Loan Servicing Definition How It Works Example

Contents

Loan Servicing: Definition, How It Works, Example

What Is Loan Servicing?

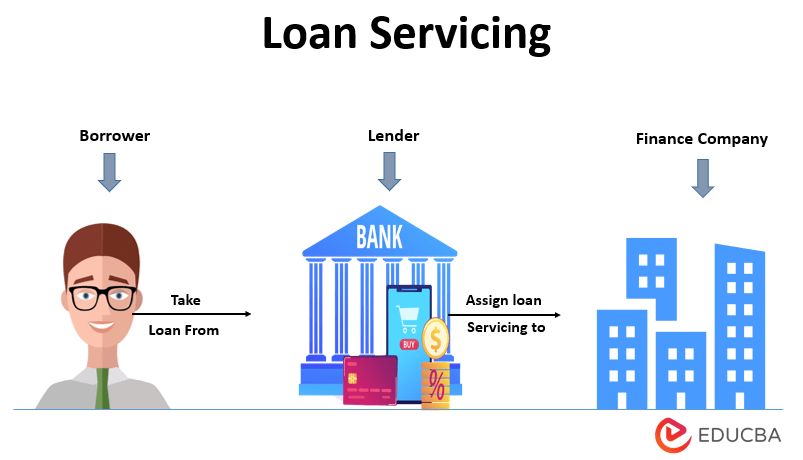

Loan servicing refers to the administrative aspects of a loan from the time the proceeds are dispersed to the borrower until the loan is paid off. It includes sending monthly payment statements, collecting payments, maintaining payment records and balances, paying taxes and insurance (and managing escrow funds), remitting funds to the note holder, and following up on delinquencies.

Key Takeaways

- Loan servicing is carried out by the bank or financial institution that issued the loan, a third-party vendor, or a company that specializes in loan servicing.

- Loan servicing functions include collecting payments, paying taxes, and other aspects of the loan that occur from the time the proceeds are dispersed until the loan is paid off.

- Securitization of loans made loan servicing less profitable for banks.

- Loan servicing is now an industry in itself and companies are compensated by receiving a small percentage of loan payments.

How Loan Servicing Works

Loan servicing can be carried out by the bank or financial institution that issued the loans, a non-bank entity specializing in loan servicing, or a third-party vendor for the lending institution. It may also refer to the borrower’s obligation to make timely payments of principal and interest on a loan to maintain creditworthiness.

Loan servicing was traditionally held within banks. Once loans were repackaged into securities and sold, the servicing of loans became less profitable. As a result, loan servicing became a separate business line and technology became crucial in managing the record-keeping burden.

Loan Servicing Example

Loan servicing is now an industry in itself. Loan servicers are compensated by retaining a small percentage of the outstanding balance, known as the servicing fee or strip. This fee usually amounts to 0.25 to 0.5 percentage points of each periodic loan payment.

For example, if the monthly mortgage payments are $2,000 and the servicing fee is 0.25%, the servicer retains $5—or (0.0025 x 2,000)—of each payment before passing the remaining amount to the note holder.

Special Considerations

Mortgages represent the bulk of the loan servicing market, amounting to trillions of dollars worth of home loans. Student-loan servicing is also significant. As of 2018, just three companies collected payments on 93% of outstanding government-owned student loans amounting to $950 billion from about 30 million borrowers.

Big mortgage loan servicers are slowly backing away from the marketplace due to regulatory concerns. Smaller, regional banks and non-bank servicers are filling the void.

The mortgage meltdown during the 2007-2008 financial crisis brought increased scrutiny on securitization and transfer of loan servicing obligations. Consequently, the cost of loan servicing has increased, and more regulation is possible.

Some loan servicers have embraced technology to reduce compliance costs. Some banks are also refocusing on servicing their own loan portfolio to maintain connections with their retail clients.