Market Average What it is How it Works History

Cierra Murry is an experienced financial analyst, underwriter, and banking consultant with expertise in banking, credit cards, investing, loans, mortgages, and real estate. With over 15 years of experience, she also serves as a loan signing agent and arbitrator, specializing in loan documentation, banking compliance, and credit risk management.

A market average is an indexed measure of the overall price level of a given market, based on a specific group of stocks or securities. It computes the sum of all current asset values in the group and divides it by the total number of shares, considering weighting or normalization factors.

Key Takeaways:

– A market average provides an indexed measure of average price levels in a market.

– It is calculated by adding up prices in an index and dividing them by the number of asset units or an index divisor.

– Different market averages are constructed and reported in different ways, providing a relative measure of price levels and changes.

Understanding Market Averages:

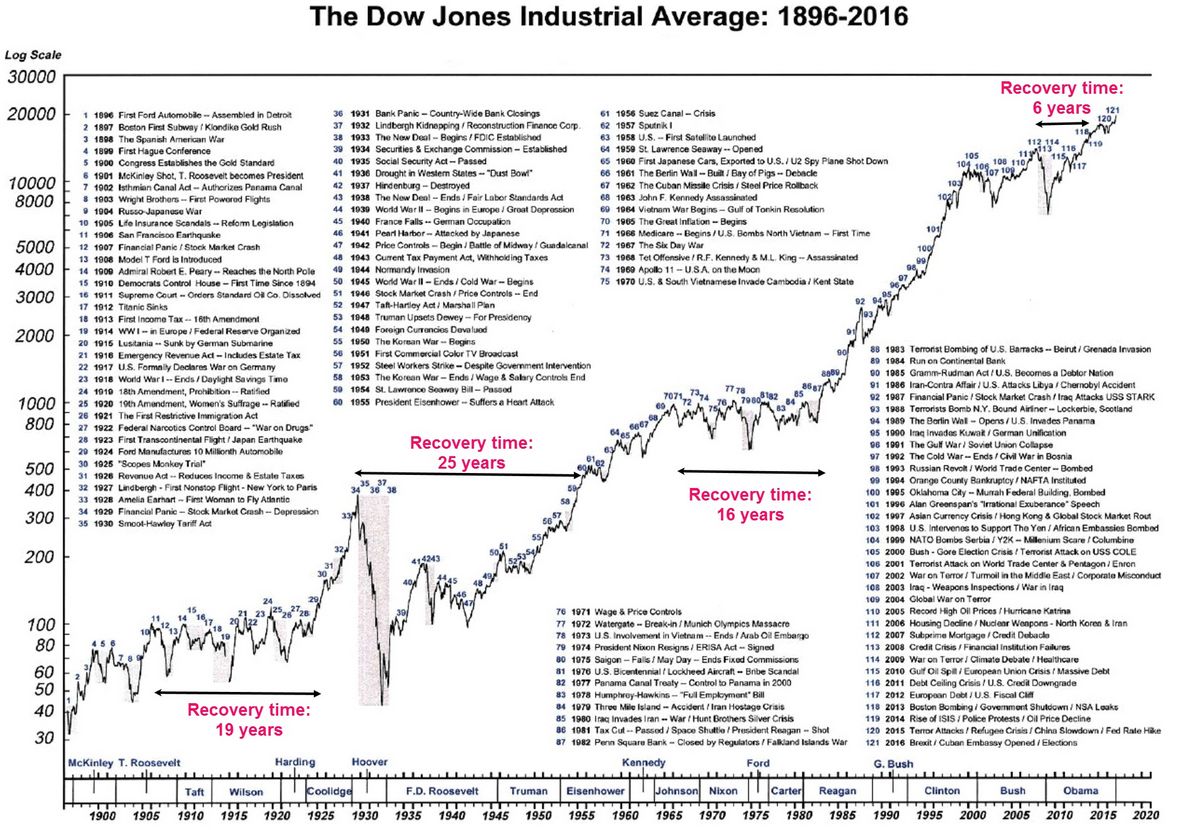

Market averages offer a straightforward method of assessing the price level of a group of assets like stocks. The Dow Jones Industrial Average (DJIA) is a widely-used market average that covers 30 blue-chip stocks listed on the NYSE. It employs a price-weighted average, dividing the stock prices of its components by the "Dow divisor," which is less than one. The divisor is continuously adjusted for corporate actions such as dividend payments and stock splits.

– The DJIA has been trading in the 20,000s for several years, although individual stock prices rarely reach that magnitude.

– The Dow’s five-digit number is a result of adjusting the denominator for stock splits. Numerous splits have occurred since the establishment of the Dow 30 in 1928.

– Whenever a blue-chip stock splits, the denominator decreases accordingly. The current divisor is approximately 0.2.

Despite these considerations, the Dow remains a highly-regarded market average, although its components have changed over time. General Electric is the only original member still included in the index, with Intel and Microsoft replacing Union Carbide and Sears Roebuck.

History of the DJIA: The Most Prominent Market Average:

Named after founder Charles Dow and his business partner Edward Jones, the Dow Jones Industrial Average serves as a proxy for the broader U.S. economy. Initially, it consisted of solely 12 industrial companies. These companies operated in sectors such as railroads, cotton, gas, sugar, tobacco, and oil. General Electric is the only surviving original component.

The index evolves alongside the changing economy, reflecting current economic conditions. Changes are made when companies experience financial distress, no longer representing the economy, or when broader economic shifts occur.

The index expanded to include 30 components in 1928 and has seen 51 component changes. The first changes were made just three months after the index’s launch, where eight stocks were replaced. Notably, the Coca-Cola Company and Procter & Gamble Co. were added during the 1932 change and have remained part of the DJIA in 2022.