Volcker Rule Definition Purpose How It Works and Criticism

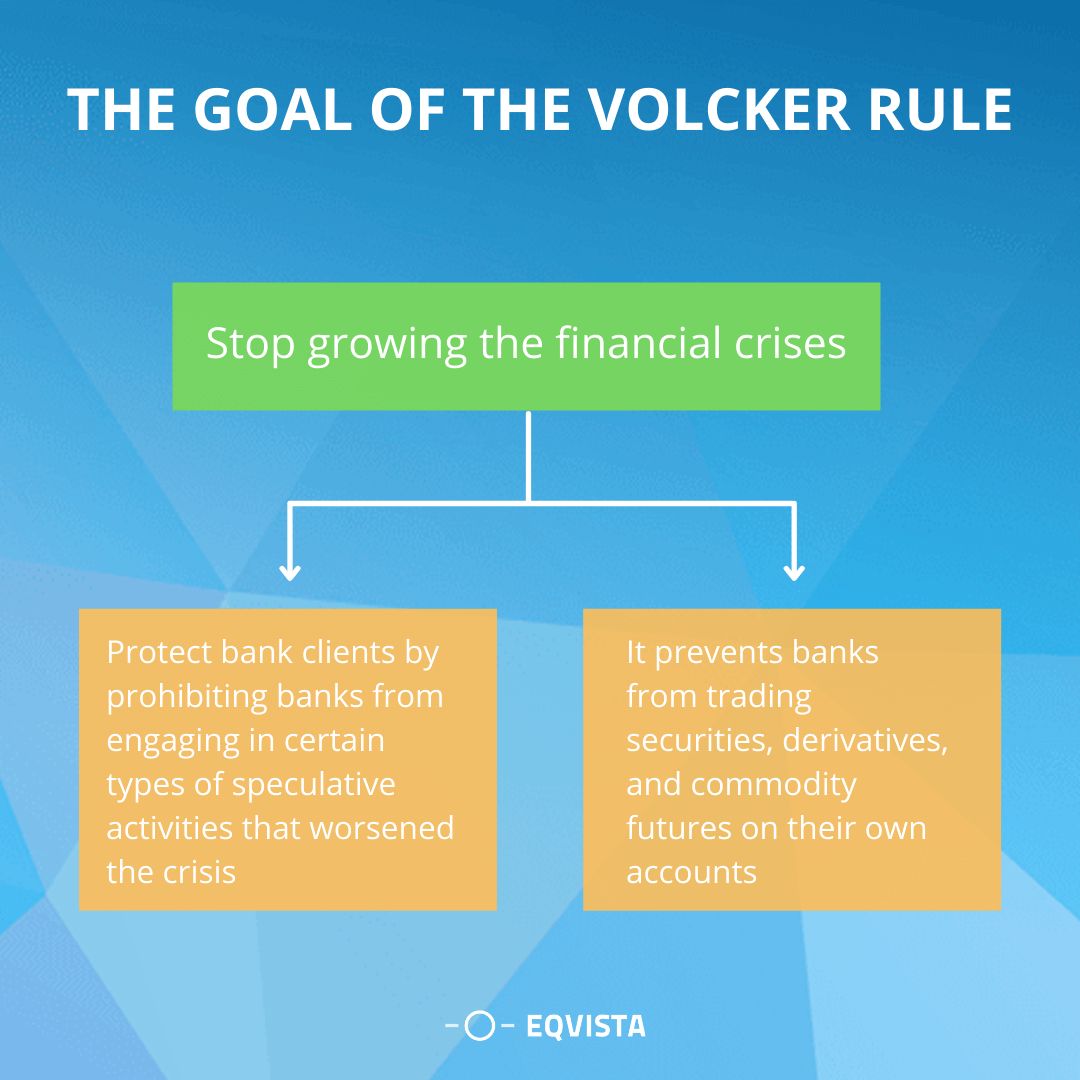

The Volcker Rule is a federal regulation that prohibits banks from conducting certain investment activities with their own accounts and limits their dealings with hedge funds and private equity funds, also called covered funds.

The rule prohibits banks from using their own accounts for short-term proprietary trading of securities, derivatives, commodity futures, and options on these instruments.

On June 25, 2020, the Federal Deposit Insurance Corp. (FDIC) announced that it will loosen the restrictions of the Volcker Rule, allowing banks to more easily make large investments into venture capital and similar funds.

The main criticism of the rule is that it will reduce liquidity because it limits banks’ market-making activities.

The Volcker Rule aims to protect bank customers by preventing banks from making speculative investments that contributed to the 2007–2008 financial crisis.

In August 2019, the U.S. Office of the Comptroller of the Currency (OCC) voted to amend the Volcker Rule to clarify what securities trading is and isn’t allowed by banks.

The rule also bars banks from acquiring or retaining ownership interests in hedge funds or private equity funds, except in certain cases. It aims to discourage banks from taking too much risk by using their own funds to make these types of investments.

The Volcker Rule is named after economist and former Federal Reserve (Fed) Chair Paul Volcker. It refers to section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

The rule went into effect on April 1, 2014, with full compliance required by July 21, 2015. However, the Fed has set procedures for banks to request extended time for certain activities and investments.

Banks may continue market making, underwriting, hedging, trading government securities, offering hedge funds and private equity funds, and acting as agents, brokers, or custodians, as long as these activities don’t create conflicts of interest or high risks.

Depending on their size, banks have varying levels of reporting requirements.

The Volcker Rule’s goal is to protect bank customers by preventing certain speculative investments.

The rule has received criticism for not having a cost-benefit analysis and potentially reducing liquidity. The IMF also argues that regulations to prevent speculative bets are difficult to enforce.

The Glass-Steagall Act, passed in 1933, prohibited commercial and investment banking activities by the same institutions. Its purpose was to avoid conflicts of interest and protect bank customers’ assets.

The Volcker Rule restricts high-risk trading activities by banks, while still allowing them to offer customer-oriented financial services. It has been developed by five federal financial regulatory agencies.