Functional Currency Definition and How It Works in Accounting

Contents

Functional Currency: Definition and How It Works in Accounting

What Is a Functional Currency?

Popular with multinationals, functional currency represents the primary economic environment in which an entity generates and expends cash. It is the main currency used by a business in its dealings.

Key Takeaways

- A functional currency is the main currency that a company conducts its business.

- Companies report their financial statements in one currency, so foreign currencies must be translated into the functional currency.

- The guidelines for translating foreign currencies for financial statements are laid out in the International Accounting Standards (IAS) and generally accepted accounting principles (GAAP).

Understanding a Functional Currency

Financial statements of a business are reported in one currency, so transactions done in another currency must be converted to the principal currency used on the financial statements. The International Accounting Standards (IAS) and generally accepted accounting principles (GAAP) offer guidance on translating foreign currency transactions.

The Financial Accounting Standards Board (FASB) introduced the idea of a functional currency under their Statement of Financial Accounting Standards (SFAS) No. 52.

Choosing a Functional Currency

The world’s economies have grown increasingly interdependent. Multinational corporations recognize the integration of world markets, including the trade of commodities and services and the flow of international capital.

With international operations comes the choice of selecting a functional currency, which addresses financial reporting issues such as determining appropriate functional currencies, accounting for foreign currency transactions, and converting financial statements of foreign subsidiaries into a parent company’s currency for consolidation.

Factors in choosing a functional currency may include the currency that most affects sales price. For retail and manufacturing entities, the currency in which inventory, labor, and expenses are incurred may be most relevant. Ultimately, management must make a judgment between a local currency, that of a parent, or the currency of a primary operational hub.

Determining overall business performance becomes challenging when dealing with multiple currencies. Therefore, both U.S. GAAP and IAS outline procedures for converting foreign currency transactions into the functional currency for reporting purposes.

A company’s functional currency may be the same as the country where it does most of its business or a separate currency from the currency in which a firm is headquartered.

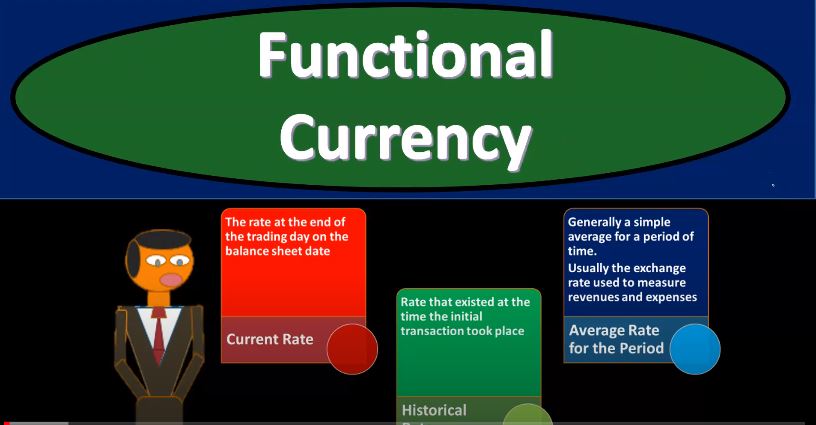

When converting a currency, exchange rates can impact a company’s performance. Conversions are usually done at the spot rate on the transaction date, but standard rates like peak or average rates may be used in some cases.