Risk Analysis Definition Types Limitations and Examples

Risk analysis is the assessment process that identifies potential adverse events affecting organizations and the environment. It’s commonly performed by corporations, governments, and nonprofits to determine project feasibility and protect interests. Risk analysts work with forecasting professionals to minimize future negative effects.

Key Takeaways:

– Risk analysis identifies, measures, and mitigates risks.

– Quantitative risk analysis uses mathematical models and simulations.

– Qualitative risk analysis relies on subjective judgment.

– Risk analysis includes risk benefit, needs assessment, root cause analysis.

– Risk analysis identifies risk, defines uncertainty, analyzes models, implements solutions.

Understanding Risk Analysis:

Risk assessment allows organizations to evaluate the probability of adverse events impacting business, economy, or investment and determine the best risk mitigation strategies. A risk analyst identifies potential risks and measures their likelihood. Risks such as market, credit, and currency risks can be reduced through hedging or insurance.

Types of Risk Analysis:

– Risk-Benefits: Compares potential benefits with associated risks.

– Needs Assessment: Analyzes current company state and resource allocation.

– Business Impact Analysis: Assesses the impact of potential risks on business operations.

– Root Cause Analysis: Identifies and eliminates processes causing issues.

Performing a Risk Analysis:

Six steps outline the common process of performing a risk analysis:

1. Identify Risks: List potential risks from internal and external sources.

2. Identify Uncertainty: Understand the uncertainty and quantify its range for each risk.

3. Estimate Impact: Calculate the financial impact of risks.

4. Build Analysis Model(s): Use data inputs to create models or simulations.

5. Analyze Results: Compare risk likelihood, financial impact, and model simulations.

6. Implement Solutions: Take action based on analysis, such as risk avoidance or risk reduction.

Qualitative vs. Quantitative Risk Analysis:

– Quantitative Risk Analysis: Uses mathematical models to assign numerical values to risk. Monte Carlo simulations generate a probability distribution of outcomes, helping manage risk exposure.

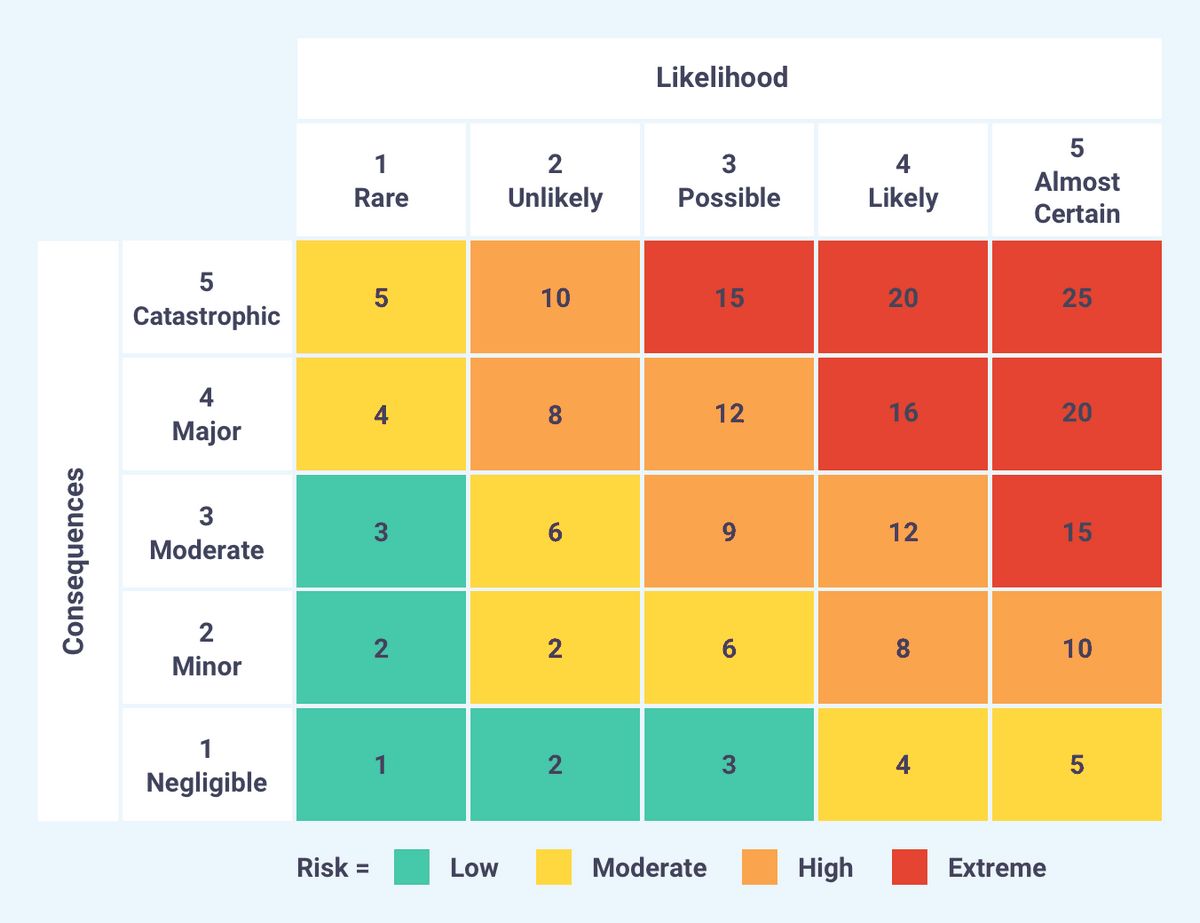

– Qualitative Risk Analysis: Analyzes uncertainties without numerical ratings. Techniques such as SWOT analysis, decision matrix, and cause and effect diagrams are used.

Example of Risk Analysis: Value at Risk (VaR):

VaR measures and quantifies financial risk within a firm or portfolio. It helps risk managers control risk exposure and make informed decisions. VaR is calculated by analyzing historical returns and estimating potential losses with different levels of certainty.

Advantages and Disadvantages of Risk Analysis:

– Pros: Informed decision-making, risk quantification, early warning signs detection.

– Cons: Probabilistic measure, difficulties in calculating, underestimation of risk magnitude or occurrence.

Risk Analysis:

– May minimize losses and quantify risks.

– Relies on estimates and may not predict unpredictable events.

– May protect company resources, produce better processes, and mitigate risk.

What Is Meant by Risk Analysis?

Risk analysis is the process of identifying and analyzing potential future events that may adversely impact a company. It helps understand the financial implications and mitigates risks.

What Are the Main Components of a Risk Analysis?

Risk analysis includes risk assessment, risk management, and risk communication. These components work together to identify, mitigate, and address risks.

Why Is Risk Analysis Important?

Risk analysis guides decision-making, safeguards company assets, and identifies areas where risks are most likely to occur.

The Bottom Line:

Risk analysis involves identifying, understanding, quantifying, analyzing, and planning for risks. It can be qualitative or quantitative and is essential for effective risk management in various situations.