Upstairs Market What It Is How It Works Advantages

Contents

Upstairs Market: What It Is, How It Works, Advantages

What Is an Upstairs Market?

The term upstairs market refers to a network between large firms and institutional investors. This network involves large trades or block orders. These orders are not submitted through a stock exchange, so they are not visible to other market participants. Professional brokers act as intermediaries between buyers and sellers. The size of orders made in the upstairs market accounts for a big portion of the market’s trading volume.

Key Takeaways

- The upstairs market is a network involving large firms and institutional investors.

- This market involves large blocks or high volumes of trade, which are made off the trading floor.

- Intermediaries often help prevent insider trading in the upstairs market.

- The upstairs market is the opposite of stock exchanges.

- Regulators monitor the effects of trading in the upstairs market on retail investors.

Understanding Upstairs Markets

Upstairs markets involve trading desks that conduct large volumes of trades. These trades are often called upstairs trades. Because of the sheer volume involved, institutional investors, such as mutual funds, banks, pension funds, insurance companies, and brokerage companies, typically carry out these trades.

These trades take place off the trading floor, normally done electronically or over the phone. The way these upstairs trades are conducted means there are no large swings or disruptions to securities prices in the market.

Routing trades through professional intermediaries can help prevent activities like front-running or trading that takes place based on inside information that will affect stock prices. Front-running may negatively impact the price or execution of a trade.

Special Considerations

These markets are sometimes described as dark pools, hence the phrase “dark pools of liquidity”. Dark pools are financial exchanges, networks, or forums where trading activity takes place privately between involved parties. Dark pools, like upstairs markets, allow investors to make large trades without having to disclose details publicly. Although they may seem shady, dark pools and upstairs trades are completely legal.

However, regulators closely monitor trading in the upstairs market. As of 2014, trades executed in the upstairs market represented 15% of all trading activity in the United States, and there’s a very good likelihood that figure continues to grow.

Some authorities continue to question whether the practice undermines the transparency and accessibility of financial markets for retail investors, leading to stricter rules that help cut down on dark pool trading. For instance:

- Canada introduced regulations in October 2012 that placed stricter limits on the conditions under which upstairs market transactions can take place.

- Australian regulators introduced similar restrictions in May 2013, which caused the volume of upstairs-market transactions to decline significantly in both countries.

Regulators in the United States are also questioning whether this method of trading hurts retail investors and undermines trading activity. They have taken some steps to make the market fair for all participants. For instance, the Financial Industry Regulatory Authority (FINRA) introduced an initiative that requires the weekly publication of trades that occur on an alternative trading system (ATS). It was approved by the U.S. Securities and Exchange Commission (SEC) in 2014.

Alternative trading systems allow trading activity to take place off exchanges and do not enforce rules about the conduct of participants, which is why regulators keep an eye on them.

Upstairs Market vs. Downstairs Market

If there’s an upstairs market, then there’s bound to be a downstairs market, right? The answer is yes. Since the upstairs market is a network involving institutional investors, brokerage firms, and intermediaries, it’s safe to assume that the downstairs markets are stock exchanges.

Downstairs markets, or stock exchanges, create liquidity in the market with trades that are executed by small investors, market makers, and traders who are actually on the floor. Unlike the upstairs market, which involves large trading volumes, trades conducted in the downstairs market are usually smaller. Trade details are also available, including prices and the amount of stock traded.

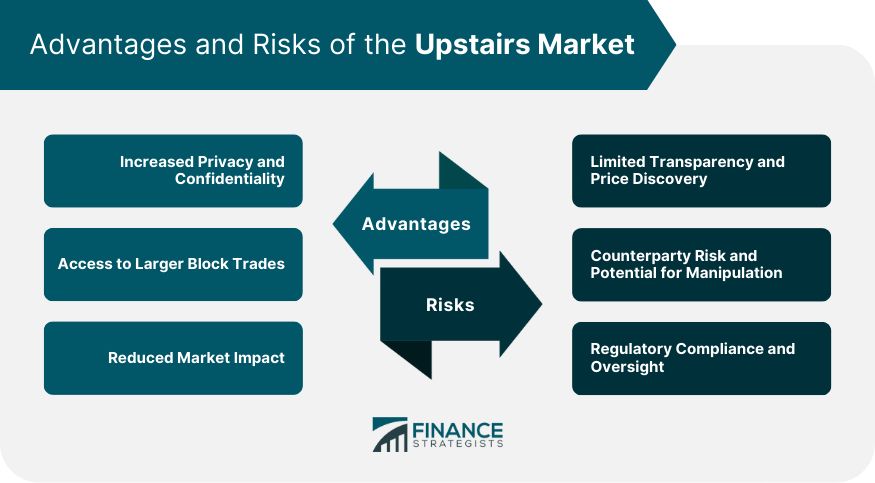

Advantages of an Upstairs Market

If a hedge fund wishes to unload its position in a security and submits a large sell order to the stock exchange accordingly, that sell order may be interpreted by other market participants as a bearish signal on that particular security. This, in turn, may lead other investors to bid down the price of the security, causing the hedge fund to obtain a less favorable sale price.

The upstairs market can also be beneficial for institutional investors because of reduced transaction fees. By carrying out a large block order with just one or a small number of institutional counterparties, the firms involved could pay substantially lower overall commissions or other fees compared to trading with a much larger number of smaller counterparts.

In some cases, such as when executing program trades that require several transactions to be executed simultaneously, using professional intermediaries in the upstairs market may be the only way to effectively carry out the strategy.

In some cases, such as when executing program trades that require several transactions to be executed simultaneously, using professional intermediaries in the upstairs market may be the only way to effectively carry out the strategy.