Value Fund Investment Strategy Overview and Examples

Contents

Value Fund: Investment Strategy Overview and Examples

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant™ designation for advanced financial planning, the Chartered Life Underwriter™ designation for advanced insurance specialization, the Accredited Financial Counselor™ for Financial Counseling and both the Retirement Income Certified Professional™, and Certified Retirement Counselor designations for advanced retirement planning.

What Is a Value Fund?

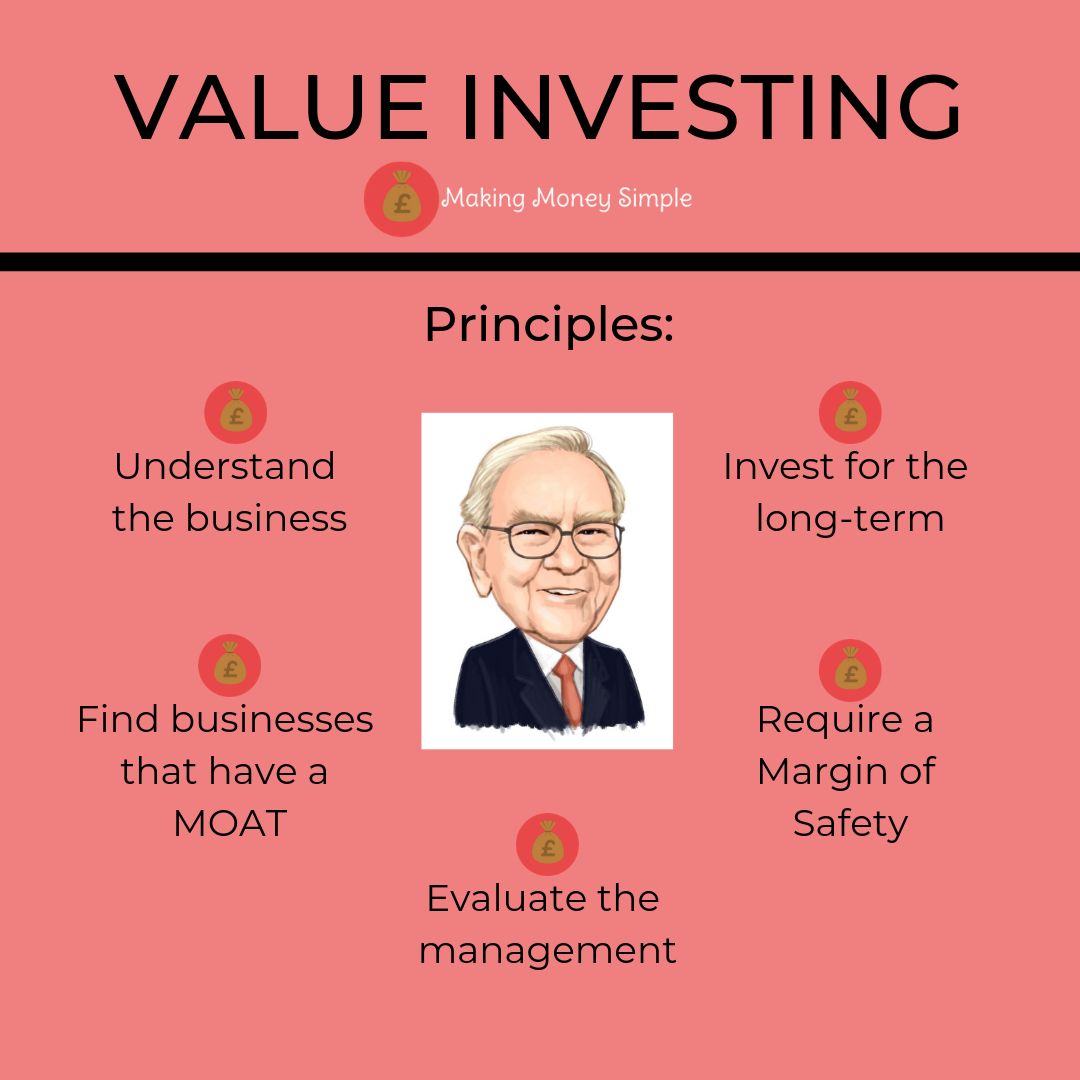

A value fund seeks to invest in undervalued stocks based on fundamental characteristics. Value investing contrasts with growth investing, which focuses on high-growth emerging companies.

Key Takeaways

- A value fund follows a strategy focusing on undervalued shares based on fundamental analysis.

- The premise behind value investing is that once the market realizes the true value of these stocks, the share price will increase and investors will gain.

- Value stocks are often well-established companies that offer dividend payments.

- Warren Buffett, one of the world’s most successful investors, is a value investor.

How a Value Fund Works

Value funds and value investing are strategies developed by investors Benjamin Graham and Warren Buffett. Value managers choose stocks based on fundamental characteristics and intrinsic value. Value funds are used for long-term investing and have the potential to grow steadily over time. Value fund investing is associated with due diligence and patience.

Nearly every large fund family offers a value fund. Value funds are often divided into varying components, such as small-, mid-, and large-cap value funds.

The premise behind value investing is that market inefficiencies cause certain companies to trade below their actual worth. Value fund managers identify these inefficiencies. Once the market corrects them, the value investor gains from an increase in share price. Value stocks are often associated with dividend payments since they are usually well-established companies with dividend distribution programs.

A blend fund (or blended fund) is an equity mutual fund that includes value and growth stocks to offer diversification in a single portfolio.

Examples of Value Funds

Below are four examples of value mutual funds and exchange-traded funds (ETFs) in the investment market:

The Vanguard Equity-Income Fund Investor Shares focuses on investing in large-cap companies that pay above-average dividends. The fund is best for investors who want higher yields and have a long-term investment horizon.

2. The ClearBridge Large Cap Value Fund (SAIFX)

The ClearBridge Large Cap Value Fund is an actively managed value fund that seeks capital appreciation and income through a value-focused investing strategy. The fund offers multiple share classes and pays a consistent quarterly dividend.

3. The Invesco S&P 500 Enhanced Value ETF (SPVU)

The Invesco S&P 500 Enhanced Value ETF tracks the performance of the S&P 500 Enhanced Value Index. Fund managers invest at least 90% of the fund’s assets in stocks that are part of the underlying index. Stocks in the index have a high "value score," indicating they tend to be undervalued based on fundamental analysis.

The iShares Edge MSCI USA Value Factor ETF is an index fund that seeks to replicate the holdings and return of the MSCI USA Enhanced Value Index. The index includes U.S. large- and mid-cap stocks with value characteristics that trade at a comparatively low valuation.

The iShares Edge MSCI USA Value Factor ETF is an index fund that seeks to replicate the holdings and return of the MSCI USA Enhanced Value Index. The index includes U.S. large- and mid-cap stocks with value characteristics that trade at a comparatively low valuation.