is expressed as a percentage.

Odd-Lot Trading Statistics

This indicator measures the number of shares being bought and sold in odd lots, which is less than 100 shares for most stocks.

The Commitment of Traders Report

This weekly report shows the aggregate positioning of different groups of traders in the futures markets.

Note that future put/call information can be used to predict future sentiment.

Sentiment Indicators vs. Technical Indicators

Sentiment indicators focus on gauging the emotions and attitudes of market participants, while technical indicators analyze price and volume data.

Limitations of Using a Sentiment Indicator

Sentiment indicators are not timing signals and should be used in conjunction with other forms of analysis. They help confirm market or economic turning points.

Example of Market Sentiment and Investing

The late 1990s and early 2000s witnessed the dot-com bubble’s unprecedented rise and subsequent collapse.

One aspect of the dot-com bubble was the overvaluation of technology stocks, many of which had little or no earnings but were trading at astronomical price-to-earnings ratios.

How Do Sentiment Indicators Differ From Technical Indicators?

Sentiment indicators focus on gauging emotions and attitudes, while technical indicators analyze price and volume data.

How Can Sentiment Indicators Impact Trading Strategies?

Sentiment indicators help traders identify potential trend reversals or confirm existing trends. They play a crucial role in shaping trading strategies.

Are Sentiment Indicators More Effective in Short-Term or Long-Term Trading?

Sentiment indicators can be relevant for both short-term and long-term trading.

Can Sentiment Indicators Predict Market Crashes?

Sentiment indicators may signal heightened risk or extreme market conditions, but predicting specific events like market crashes is challenging.

The Bottom Line

Market sentiment indicators assess the prevailing emotional tone of investors and traders, offering insights into the market’s optimism, pessimism, or neutrality. These indicators help anticipate market trends and provide valuable context for decision-making and risk management in financial markets.