Managed Account Definition and How It Works Vs Mutual Funds

A managed account is an investment account owned by an investor but managed by someone else. The manager makes investment decisions based on the investor’s needs, goals, risk tolerance, and asset size. These accounts are common among high-net-worth investors.

Key takeaways:

– A managed account is owned by one investor but managed by a professional money manager.

– Money managers charge a fee based on a percentage of assets under management.

– Robo-advisors offer algorithmically-managed accounts at a lower cost for everyday investors.

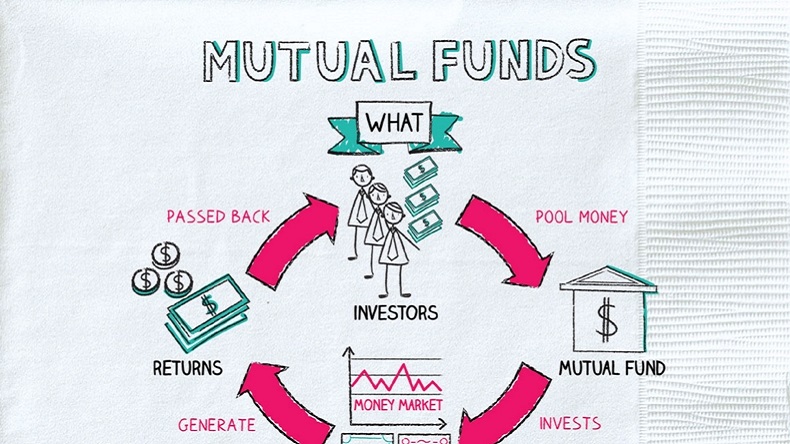

– A mutual fund is a type of managed account that is open to anyone.

The manager of a managed account has the authority to buy and sell assets without the client’s approval, as long as it aligns with the client’s objectives. The manager must act in the best interest of the client to avoid penalties. Regular reports on the account’s performance and holdings are provided to the client.

Money managers typically require a minimum investment amount, often starting at $250,000. They charge annual fees based on a percentage of assets managed. Larger portfolios receive smaller percentage fees. These fees are no longer tax-deductible.

Robo-advisors are a new option for lay investors. They offer automated, algorithmically-driven portfolio management at a lower cost, with starting balances as low as $5.

Managed accounts are commonly used by high-net-worth individuals due to their high minimum investment requirements.

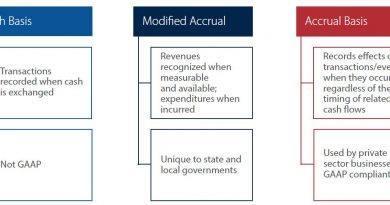

Managed accounts and mutual funds are both actively managed portfolios that invest in a variety of assets. However, managed accounts are tailored to the account holder’s needs, while mutual funds follow the fund’s objectives. Managed account trades can be timed to minimize tax liability, while mutual fund investors have no control over taxable capital gains. Managed account-holders have more transparency and control over assets, while mutual fund-holders only own a share of the fund’s asset value. Managed accounts have higher annual fees, longer investment processes, and higher investment minimums compared to mutual funds.

Both managed accounts and mutual funds are overseen by professional managers. Managed accounts are personalized, while mutual funds have set investment objectives. With a managed account, the investor allocates funds, and the manager makes trades accordingly. In contrast, mutual fund investors own a percentage of the fund’s value, not the fund itself or its assets.

Managed accounts may have slower transactions and specific liquidation times, while mutual fund shares can be bought or sold daily. Managed accounts aim to minimize tax liabilities on profits, while mutual fund shareholders have no control over taxable capital gains.

In 2016, institutional investors opted for managed accounts over hedge funds, seeking broader platforms, customized strategies, full control over separate accounts, daily valuation, lower fees, and transparency. The Alaska Permanent Fund Corp. and Iowa Public Employees’ Retirement System both moved investments to managed accounts.