Vanishing Premium Policy Meaning History Examples

Contents

Vanishing Premium Policy: Meaning, History, Examples

What is Vanishing Premium Policy

A vanishing premium policy is a type of permanent life insurance where the holder can use dividends to pay premiums. As the cash value of the policy increases, the dividends earned equal the premium payment, causing the premium to vanish.

Understanding Vanishing Premium Policy

Vanishing premium policies may be suitable for consumers worried about long-term income fluctuations. This includes the self-employed, individuals starting a business, or those planning for early retirement.

Some policies initially have a high annual premium with modest benefits, but the premium decreases and benefits increase over time. Others have a consistent premium with a set level of benefits until the premium vanishes. In both cases, the cash value generally increases over time.

A vanishing premium policy can be useful for consumers who plan to use the benefits as supplemental income during retirement. The policy also offers tax-deferred advantages while the cash value accumulates and can be used for estate planning purposes.

Key Takeaways

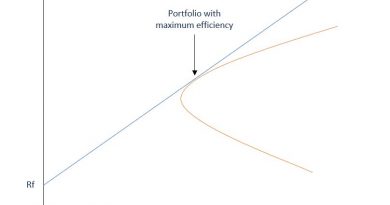

- Dividend payments, based on current interest rates, from the cash value of life insurance cover premium payments in vanishing premium policies.

- These policies charge high premiums with limited benefits initially.

- Vanishing premium policies were popular during periods of high interest rates in the late 1970s and 1980s.

- It is important to consider interest rates when choosing a vanishing premium policy.

One criticism of vanishing premium policies is that some insurance representatives were accused of misleading consumers about the number of years of premium payments required. This situation arose due to the circumstances surrounding vanishing premium policies.

Consumers should be cautious about relying solely on maximum benefit relative to minimum premiums, as the actual amount earned could be lower.

Lastly, it is important for prospective buyers to understand that lower interest rates than expected in the policy can result in paying premiums for more years than anticipated. Therefore, buying a vanishing premium policy during a period of historically high interest rates might not be advisable.

A Brief History of the Vanishing Premium Policy

Vanishing premium policies were popular in the late 1970s and early 1980s when nominal interest rates were high. These policies were often sold as a form of whole life insurance. However, when dividend rates dropped, policyholders had to pay premiums for longer periods than expected. Some policies never fulfilled the promise of vanishing premiums, leading to lawsuits against major insurers.

Insurance companies faced legal action, including lawsuits and regulatory investigations, due to negative publicity surrounding vanishing premium policies. Money Magazine listed these policies as one of the "eight biggest rip-offs in America."

However, legal scholars argue that insurance companies did not violate their contracts with policyholders. The written contracts explicitly stated that future interest rate credits were not guaranteed but depended on the insurers’ discretion "in light of future economic events." State laws also provided a "free look" period for customers to cancel their insurance contracts.

Examples of Vanishing Premium Insurance Policy

Interest rates on one-year Treasury Bills rose as high as 16% in the early 1980s but fell to 3% in the early 1990s. Insurance companies experienced strong sales of vanishing premium insurance policies during the 1980s. However, when interest rates dropped, customers filed lawsuits against the companies.

In one case, a policyholder sued Connecticut Mutual Life Insurance after being notified of outstanding premium payments despite being told the premiums would cease. Similar complaints were raised in other cases, including one where a client was misled by an insurance broker about the total premium amount.