Unit Cost What It Is 2 Types and Examples

Contents

Unit Cost: Definition, Types, and Examples

What Is Unit Cost?

A unit cost is the total expenditure to produce, store, and sell one unit of a product or service. It is synonymous with cost of goods sold (COGS).

Unit cost includes fixed and variable costs associated with production. Analyzing unit costs helps assess production efficiency. Companies can use profit-volume charts to track earnings or losses based on sales volume.

Variable and Fixed Unit Costs

Successful companies improve overall unit costs by managing fixed and variable costs. Fixed costs, like rent and insurance, are not dependent on output volume. They can be managed through long-term rental agreements.

Variable costs depend on the level of output. Examples include direct labor costs and direct material costs. Companies can improve variable costs by sourcing materials from cheaper suppliers or outsourcing the production process to more efficient manufacturers.

Key Takeaways

- Unit costs represent the expense to create one unit of a product or service.

- Unit costs vary between businesses.

- A large organization may lower unit costs through economies of scale.

- Unit costs are useful in analyzing gross profit margin and setting market offering prices.

- Companies seek to reduce unit costs and optimize market offering prices to maximize profit.

Unit Cost on Financial Statements

Financial statements report unit costs, which are vital for internal management analysis. Unit costs may vary depending on the type of business. Goods-centric companies have clearly defined calculations, while unit costs for service companies can be more vague.

Both internal management and external investors analyze unit costs. These costs include fixed and variable expenses directly associated with production, such as workforce wages and advertising fees. Companies closely monitor these costs to control expenses and reduce unit costs. As companies grow, their unit cost of production typically decreases due to economies of scale.

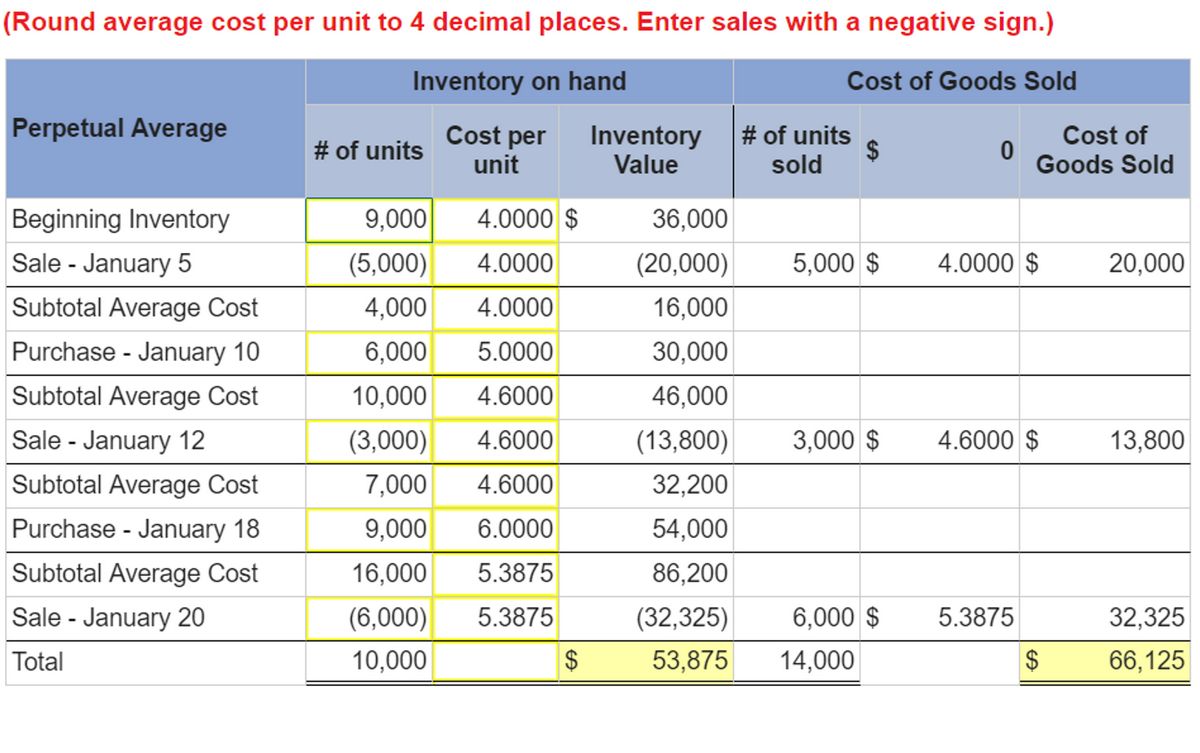

Accounting for Unit Costs

Private and public companies account for unit costs on their financial statements. Public companies use the generally accepted accounting principles (GAAP) accrual method of reporting. Unit costs are recorded at the time of production and matched to revenues through revenue recognition. Goods-centric companies file unit costs as inventory on the balance sheet. When a sale occurs, unit costs are matched with revenue and reported on the income statement.

The first section of an income statement focuses on direct costs, including unit costs and gross profit. Gross profit represents revenue minus unit costs. Gross profit margin, calculated as gross profit divided by sales, is a key metric in analyzing unit cost efficiency. A higher gross profit margin indicates higher profitability per unit sold.

Breakeven Analysis

The unit cost, also known as the breakeven point, is the minimum price a company must sell a product for to avoid losses. For example, a product with a breakeven unit cost of $10 must be sold above that price to generate profit.

To calculate the unit cost of production, companies combine variable and fixed costs and divide by the total number of units produced. For instance, if total fixed costs are $40,000, variable costs are $20,000, and 30,000 units are produced, the production cost per unit is $2 (40,000 + 20,000 = 60,000 ÷ 30,000 = $2 per unit). A unit must be sold for more than its unit cost to generate profit.

Companies consider various factors when determining market offering prices, including indirect costs that require higher pricing to cover all expenses.

Real World Example

Unit cost is determined by combining fixed and variable costs and dividing by the total number of units produced. For example, if total fixed costs are $40,000 and variable costs are $20,000, and 30,000 units are produced, the total production cost is $60,000. The unit cost is $2 per unit (40,000 + 20,000 = 60,000 ÷ 30,000 = $2 per unit).