TZero Meaning History and Regulation

tZero: Meaning, History, and Regulation

What Is tZero?

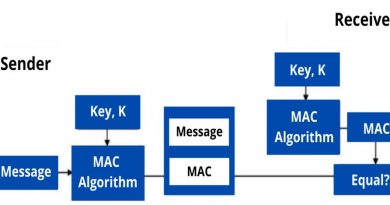

tZero Group Inc. is a registered broker-dealer that uses blockchain technology to securitize interest in companies searching for private equity. It also offers trading and investing services. The company was originally created as a cryptocurrency exchange to provide a trading platform for the security tokens of companies seeking funding and to bring legitimacy and oversight to initial coin offerings (ICOs).

tZero spun out from Overstock in 2021, and the crypto exchange shut down in March 2023. The company now provides private equity blockchain and security token services for companies seeking capital from private equity, accredited, and retail investors.

Key Takeaways

-tZero is a private equity firm that offers blockchain tokenization services for companies raising capital or looking to modernize and secure their capital structures.

-In 2023, tZero reorganized as a private equity services firm and exchange.

-Democratizing access to private equity is one of tZero’s goals, reflecting a growing trend in private equity circles as smaller investors are crowded out by institutions and large venture capital funds.

tZero History

tZero grew from Overstock.com’s blockchain technology called Medici, which allowed for the sale of cryptocurrencies. This project began in 2014 but was abandoned in 2018.

In December 2017, tZero began selling Simple Agreements for Future Equity (SAFEs) to accredited investors. SAFEs enable companies to raise capital outside traditional debt and equity markets and offer investors features of convertible notes. tZero expected to raise $250 million.

tZero became an approved Alternative Trading System (ATS) regulated by the SEC, allowing securitized tokens to be traded. Companies used tZero’s blockchain and trading platform to raise funds, and investors found opportunities.

In response to regulatory issues, tZero changed its business model to become a democratized private equity facilitator. It shut down its cryptocurrency exchange in March 2023.

Private Equity Issues

Startups often rely on venture capital and private equity firms for funding. However, these markets can be centralized, excluding businesses that don’t meet specific criteria and smaller private equity investors.

Smaller private firms began pooling their resources to compete with larger investors, leading to the idea of democratized private equity.

Blockchain and Private Equity

tZero’s blockchain and platform securitize interest in startups and companies seeking capital, offering investment opportunities to anyone. This increases their chances of funding without meeting stringent requirements from venture capitalists.

tZero provides tokenization services and operates a digital security trading platform for individual and accredited investors, bridging the gap between companies and investors.

The Future of tZero

tZero appeals to investors and businesses looking for private funding, providing an alternative to centralized private equity dominated by institutions.

Gaining access to private funding is crucial for growing businesses, and tZero’s model simplifies the connection between businesses and investors, bypassing traditional systems.

The blockchain tZero operates on.

tZero allows companies to choose from blockchains such as Ethereum, Tezos, Algorand, and others for tokenization.

tZero’s Ownership

TZero spun out from Overstock in 2018 and is now part of tZero Group Inc.

Investing in tZero

As a broker, tZero offers blockchain and trading services for investing in other companies. Its parent company, tZero Group Inc., is traded in the over-the-counter markets.

The Bottom Line

tZero is a blockchain services company with a trading platform that brings investors and companies together. It facilitates the offering of digital shares and the trading of digital securities using its platform.