Funds From Operations FFO A Way to Measure REIT Performance

Contents

- 1 Funds From Operations (FFO): A Way to Measure REIT Performance

- 1.1 What Is Funds From Operations (FFO)?

- 1.2 Formula and Calculation of Funds From Operations (FFO)

- 1.3 What FFO Can Tell You

- 1.4 Why FFO Is a Good Measure of REIT Performance

- 1.5 Funds From Operations (FFO) vs. Adjusted Funds From Operations (AFFO)

- 1.6 Example of How to Use FFO

- 1.7 What Do a Company’s Funds From Operations Tell You?

- 1.8 Where Do You Find a REIT’s Funds From Operations?

- 1.9 What’s the Difference Between Funds From Operations and the Cash Flow From Operations?

- 1.10 The Bottom Line

Funds From Operations (FFO): A Way to Measure REIT Performance

What Is Funds From Operations (FFO)?

Funds from operations (FFO) is the cash flow measurement used by real estate investment trusts (REITs) to define their operational cash flow. FFO is calculated by adding depreciation, amortization, and losses on asset sales to earnings, and then subtracting gains on asset sales and interest income. It is sometimes expressed per-share and should be used instead of earnings per share (EPS) when evaluating REITs and similar investment trusts.

Key Takeaways

- FFO is the cash flow measurement used by REITs to define operational cash flow.

- It includes depreciation, amortization, and losses on asset sales, but excludes gains on asset sales and interest income.

- REITs disclose their FFO in the footnotes of their income statements.

Formula and Calculation of Funds From Operations (FFO)

The formula for FFO is:

- Obtain net income from the income statement.

- Add back depreciation and amortization expenses.

- Subtract any gains on asset sales.

- Subtract any interest income.

For example, if a REIT has depreciation of $20,000, gains on sales of property of $40,000, and net profit of $100,000, its FFO would be $80,000.

What FFO Can Tell You

FFO is a measure of the cash generated by a REIT and is used to assess its operational performance. It represents the net cash flow from regular business activities. FFO should not be seen as an alternative to cash flow or as a measure of liquidity.

FFO should not be confused with metrics such as cash flow from operations or EBITDA. FFO focuses on operational cash flow, excluding gains on asset sales and interest income.

Why FFO Is a Good Measure of REIT Performance

FFO compensates for cost-accounting methods that may inaccurately communicate a REIT’s true performance. It addresses the issue of property depreciation and excludes nonrecurring gains on asset sales. FFO per share is often provided in addition to EPS and helps investors assess a REIT’s income generation.

Funds From Operations (FFO) vs. Adjusted Funds From Operations (AFFO)

Some analysts calculate adjusted funds from operations (AFFO), which subtracts recurring capitalized expenses and straight-lined rents from FFO. This provides a more accurate estimate of a REIT’s earnings potential.

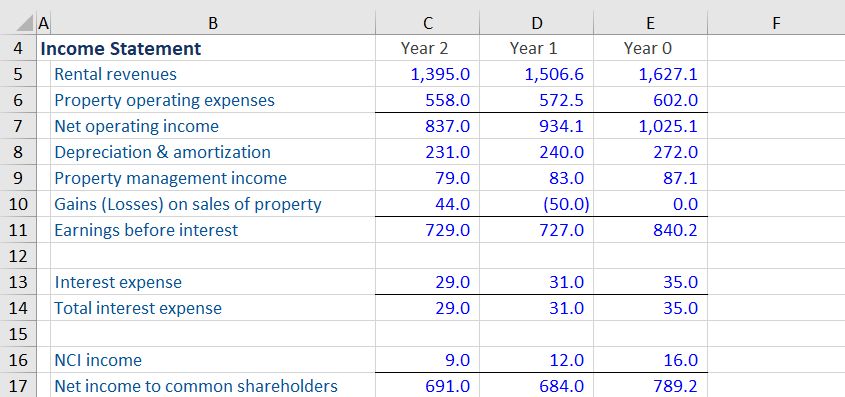

Example of How to Use FFO

For example, Simon Property Group reported FFO of $4 billion on its 2017 income statement, while net income was $2.2 billion. Simon’s diluted FFO-per-share figure was $11.21 compared to diluted EPS of $6.24.

What Do a Company’s Funds From Operations Tell You?

FFO measures a REIT’s generated cash flow from regular business activities and is used to assess its operational performance. It excludes gains from property sales since these are not ongoing or recurring activities.

Where Do You Find a REIT’s Funds From Operations?

REITs disclose their funds from operations in their public financial statements. The figure can usually be found in the footnotes of the income statement.

What’s the Difference Between Funds From Operations and the Cash Flow From Operations?

Funds from operations focus on operational performance and exclude gains on asset sales and interest income. Cash flow from operations, on the other hand, represents the total cash earned from all business activities.

The Bottom Line

FFO is a standard measure used by REITs to assess operational cash flow and performance. It compensates for inaccuracies caused by depreciation and excludes nonrecurring gains. FFO can be found in the footnotes of a REIT’s income statement.