Vanilla Strategy What it is How it Works Example

Contents

Vanilla Strategy: What it is, How it Works, Example

What Is a Vanilla Strategy?

A vanilla strategy refers to a simple and straightforward approach, with little complexity. It can be a common approach to investing or certain decisions made in business. While basic, many investors succeed by sticking with a simple, proven strategy such as passive investing through exchange-traded funds.

Similarly, businesses can succeed through plain vanilla strategies such as focusing business lines where there is a clear competitive advantage. However, a vanilla strategy must allow for some innovation as a competitive advantage can weaken over time for many products and services.

Key Takeaways

- A vanilla strategy is a simple, effective approach that is not overly complicated.

- In investing, vanilla strategies can include passive index investing or the use of a roboadvisor.

- For businesses, simple vanilla strategies are often cost-effective ways of getting the job done.

Understanding a Vanilla Strategy

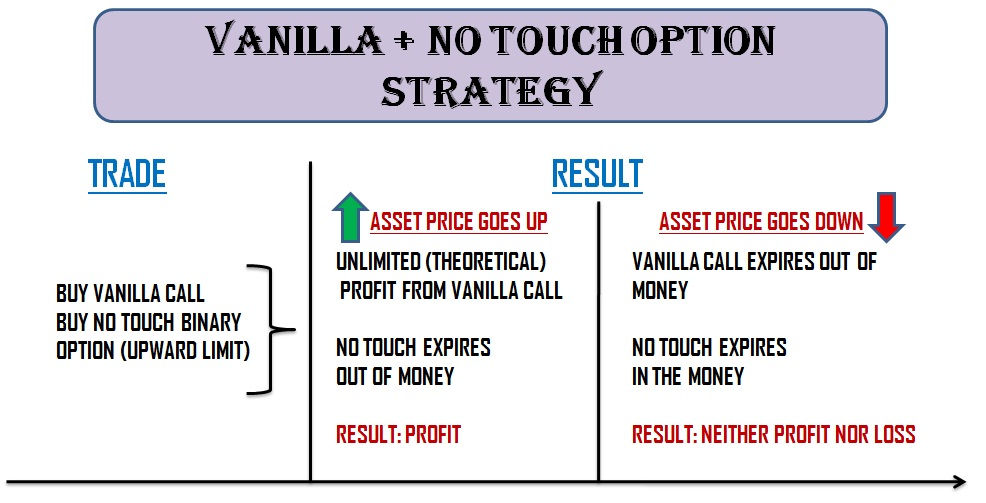

Vanilla strategies are simple, practical, and often conservative. Generally, a vanilla strategy makes sense when explained in a few short sentences. For example, to build an income portfolio, buy and hold dividend-paying stocks with a history of paying dividends for 10 years or more. Compare this to something like an iron condor options strategy, and you can see why it is considered a vanilla strategy.

Vanilla strategies are not diminished by their simplicity – they are simply not as flashy or aggressive as other approaches. More importantly, it can be difficult to implement and stick to a vanilla strategy long term. When speaking about investment strategies, a vanilla strategy can often be outperformed by short-term strategies. However, over the long term, a vanilla strategy will generally see less under-performance than more aggressive strategies do in challenging markets.

Business Usage

Similarly, a simple, conservative approach in business may not catch the attention of the financial media compared to a highly leveraged tech start-up, but investors will eventually appreciate the strong balance sheet that these companies employing vanilla strategies usually have.

Elements of vanilla strategies in business include focusing resources where the competitive advantage is strongest, using moderate debt financing to fund growth, and avoiding overdependency on a single client or product.

Example: A Vanilla Strategy for Retirement

There are many strategies in finance that fit the definition of a vanilla strategy, but one of the most popular is the basic advice for retirement planning. A vanilla strategy for retirement savings includes saving at least 10% of one’s annual income, investing in a diversified portfolio of stocks and bonds through tax-advantaged savings accounts like a 401(k) and Roth IRA, and buying a home with a plan to pay off the mortgage before reaching retirement. Many people find success with this strategy.

A higher-risk portfolio approach to retirement would include a focus on momentum, concentration, penny stocks, emerging countries or technologies, currencies, futures, and/or options. It may work, but not many people have had success with such an aggressive approach. The vanilla strategy is much less work.