Treasury Yield What It Is and Factors That Affect It

Contents

Treasury Yield: Factors and Impact

What Is the Treasury Yield?

Treasury yield is the annual interest rate that the U.S. government pays on its debt obligations, expressed as a percentage. It represents the annual return investors can expect from holding a U.S. government security with a given maturity.

Treasury yields affect government borrowing costs and investment returns. They also impact consumer and business loan interest rates for real estate, vehicles, and equipment purchases.

Treasury yields reflect investor sentiment towards the economy. Higher yields on long-term U.S. Treasuries indicate higher confidence in the economic outlook. However, high long-term yields may also suggest rising inflation expectations.

Understanding the Treasury Yield

When the U.S. government decides to borrow funds, it issues debt instruments through the U.S. Treasury.

Treasury bonds, or T-bonds, are specific types of U.S. government bonds with maturities of 20 to 30 years. Treasury notes are obligations with maturities between one and ten years, and Treasury bills are obligations maturing within a year.

Treasury yields and prices have an inverse relationship. Each Treasury maturity has its own yield, which is an expression of price. The U.S. Treasury publishes daily yield data for all maturities on its website.

Key Takeaways

- Treasury yields are the interest rates that the U.S. government pays to borrow money for varying periods of time.

- Treasury yields are used to price and trade fixed-income securities, including Treasuries.

- Treasury securities with different maturities have different yields, with longer-term ones typically having higher yields.

- Treasury yields indicate investors’ assessments of the economy’s prospects, including inflation expectations.

How Treasury Yields Are Determined

Treasuries are considered low-risk investments as they are backed by the full faith and credit of the U.S. government. Investors who purchase Treasuries lend money to the government and receive interest payments, or coupons, in return. The yield investors receive is determined by supply and demand.

Treasury bonds and notes are issued at face value, the principal amount the Treasury will repay at maturity. They are auctioned off to primary dealers based on bids specifying a minimum yield. If secondary trading prices rise, yields decrease, and vice versa.

For example, if a 10-year T-note with a face value of $1,000 is auctioned at a 3% yield, and its market value drops to $974.80, the yield rises to 3.3%. The interest payments and principal repayment remain constant. Conversely, if the market value rises to $1,026, the yield for a buyer at that price declines to 2.7%.

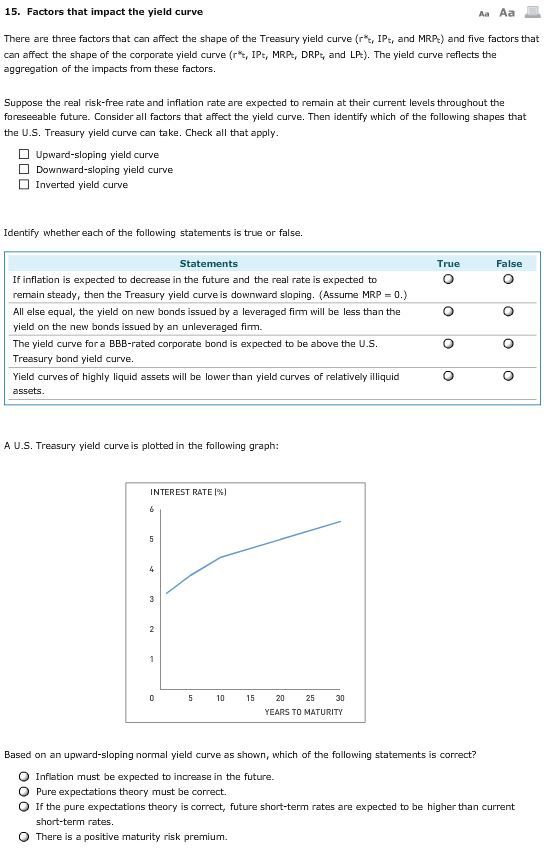

Treasury Yield Curve and the Fed

Changes in Treasury yields can be influenced by the Federal Reserve’s target for the federal funds rate. Short-term maturities are more directly affected, while longer-term ones reflect investors’ expectations for economic performance. Prior to recessions, the yield curve sometimes inverts, indicating slower economic growth.

An inverted yield curve, such as when the 10-year note has a lower yield than the 2-year note, has historically preceded recessions, though false alarms have occurred.

An inverted yield curve indicates an economic downturn.

Yield on Treasury Bills

Treasury bills, or T-bills, are zero-coupon bonds issued at a discount and redeemed at maturity. The difference between the purchase price and face value represents interest earned, used to calculate the bill’s yield. The Treasury Department uses two methods for calculation: the discount method and the investment method.

Under the discount method, the yield is calculated as a percent of the face value. Under the investment method, the yield is calculated as a percent of the purchase price. The two methods differ in the number of days used for calculations, but both offer yield comparisons.

Yield on Treasury Notes and Bonds

The rate of return for Treasury notes and bonds considers coupon payments received semi-annually and the principal repaid at maturity. These securities can be purchased at par, discount, or premium, affecting the yield relative to the coupon rate.

The formula for calculating the Treasury yield is:

Treasury Yield = [C + ((FV – PP) / T)] ÷ [(FV + PP)/2]