Moneyness Definition and Intrinsic Value of Options

Moneyness refers to the relationship between the strike price of a derivative and the price of its underlying asset. It determines the intrinsic value of an option in its current state, especially for put and call options. Moneyness can be measured based on the current or future price of the underlying asset.

To determine if exercising an option would result in a profit, option holders should consider the moneyness. There are three types of moneyness: in, out, and at the money. In this context, moneyness evaluates the value an option would have if exercised immediately.

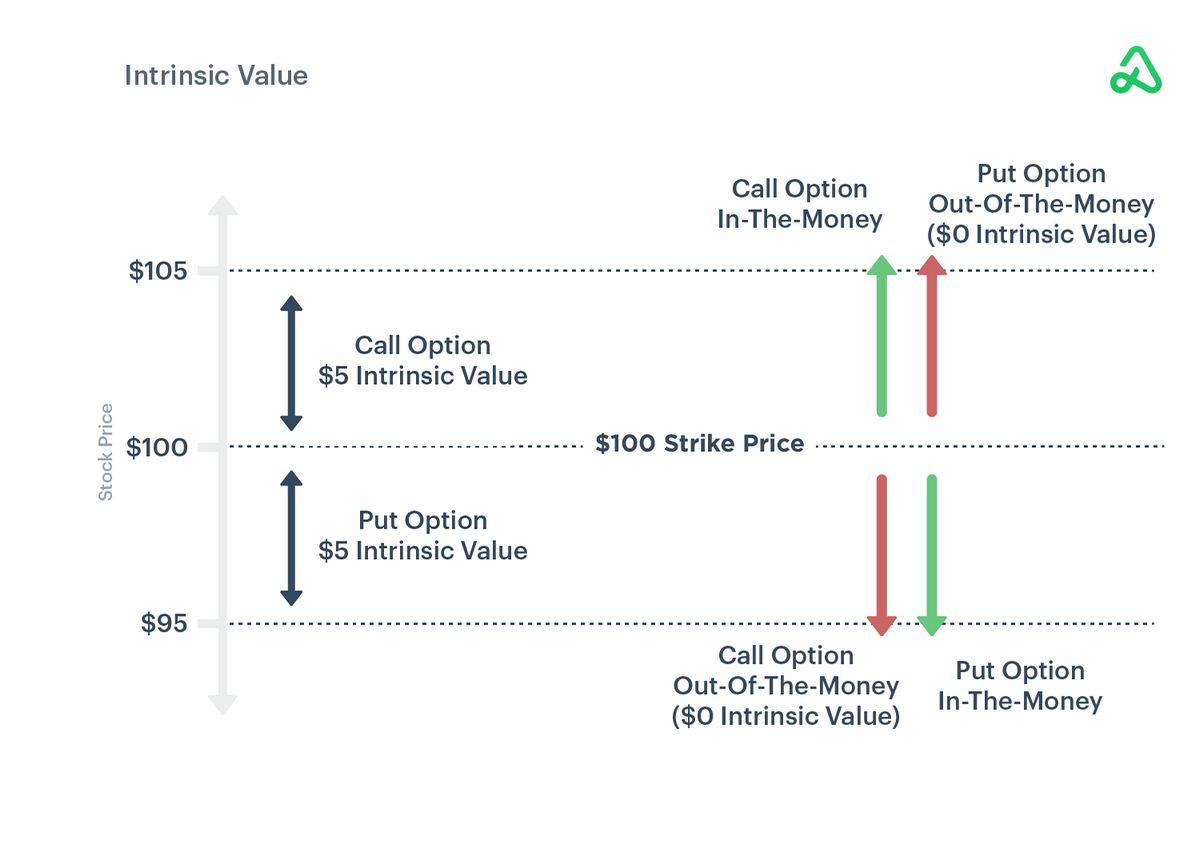

An option is considered "in the money" when exercising it would lead to a profit. For instance, if the market price of a share is higher than the strike price of a call option, the option is in the money. Conversely, for a put option, the market price of a share must be lower than the strike price for it to be in the money.

An option is said to be "at the money" if exercising it would not result in a gain or loss. This occurs when the market price for a share is equal to the strike price of the option.

On the other hand, an option is considered "out of the money" when exercising it would lead to a loss. For example, if the market price of a share is lower than the strike price of a call option, the option is out of the money. Similarly, a put option is out of the money when the market price of a share is higher than the strike price.

Intrinsic value and time value are the two components that make up an option’s value. Moneyness describes intrinsic value, which represents the financial value of an option if it were exercised immediately. Intrinsic value can be calculated using specific formulas for call and put options.

Time value is the other component of an option’s value, and it represents the potential for the moneyness or intrinsic value of the option to increase over time. As an option approaches its expiration date, the time value decreases until it reaches zero.

Understanding moneyness is crucial for trading options because it determines a significant portion of an option’s value alongside time value. By understanding moneyness, traders can assess how much of an option’s price is determined by its intrinsic value and time value. This knowledge is essential for determining the potential profitability of options trades and managing risk effectively.

An option is considered "near-the-money" or "at-the-money" when its strike price is close to the market price of a share. This means that even a small deviation in the share’s price could affect the option’s moneyness.

Deciding whether to exercise an in the money option depends on various factors. While exercising can result in a profit, it also means giving up the time value of the option. Traders may choose to sell the option or hold it in the hopes of its moneyness increasing.

The value of an option is the combination of its intrinsic value (moneyness) and time value. As the expiration date approaches, moneyness becomes a more significant portion of the option’s overall value.

Whether it is better to buy in-the-money or out-of-the-money options depends on individual trading strategies, risk tolerance, and other factors. In-the-money options are more expensive due to their higher intrinsic value, but exercising them can help recover some of the initial investment. Out-of-the-money options are cheaper but lack intrinsic value.

American and European options differ in terms of exercise flexibility. American options can be exercised at any point up to the expiration date, while European options can only be exercised on the expiration date. This makes American options more flexible.

In conclusion, moneyness plays a crucial role in understanding the intrinsic value of options and assessing their potential profitability. By understanding moneyness and considering other factors, traders can make informed decisions and manage risk effectively in options trading.