What Is a Bottom Line in Accounting and Why Does It Matter

Dr. Melody Bell, a personal finance expert, entrepreneur, educator, and researcher, now develops personal finance curricula, teaches postsecondary business and finance courses, and provides strategic consulting for businesses. She founded Financial Beginnings, a national nonprofit, after a career in finance.

The bottom line refers to a company’s earnings, profit, net income, or earnings per share (EPS). It describes the relative location of the net income figure on a company’s income statement.

The term "bottom line" is commonly used for any actions that may increase or decrease net earnings or a company’s overall profit. Companies aim to improve their bottom lines through two simultaneous methods: increasing revenues (i.e., generate top-line growth) and improving efficiency (or cutting costs).

Key Takeaways:

– The bottom line refers to a company’s net income, presented at the bottom of the income statement.

– Management can increase the bottom line by enacting strategies to increase revenues or decrease expenses.

– Net income, or the bottom line, can be retained for future use in the business, distributed as dividends, or used to repurchase shares of outstanding stock.

– The top line refers to gross sales or revenues, found on the top line of the income statement.

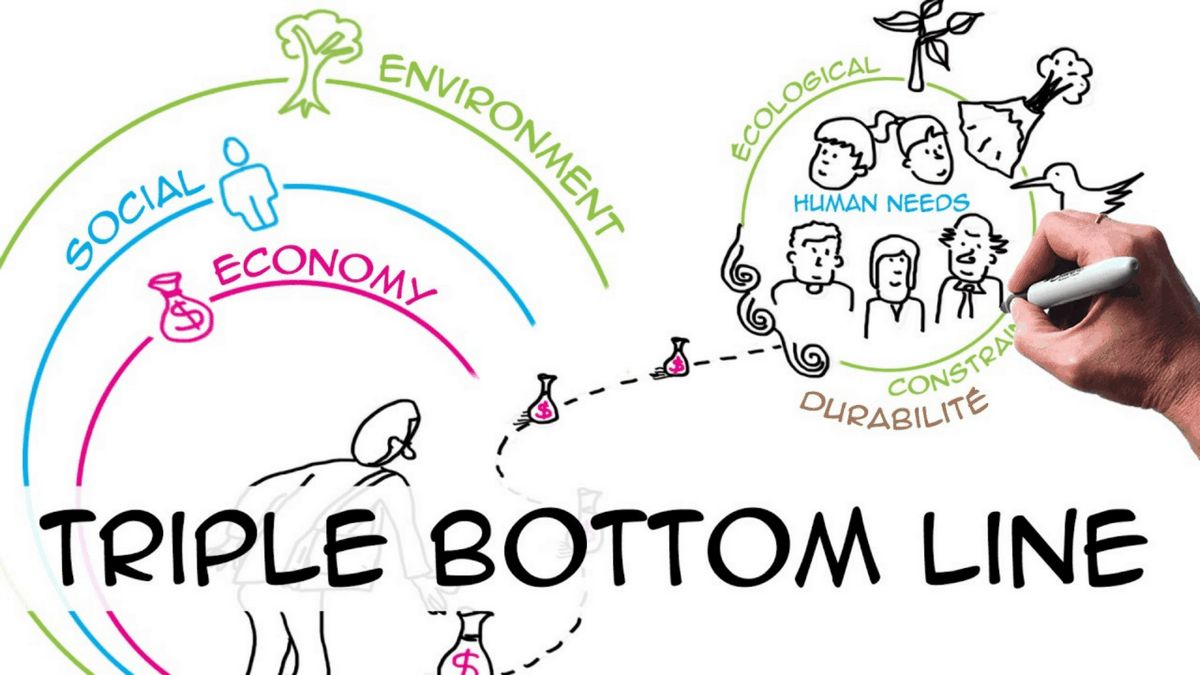

– Triple bottom line (TPL) measures the profitability of a company, along with its social and environmental responsibility.

Understanding the Bottom Line:

The bottom line refers to the net income reported at the bottom of the income statement. The income statement has a general format, with variations in layouts, resulting in net income at the end.

The income statement begins with a company’s main business activity’s sales or service revenues at the top. Other revenue sources follow. Expenses are then listed, grouped differently per industry and company preferences. Total revenue minus total expenses results in net income for the period.

Management can increase the bottom line by increasing revenues or reducing expenses. This can be achieved through production, sales improvements, expanded product lines, increased prices, additional income sources, and cost reduction.

$88.21 billion: The net income of the most profitable company worldwide, Saudi Aramco.

A company can also increase its bottom line by reducing expenses. This includes using cheaper materials, more efficient methods, decreasing wages and benefits, operating from less costly facilities, and limiting capital costs.

How the Bottom Line Is Used:

The bottom line, or net income, does not carry over from one accounting period to the next. Accounting entries close all temporary accounts, transferring the net income into retained earnings on the balance sheet.

Net income can be used in various ways. It can be distributed as dividends to stockholders, used to repurchase stock, or retained for company use in product development or expansion.

Bottom Line vs. Top Line:

Bottom line refers to a company’s net income found at the bottom of its income statement. It shows profit and expense control.

The top line, also on the income statement, reflects gross revenues within a specific period. It represents the top line item. Increases in the top line indicate increased sales or revenues, while increases in the bottom line may result from increased sales, decreased expenses, or both.

Example of Bottom Line:

Cigna, a publicly-traded health insurance company, reported a bottom line of $8.49 million, a 65.8% increase from the previous year. Total revenues were $160.40 million, and total benefits and expenses were $152.25 million. Income from operations was $8.15 million. After adjustments, the income before taxes was $10.87 million, with taxes of $2.38 million, resulting in a bottom line of $8.49 million.

Special Considerations:

In addition to profitability, companies are now measured by their impact on society and the environment, known as the triple bottom line (TPL). This approach considers social and environmental responsibility in addition to profitability.

There is no consensus on how to measure success in these areas. Some suggest assigning monetary values, while others propose using an index. Regardless, attention to social and environmental impact is crucial.

Bottom Line FAQs:

– What is the bottom line in business? It refers to a business’s net income found at the bottom of the net income statement, calculated by deducting expenses from revenues.

– What is another word for the bottom line? Net income, net earnings, and net profit are synonymous with the bottom line.

– How do you calculate the bottom line? Subtract expenses from gross revenues or sales, including depreciation, operating expenses, and interest expenses.

– Why is the bottom line important? It indicates profitability, available funds for dividends and retained earnings, and potential for debt repayment, funding projects, or reinvesting in the company.

In summary, the bottom line refers to a company’s net income recorded at the bottom of the income statement. It showcases profitability and the ability to control expenses. Management can improve the bottom line by increasing revenues and reducing expenses. The top line represents gross sales or revenues and is used to calculate the bottom line. The concept of the triple bottom line emphasizes the importance of social and environmental responsibility in addition to profitability.