What Are Bills Payable Definition and How It Works in Banking

Ariel Courage, an experienced editor, researcher, and former fact-checker, has performed editing and fact-checking work for top finance publications like The Motley Fool and Passport to Wall Street.

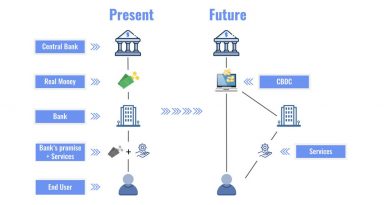

Bills payable are short-term borrowings by banks from other banks, often the central bank of the country. Banks borrow money from the central bank or other banks to meet reserve requirements and maintain liquidity.

Bills payable is also a synonym for accounts payable, particularly in the U.K.

Key Takeaways:

– Bills payable are the money that banks borrow, usually on a short-term basis, and owe to other banks.

– Commercial banks often borrow from the central bank for emergency liquidity or to meet reserve requirements.

– Bills payable is a British term used for accounts payable, which is a current liability on the balance sheet.

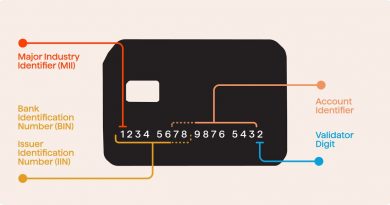

In the context of banking, bills payable refers to a bank’s indebtedness to other banks, typically the Federal Reserve Bank in the U.S. These are short-term interbank loans backed by collateral, such as the bank’s promissory note and government securities.

Banks borrow this money to maintain sufficient liquidity levels. Banks are required to keep a certain amount of cash, known as required reserves, based on their loan portfolio. These reserves act as a cushion to ensure enough liquid cash is available for depositors to withdraw. Insufficient cash can lead to a bank run unless emergency measures are taken.

Apart from borrowing from central banks, banks can also borrow from other banks with excess reserves on a given day. Instead of keeping the extra cash idle, banks can lend it to those in need with interest. These loans, known as bills payable, are very short-term, often overnight loans.

In personal finance and business accounting, bills payable may refer to outstanding liabilities that need to be paid, such as utility bills or rent. These are recorded as accounts payable (AP) and listed as current liabilities on a balance sheet.

Bills payable can be distinguished from bills receivable (accounts receivable), which are funds owed to the company by others but not yet paid.

A less common definition of bills payable specifically refers to short-term notes issued by a company as a bill of exchange or trade acceptance. However, these items are typically listed under a company’s accounts payable.