Funds From Operations FFO to Total Debt Ratio Meaning Formula

Funds From Operations (FFO) to Total Debt Ratio: Meaning, Formula

What Is Funds From Operations (FFO) to Total Debt Ratio?

The funds from operations (FFO) to total debt ratio is a leverage ratio that credit rating agencies or investors can use to evaluate a company’s financial risk. It compares earnings from net operating income, depreciation, amortization, deferred income taxes, and other noncash items to long-term debt, current maturities, commercial paper, and short-term loans. Costs of current capital projects are not included in total debt.

Formula and Calculation of Funds From Operations (FFO) to Total Debt Ratio

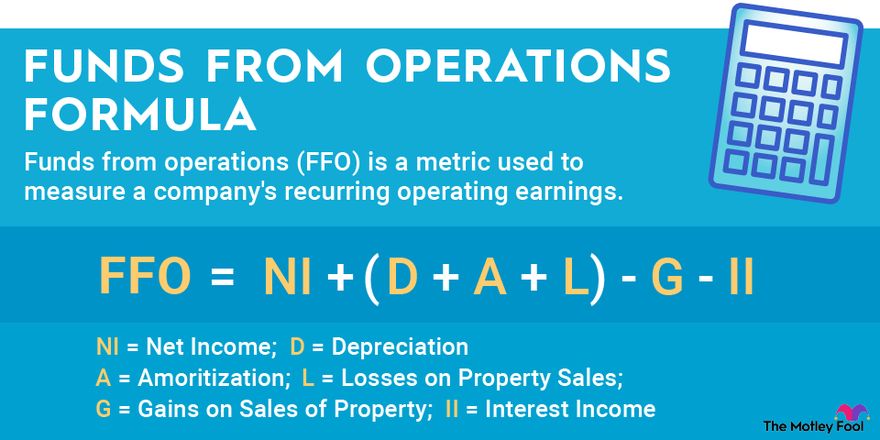

FFO to total debt is calculated as:

Free cash flow / Total debt

– Free cash flow includes net operating income, depreciation, amortization, deferred income taxes, and other noncash items.

– Total debt includes long-term debt, current maturities, commercial paper, and short-term loans.

Key Takeaways

– Funds from operations (FFO) to total debt is a leverage ratio used to assess the risk of a company, particularly real estate investment trusts (REITs).

– The ratio measures a company’s ability to pay off its debt using net operating income alone.

– A ratio below one indicates high leverage, possibly requiring asset sales or additional loans to stay in business.

What Funds From Operations (FFO) To Total Debt Ratio Can Tell You

FFO represents the cash flow generated by a real estate investment trust (REIT). It includes money from inventory sales and customer services. GAAP requires REITs to depreciate investment properties, but this can be inaccurate since the value of properties often increases over time. Depreciation and amortization are added back to net income to address this issue.

The FFO to total debt ratio measures a company’s ability to pay off its debt using net operating income alone. A ratio below one indicates high leverage and the need to sell assets or take out additional loans to stay afloat. A higher ratio indicates a company’s strength in paying its debts from operating income and lower credit risk.

The FFO to total debt ratio is not meant to gauge whether a company’s annual FFO fully covers its debt, but rather if it can service debt within a prudent timeframe. Additional resources such as loans, asset sales, bonds, or stock issuance may be used to repay debts.

Standard & Poor’s considers a company with an FFO to total debt ratio above 0.6 to have minimal risk. However, these thresholds vary by industry.

Limitations of Using FFO to Total Debt Ratio

FFO to total debt alone does not provide enough information to evaluate a company’s financial standing. Other related leverage ratios, such as debt to EBITDA and debt to total capital ratios, are also important in assessing financial risk.