Unlevered Beta Definition Formula Example and Calculation

Unlevered Beta: Definition, Formula, Example, and Calculation

What Is Unlevered Beta?

Beta is a measure of market risk. Unlevered beta measures the market risk of the company without the impact of debt.

‘Unlevering’ a beta removes the financial effects of leverage, thus isolating the risk due solely to company assets.

Key Takeaways:

– Levered beta (commonly referred to as just beta or equity beta) is a measure of market risk, with debt and equity factored in.

– Unlevered beta strips off the debt component to isolate the risk due solely to company assets.

– High debt-to-equity ratio usually translates to an increase in the risk associated with a company’s stock.

– A beta of 1 means that the stock is as risky as the market, while betas greater or less than 1 reflect higher or lower risk thresholds than the market, respectively.

Understanding Unlevered Beta:

Beta is the slope of the coefficient for a stock regressed against a benchmark market index like the Standard & Poor’s (S&P) 500 Index. A key determinant of beta is leverage, which measures the level of a company’s debt to its equity. Levered beta measures the risk of a firm with debt and equity in its capital structure to the volatility of the market. The other type of beta is known as unlevered beta.

‘Unlevering’ the beta removes any beneficial or detrimental effects gained by adding debt to the firm’s capital structure. Comparing companies’ unlevered betas gives an investor clarity on the composition of risk being assumed when purchasing the stock.

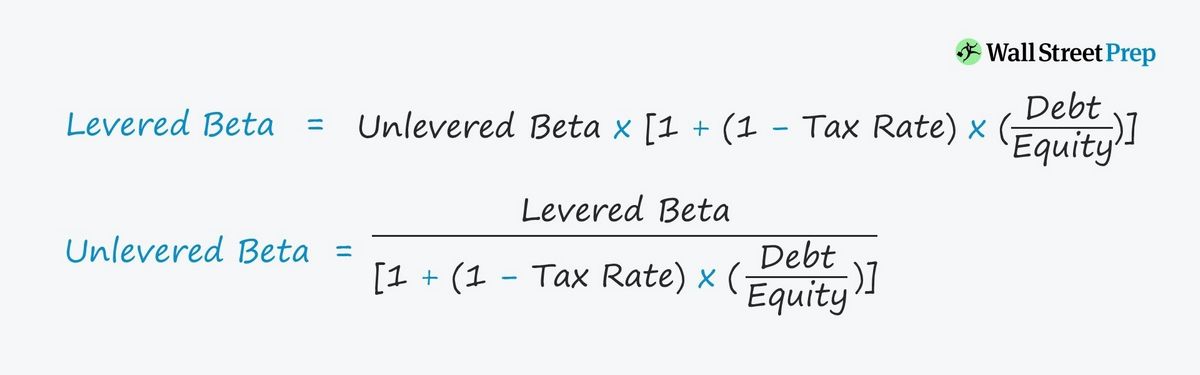

Unlevered beta (asset beta) = Levered beta (equity beta) ( 1 + ( 1 − tax rate ) ∗ Debt Equity )

Take a company that is increasing its debt, thus raising its debt-to-equity ratio. This will lead to a larger percentage of earnings being used to service that debt, which will amplify investor uncertainty about future earnings stream. Consequently, the company’s stock is deemed to be getting riskier, but that risk is not due to market risk.

Isolating and removing the debt component of overall risk results in unlevered beta.

The level of debt that a company has can affect its performance, making it more sensitive to changes in its stock price. Note that the company being analyzed has debt in its financial statements, but unlevered beta treats it like it has no debt by stripping any debt off the calculation. Since companies have different capital structures and levels of debt, an analyst can calculate the unlevered beta to effectively compare them against each other or against the market. This way, only the sensitivity of a firm’s assets (equity) to the market will be factored in.

To ‘unlever’ the beta, the levered beta for the company has to be known in addition to the company’s debt-equity ratio and corporate tax rate.

Systematic Risk and Beta:

Systematic risk is the type of risk that is caused by factors beyond a company’s control. This type of risk cannot be diversified away. Examples of systematic risk include natural disasters, political elections, inflation, and wars. Beta is used to measure the level of systematic risk, or volatility, of a stock or portfolio.

Beta is a statistical measure that compares the volatility of the price of a stock against the volatility of the broader market. If the volatility of the stock, as measured by beta, is higher, the stock is considered risky. If the volatility of the stock is lower, the stock is said to have less risk.

A beta of one is equivalent to the risk of the broader market. That is, a company with a beta of one has the same systematic risk as the broader market. A beta of two means the company is twice as volatile as the overall market, but a beta of less than one means the company is less volatile and presents less risk than the broader market.

Example of Unlevered Beta:

BU = BL ÷ [1 + ((1 – Tax Rate) x D/E)]

For example, calculating the unlevered beta for Tesla, Inc. (as of November 2017):

– Beta (BL) is 0.73

– Debt to Equity (D/E) ratio is 2.2

– Corporate tax rate is 35%.

Tesla BU = 0.73 ÷ [1 +((1 – 0.35) * 2.2)] = 0.30

Unlevered beta is almost always equal to or lower than levered beta, given that debt will most often be zero or positive. (In the rare occasions where a company’s debt component is negative, say, a company is hoarding cash, then unlevered beta can potentially be higher than levered beta.)

If the unlevered beta is positive, investors will invest in the company’s stock when prices are expected to rise. A negative unlevered beta will prompt investors to invest in the stock when prices are expected to decline.

How Can Unlevered Beta Help an Investor?

Unlevered beta removes any beneficial or detrimental effects gained by adding debt to the firm’s capital structure. Comparing companies’ unlevered betas gives an investor clarity on the composition of risk being assumed when purchasing the stock. Since companies have different capital structures and levels of debt, an investor can calculate the unlevered beta to effectively compare them against each other or against the market. This way, only the sensitivity of a firm’s assets (equity) to the market will be factored in.

What Is Beta?

Simply put, beta (β) is a measure of market risk. More precisely, it is a measure of the volatility—or systematic risk—of a security or portfolio compared to the market as a whole. In statistical terms, it is the slope of the coefficient for a security (stock) regressed against a benchmark market index (S&P 500). Each of these data points represents an individual stock’s returns against those of the market as a whole. So, beta effectively describes the activity of a security’s returns as it responds to swings in the market.

What Is Levered Beta?

Levered beta measures the risk of a firm with debt and equity in its capital structure to the volatility of the market. A key determinant of beta is leverage, which measures the level of a company’s debt to its equity. So, a publicly traded security’s levered beta measures the sensitivity of that security’s tendency to perform in relation to the overall market. A levered beta greater than positive 1 or less than negative 1 means that it has greater volatility than the market. A levered beta between negative 1 and positive 1 has less volatility than the market.