Fund Category

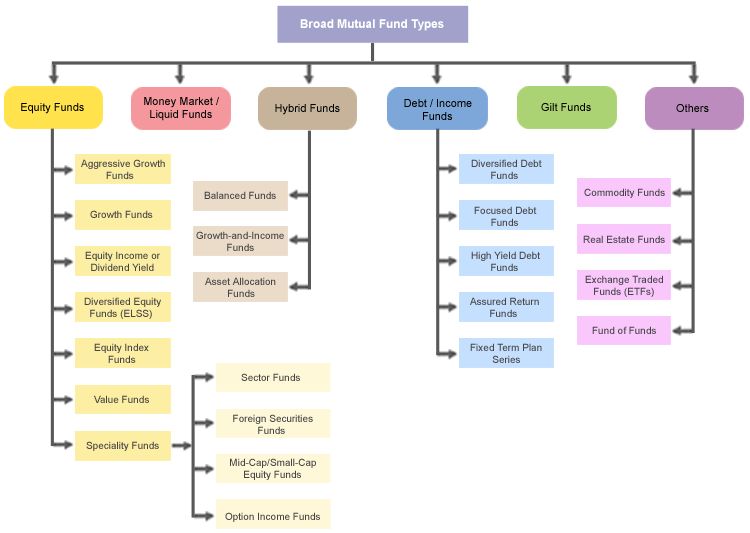

A fund category differentiates mutual funds based on investment objectives and features. It allows investors to diversify their investments by spreading them across funds with different risk and return characteristics.

Fund categories can be structured in various ways, depending on a fund’s objective. Individual and professional investors use different variations of fund categories when building portfolios.

Professionally managed fund of funds is an example of using different fund categories to build a portfolio. These portfolios aim to achieve a specific asset allocation objective by including funds from different categories.

Retail investors can choose funds based on investment styles and balancing objectives. To create a comprehensive portfolio, investors can create an investment profile that outlines their interests, objectives, risk tolerances, and goals.

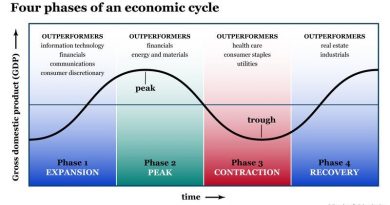

Across the investment universe, investors have a range of options by fund category. Standard options focus on asset allocations like stocks and bonds. Managed objective categories offer strategies based on growth, value, income, and asset allocation blend.

Investors can also choose to invest by asset category, building a portfolio defined by targeted asset holdings such as stock funds and bond funds. Stock funds are categorized by company size (large-cap, mid-cap, small-cap) while bond funds are categorized by portfolio maturities and credit quality.

Managed objective fund categories cover a wide range of objectives like value, growth, income, and asset allocation. Hybrid funds, including conservative, moderate, and aggressive growth funds, allow investors to meet broader or more specific investment goals. Target-date strategies provide diversified portfolios that shift over time to meet the investor’s target date utilization goal.