Fully Subscribed What It Is How It Works Example

Fully Subscribed: What It Is, How It Works, Example

What Is Fully Subscribed?

Fully subscribed is the position a company finds itself in once all the shares of its initial bond or stock offering have been purchased or guaranteed by investors. An underwriting company usually facilitates these initial bond or stock offerings on behalf of younger companies that are making their initial public offerings (IPOs).

Key Takeaways

– A fully subscribed offering is the goal of an initial offering.

– It prevents a company from having shares left over that they cannot sell after they go public, or shares that must undergo a price reduction to be purchased by investors.

– Deciding the offer price at which the shares will be sold by the issuing company is key to ensuring a fully subscribed (or even oversubscribed) IPO.

Understanding Fully Subscribed

A fully subscribed offering prevents a company from having shares left over that they cannot sell after they go public, or shares that must undergo a price reduction to be purchased by investors.

To determine an offering price, underwriters must research and determine what amount potential investors will be willing to pay per share. This can be done in several ways, but it is often determined by polling potential investors beforehand.

Underwriters have flexibility to make changes to the stock offering price based on anticipated demand, but they must ensure they hit the right price point to achieve a fully subscribed offer.

A price that is too high can result in not enough shares being sold. A price that is too low can result in inflated demand and a bidding situation that prices some investors out of the market.

Another expression for fully subscribed is the slang term "pot is clean."

How to Ensure a Fully Subscribed IPO

Once the IPO has been approved by the SEC, and one day before the effective date, the issuing company and the underwriter decide the offer price and the number of shares to be sold.

Deciding the right price at which the shares will be sold is key: an underpriced IPO will attract investors.

Factors like the success of marketing campaigns and roadshows, the issuing company’s goal, and the overall condition of the market impact the offer price.

To ensure that an IPO is fully subscribed or even oversubscribed, issues are usually underpriced, even if this means not receiving the full value of shares. Underpriced IPOs compensate investors for the risk they are taking.

If the shares are underpriced, investors expect a rise in price on the offer day, which increases demand and the chances of having an oversubscribed offer.

A roadshow is a series of presentations to potential investors leading up to an IPO. They generate excitement about the company and are critical to its success.

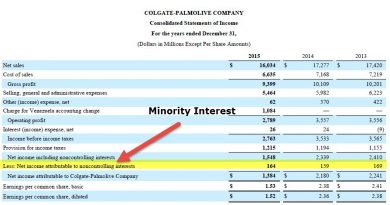

Example of Fully Subscribed

Consider that Company ABC is about to go public. There will be 100 shares available. The underwriter determines that the fair market price is $40 per share. They offer these shares to investors at $40 each, and the investors agree to buy all 100 shares. The offering for ABC is now fully subscribed.

If the shares were priced at $45 per share, they may have only been able to sell half of the shares. This would have left the stock undersubscribed, with half of the stock remaining unpurchased and subject to being re-offered at a lower rate, for example, $35 per share.

Additionally, if the shares were priced at $35 per share, they would have shorted the ABC company $500 in this transaction, or $5 per share. They would have also run the risk of creating a bidding situation where some potential investors would be priced out of ABC’s stock.

What Happens When an IPO Is Oversubscribed?

An IPO is oversubscribed when the number of shares offered by the issuing company is less than the investors’ demand. When this happens, the company can offer more shares, raise the price of the stock, or both. This increases the margin of profit for the issuing company.

What Happens When an IPO Is Not Fully Subscribed?

When an IPO is not fully subscribed, the offer price is often lowered to increase interest among investors. The main drawback is that the issuing company won’t raise the expected capital.

Can You Sell an IPO Immediately?

It depends. Retail investors who invest in a company right after it goes public are generally allowed to sell their shares immediately after they buy them. IPO investors, however, may not be allowed to sell their IPO shares for a certain period after the company goes public. This is called the "lock-up period" and it usually applies to insiders.

What Is a Grey Market IPO?

A grey market IPO is one where a company’s shares are bid and offered by traders unofficially. Therefore, there are no rules or regulators like the SEC. Grey market IPOs are generally run by a small group of individuals.