Unearned Premium

Unearned Premium

What Are Unearned Premiums?

An unearned premium is the premium amount that corresponds to the time period remaining on an insurance policy. It is the portion of the policy premium that has not yet been "earned" by the insurance company because the policy still has time before it expires.

Unearned premiums are liabilities on the insurer’s balance sheet because they would be paid back upon policy cancellation.

For example, at the end of the first year of a fully prepaid five-year insurance policy with premiums of $2,000 per year, the insurer has earned a premium of $2,000 and has an unearned premium of $8,000.

Key Takeaways

– Unearned premium is the portion of the policy premium that has not yet been "earned" by the insurance company because the policy still has time before it expires.

– Provisions in the insurance contract govern the terms for unearned premium.

– In certain circumstances, an insurance company may not have to issue a refund for unearned premium.

Understanding Unearned Premiums

An unearned premium is the portion of an insurer’s total premiums collected in advance. It may be subject to return if coverage ends before the term covered by the premium is complete. An unearned premium may be returned in the event of a total loss, cancellation, or a change in coverage.

For example, if a client paid an auto insurance premium one year in advance and their vehicle was destroyed four months into the coverage period, the insurance company keeps one-third of the annual premium for coverage provided and returns the other two-thirds as unearned premium.

Provisions in the insurance contract govern the terms for unearned premium, which must adhere to applicable regulations. A specific formula may be required to calculate the amount of unearned premium.

An insurance premium is not immediately recognized as earnings by the insurer. In certain circumstances, an insurance company may not have to issue a refund for unearned premium.

For example, if the insured provided false information on their application, the provider may not be required to refund any part of the earned or unearned premiums collected. Policies typically outline the conditions for obtaining the unearned portion of a premium.

Insurance providers may not have to return a portion of unearned premium if the policyholder terminates coverage for unspecified reasons or to secure a policy with a different provider. It is advisable for the policyholder to wait until the coverage period of the last paid premium is close before switching insurance companies.

However, if the insured can prove that the provider did not honor the terms and conditions outlined in the policy provisions, any unused portion of the premium should be refunded.

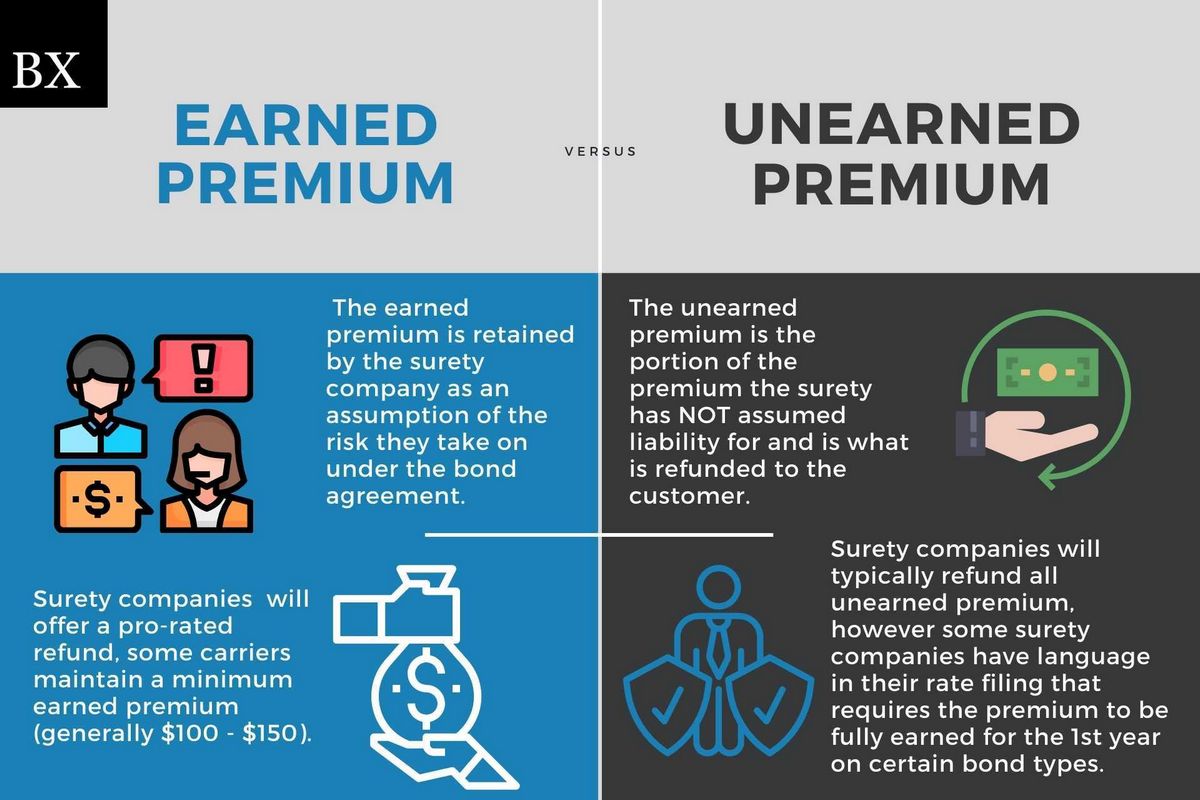

Unearned Premium vs. Earned Premium

An unearned premium on an insurance policy is the opposite of earned premium. Earned premium refers to the pro-rated amount of paid-in-advance premiums that now belongs to the insurer. It is the sum of the total premiums collected over a specific period of time.

In other words, earned premium is the portion of an insurance premium that paid for the period during which the insurance policy was in effect but has now expired. The insurance company considers the associated premium payment as "earned" because it covered the risk during that time.

Example of Unearned Premium

Because canceling a policy may require issuing a refund, unearned premiums appear as liabilities on an insurance company’s balance sheet.

For instance, if an insurance company receives $600 on January 27 for coverage from February 1 to July 31, but as of January 31, the $600 has not been earned. The insurance company reports the $600 in its cash account and records it as a current liability in its unearned premium revenue account. As the company earns the premium, it moves the earned amount from the liability account to a revenue account on its income statement.