Unsatisfied Judgment Fund What It Is How It Works

Contents

Unsatisfied Judgment Fund: What It Is, How It Works

Brian Beers is a digital editor, writer, Emmy-nominated producer, and content expert with 15+ years of experience writing about corporate finance & accounting, fundamental analysis, and investing.

What Is an Unsatisfied Judgment Fund?

An unsatisfied judgment fund is money set aside by certain states to cover uncompensated expenses related to bodily injuries sustained in motor vehicle accidents where the responsible driver is unable to pay for the damages. It is used to help the injured and not-at-fault driver pay for medical bills related to the accident.

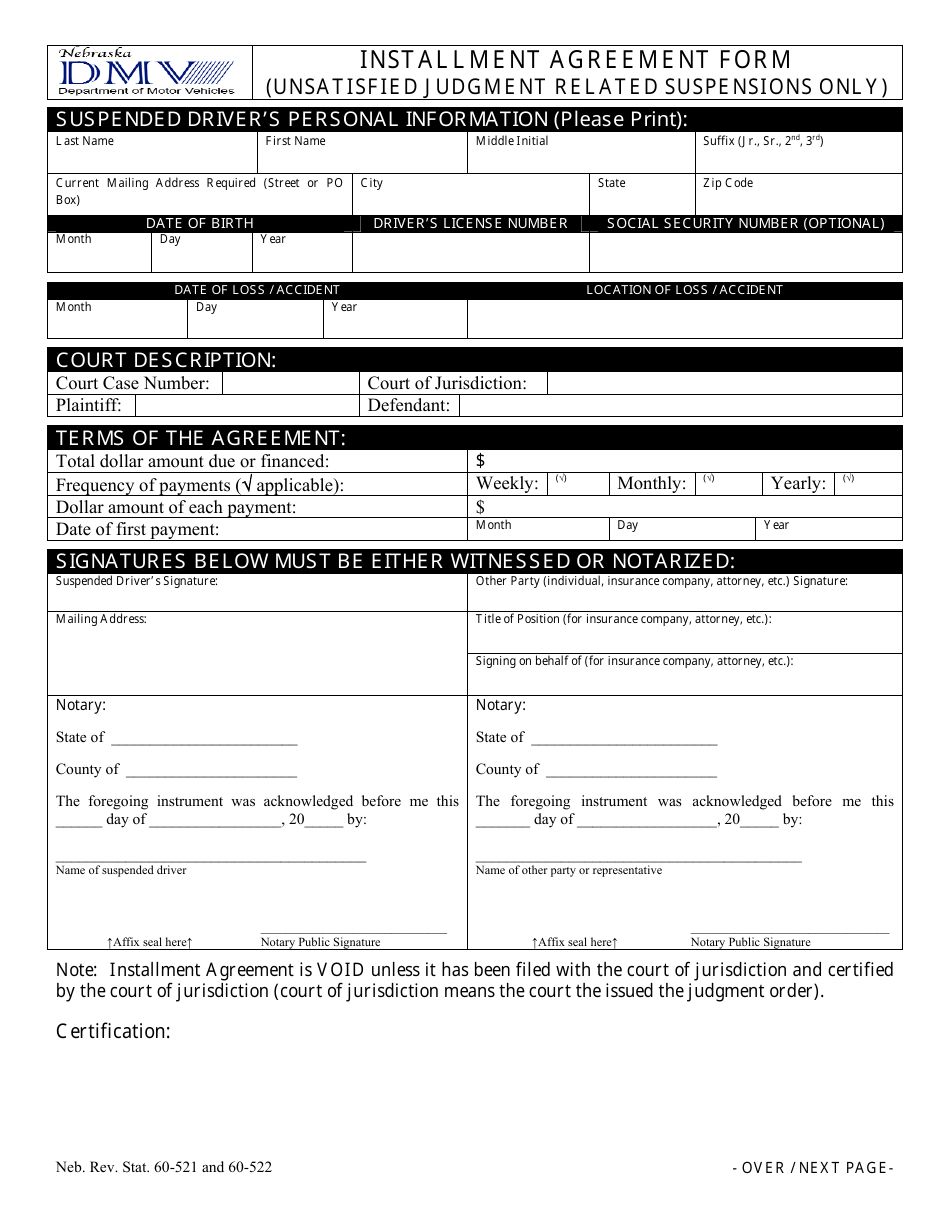

To be eligible for assistance from the fund, the injured party must prove that they were not at fault and cannot collect money from the responsible party. Usually, the injured party must file supporting paperwork with the DMV to get an unsatisfied judgment against another driver. The requirements for this paperwork vary by state.

Key Takeaways

- An unsatisfied judgment fund is money set aside by certain states to cover uncompensated expenses related to bodily injuries sustained in motor vehicle accidents where the responsible driver is unable to pay for the damages.

- The fund is intended to protect drivers from financial losses resulting from motor vehicle accidents for which they are not responsible.

- In most states with unsatisfied judgment funds, a motorist can discharge the debt by paying it off in full or filing bankruptcy.

Unsatisfied Judgment Funds Explained

The fund is intended to protect drivers from financial losses resulting from motor vehicle accidents for which they are not responsible. The responsible party may be unable to pay due to being insolvent, underinsured, or uninsured. State funds are often financed by a small addition to the state’s automobile registration fee. The fund pays unsatisfied judgments up to certain fixed limits.

If a driver is determined to be at fault in an accident and unable to pay for damages, there can be penalties such as losing their driver’s license until the financial damages are covered. Once the responsible driver pays back the money to the unsatisfied judgment fund, they may be eligible for a driver’s license again.

Penalties for Unsatisfied Judgments

Penalties for having an unsatisfied judgment can vary by state, but they usually include losing your license and ability to register a vehicle until the debt is paid. In most states with unsatisfied judgment funds, a motorist can discharge the debt by paying it off in full or filing bankruptcy.

In some states, a motorist can discharge the debt entirely via bankruptcy, while in others, they are still required to pay the debt but can be given a payment plan. Once the motorist can show the DMV that the debt has been paid or discharged, or that they are making payments according to a court-approved plan, driving and vehicle registration privileges can typically be reinstated.

If the motorist at fault pays back the unsatisfied judgment amount, the injured motorist must file paperwork with the court to show they have received the owed money. Once this paperwork is filed, the motorist at fault can take it to the DMV as proof that the debt is paid and use it to have their license reinstated.

The costs of an unsatisfied judgment can be steep and can cause an uninsured or underinsured motorist to lose driving privileges for years if they cannot pay back the debt or declare bankruptcy. This is why motorists are required in most states to carry collision insurance and why it’s a good idea to ensure sufficient coverage.

The costs of an unsatisfied judgment can be steep and can cause an uninsured or underinsured motorist to lose driving privileges for years if they cannot pay back the debt or declare bankruptcy. This is why motorists are required in most states to carry collision insurance and why it’s a good idea to ensure sufficient coverage.