Master-Feeder Structure Definition How It Works Pros Cons

Master-Feeder Structure: Definition, How It Works, Pros & Cons

What Is a Master-Feeder Structure?

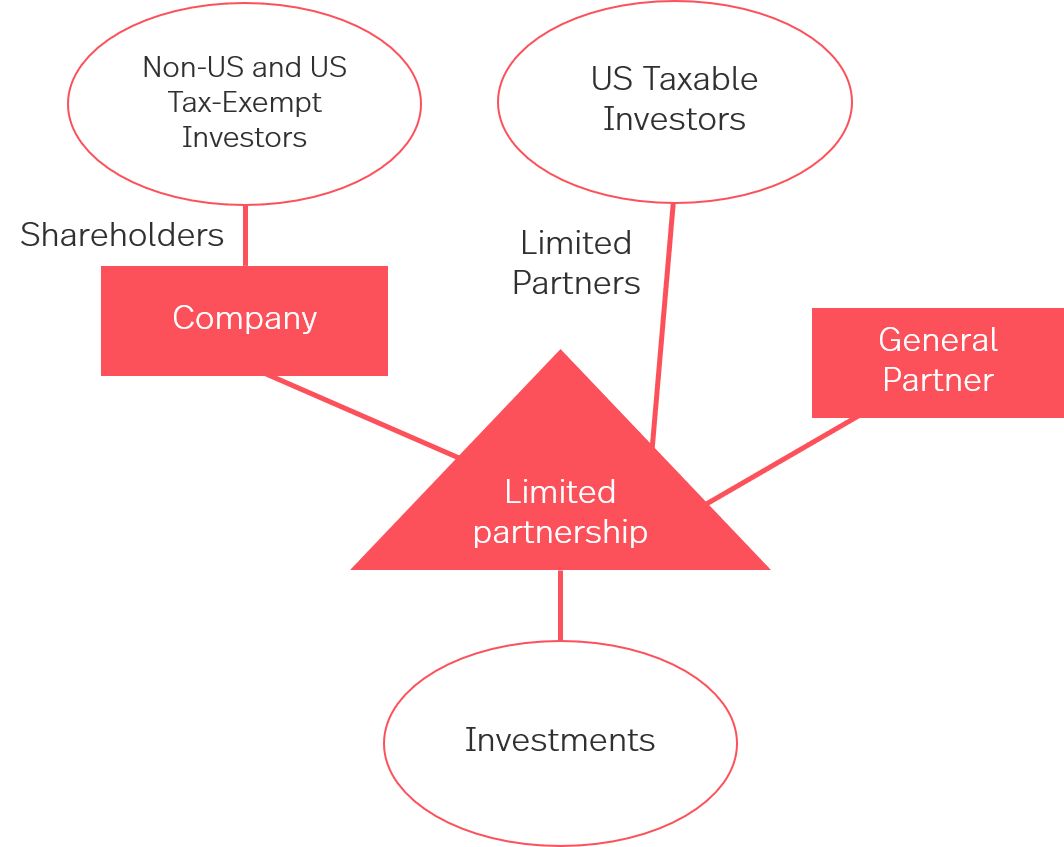

A master-feeder structure is commonly used by hedge funds to pool capital from investors in the United States and overseas into a master fund. Separate investment vehicles, known as feeders, are established for each group of investors.

Investors put capital into their feeder funds, which invest assets into a centralized master fund. The master fund makes all portfolio investments and conducts all trading activity. Fees are paid at the feeder-fund level.

Key Takeaways

- In a master-feeder structure, investment funds are formed from investor capital; these feeder funds, in turn, invest in a centralized master fund.

- Hedge funds commonly use master-feeder structures to accommodate both U.S. and non-U.S. investors.

- The master-feeder structure allows funds to benefit from economies of scale and favorable tax treatment.

How the Master-Feeder Structure Works

The master-feeder structure begins with investors depositing capital into the feeder fund. The feeder fund purchases "shares" of the master fund, receiving all of its income attributes.

This structure is common among hedge funds serving U.S. and offshore investors, allowing them to benefit from a large capital pool while catering to niche markets.

Composition of Master-Feeders

The average master-feeder structure involves one offshore master fund with one onshore feeder and one offshore feeder. Feeder funds can invest in various master funds.

Feeder funds do not have to adhere to a specific master fund but can invest independently with different operational attributes.

For example, if feeder fund A contributes $100 and feeder fund B contributes $200 to a master fund, fund A would receive one-third of the master fund returns while fund B would receive two-thirds of the returns.

Advantages of the Master-Feeder Structure

One significant advantage of the master-feeder structure is the consolidation of portfolios into one entity, reducing operation and trading costs and benefiting from economies of scale. Additionally, the portfolio has better options and terms offered by prime brokers and institutions.

- Economies of scale

- Tax-advantaged partnership status

- Convenient for both domestic and international investors

- Dividends subject to withholding tax (if offshore)

- Difficulty of setting universal investment strategy

Disadvantages of the Master-Feeder Structure

The primary drawback is the 30% withholding tax on U.S. dividends for funds held offshore. The structure also pools together investors with different characteristics and investment priorities, making it challenging to find suitable investment strategies.

Real-World Example of Master-Feeder Structure

A court case in 2018 highlighted complexities between a master fund and its feeder funds. The Ardon Maroon Asia Dragon Feeder Fund was a feeder fund to the Ardon Maroon Asia Master Fund. Both funds had the same directors and appointed the same investment manager, administrator, and transfer agent.

In 2014, a redemption notice was submitted by an investor of the feeder fund. However, both funds went into liquidation a few months later, and the liquidators rejected the proof of debt as the feeder fund hadn’t submitted a separate redemption request notice to the master fund.

A lawsuit was filed, and in 2018, the court decided in favor of the master fund, stating that written notice was required from feeder funds despite the common practice of back-to-back redemptions.

The importance of separate notifications was emphasized, even when the same people served as directors of two funds and both funds shared the same management and administration.