Vendor Financing Definition How It Works Pros and Cons

Contents

Vendor Financing: Definition, How It Works, Pros, and Cons

Andrew Bloomenthal has over 20 years of editorial experience as a financial journalist and services marketing writer.

Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company. She has nearly two decades of experience in the financial industry as a trainer for professionals and individuals.

What Is Vendor Financing?

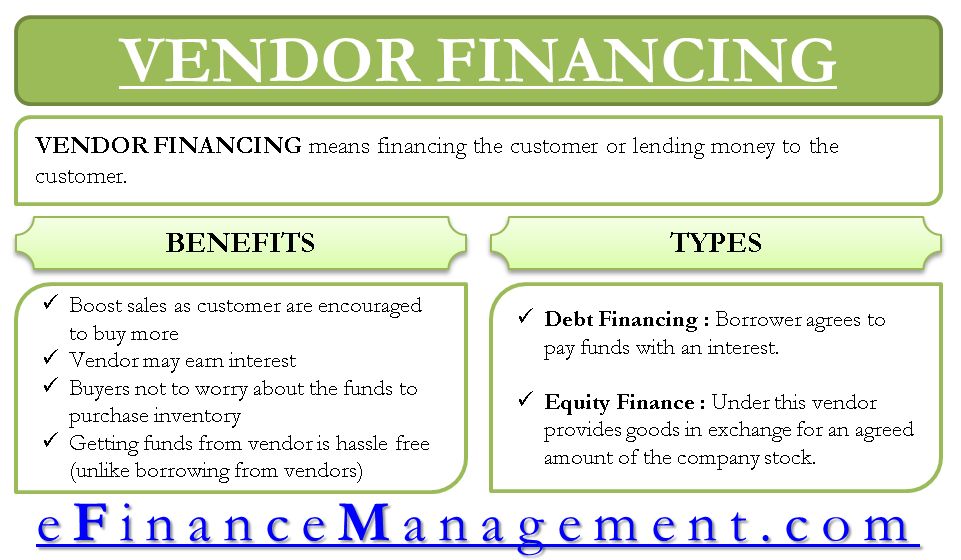

Vendor financing is the lending of money by a vendor to a customer who uses that capital to purchase the vendor’s product or service.

Sometimes called "trade credit," vendor financing usually takes the form of deferred loans. It may also include a transfer of stock shares from the borrowing company to the vendor. Such loans typically carry higher interest rates than traditional bank loans.

Key Takeaways

- Vendor financing is lending by a vendor to a business owner, who uses the capital to buy the same vendor’s products or services.

- Vendor financing deals often have higher interest rates than traditional lenders.

- Vendor financing helps cement relationships between vendors and business owners.

- Vendors engaged in this practice may include payroll management facilitators, security firms, and other service providers.

Understanding Vendor Financing

Vendor financing helps business owners purchase essential goods or services without needing traditional bank loans or personal assets as collateral. It also helps recipients build credit histories and postpone bank financing until necessary for capital improvements.

Vendor financing occurs when a vendor sees higher value in a customer’s business than a traditional lender does. A trusting relationship between the borrower and the vendor is crucial in vendor financing.

While it’s not ideal for vendors to provide products or services without immediate payment, making a sale with delayed payment is better than none. Vendors also collect interest on deferred payments and gain a competitive advantage by offering financing programs.

Vendor Financing Types

Vendor financing can be structured as debt or equity. Debt vendor financing involves a borrower paying an agreed-upon price for inventory with interest. The sum is repaid over time or written off as bad debt. Equity vendor financing involves the vendor providing goods in exchange for an agreed-upon amount of company stock.

Equity vendor financing is common among startups, using "inventory financing" where inventory acts as collateral for short-term loans.

In business, the use of credit in vendor finance is an "open account."

Vendor financing can also help individuals lacking capital to buy a business outright. By providing a loan, vendors secure the business while strengthening the relationship with the owner.

Various Vendor Types

Vendors include payroll management outfits, security firms, maintenance organizations, and service providers. Business-to-business suppliers, such as office equipment manufacturers, commonly provide vendor financing. Materials and parts suppliers also engage in vendor financing activities.