Locked-in Interest Rate What it Means How it Works

Contents

Locked-in Interest Rate: Meaning and Mechanics

What Is a Locked-in Interest Rate?

A locked-in interest rate occurs when a lender commits to a fixed interest rate until the borrower completes the transaction by a specific deadline. It is also referred to as a rate-lock or rate commitment.

Key Takeaways

- A locked-in interest rate, also known as a rate-lock, is when the lender agrees to fix the interest rate before closing.

- Lock-ins are typically used in mortgage applications to protect homebuyers from rate increases between accepting the bank’s offer and closing on the property.

- The rate lock may become void if there are significant changes to the mortgage application or credit report.

- If interest rates drop during the mortgage negotiation, a rate lock prevents the borrower from securing a better deal.

How Does a Locked-in Interest Rate Work?

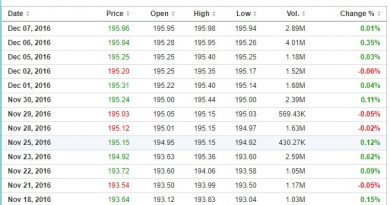

Locked-in interest rates benefit homebuyers because mortgage interest rates can fluctuate frequently. When deciding on a mortgage, homebuyers usually consider the interest rate a crucial factor. However, completing a home sale is often a time-consuming process.

The market interest rate might increase between the homebuyer’s decision to proceed and their agreement with the bank. A locked-in interest rate shields the homebuyer from such potential rate hikes.

By locking in the rate, the bank guarantees that it will not change as long as the borrower closes within a specific timeframe, typically 15, 30, 45, or 60 days, and does not make significant alterations to their application. The rate lock may no longer be valid if there are changes to the borrower’s application, such as a lower-than-expected appraisal or a credit score change.

For example, if the appraisal reveals a higher or lower home value than anticipated, the bank may modify the rate. The bank might also increase an already locked-in rate due to income verification issues, missed payments on other loans, or changes in the credit report.

Additional Considerations

The cost of a locked-in interest rate depends on the lending institution and the borrower’s circumstances. Some lenders offer short-term rate locks at no cost, but longer locks often come at a higher percentage.

If a borrower needs to extend the closing date, lenders may charge a fee, typically a percentage of the total mortgage. Commercial loans usually always have a lock-in rate fee.

In all cases, borrowers should request a written lock-in agreement and consider reviewing it with a legal or real estate professional before signing. Borrowers may also want to inquire about the consequences of a delayed settlement beyond their control.

Homebuyers should also factor in the possibility of interest rates decreasing during the mortgage negotiation, as a rate lock would prevent them from obtaining a better deal.