Uberrimae Fidei Contract Definition and Examples

Uberrimae Fidei Contract: Definition and Examples

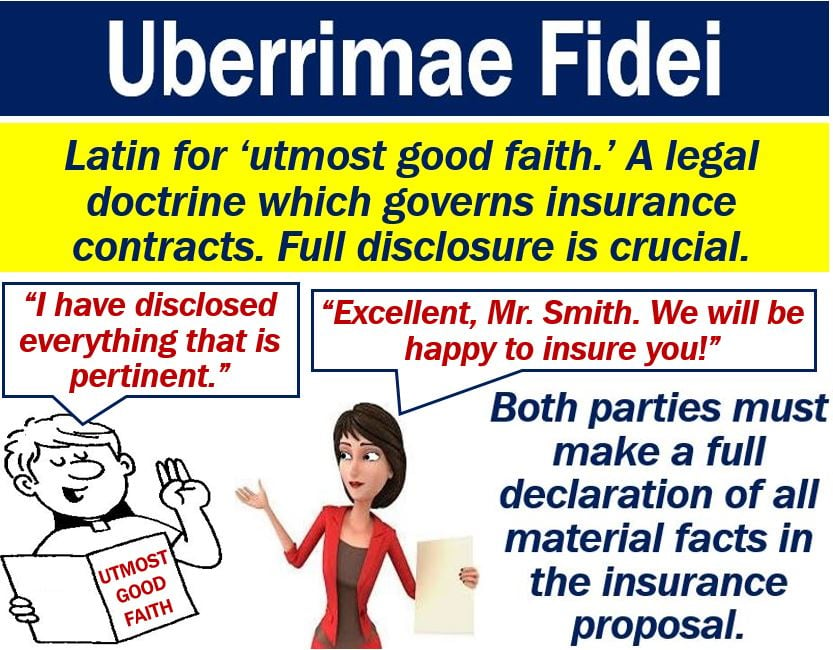

An uberrimae fidei contract, common in the insurance industry, requires the highest standard of good faith during the disclosure of all material facts that could influence the other party’s decision. Failure to adhere to this contract voids the agreement. Uberrimae fidei is also known as utmost good faith.

Key Takeaways:

– An uberrimae fidei contract requires the highest standard of good faith during the disclosure of all material facts.

– Uberrimae fidei means "utmost good faith" in Latin.

– The principles of uberrimae fidei were expressed in the case of Carter v Boehm.

Understanding Uberrimae Fidei Contracts

Uberrimae fidei requires parties to fully disclose relevant conditions, circumstances, or risks to their counterparts. Failure to do so can render the contract null and void, releasing the other party from obligations.

Uberrimae Fidei in Insurance Contracts

Insurance contracts are the most common type of uberrimae fidei contracts. Full disclosure is essential to accurately determine the level of risk undertaken by the insurer. This principle aims to protect against adverse selection, where the applicant possesses more information about their risk than the insurer. Not acting in utmost good faith can result in rescinding the policy.

Special Considerations

Uberrimae fidei serves as the foundation of reinsurance contracts. It allows reinsurers to rely on primary insurers’ processes while investigating and reimbursing good faith claims.

Origin of Uberrimae Fidei

The principles of uberrimae fidei were first expressed in the case of Carter v Boehm. The insured must not withhold any privately known information and must act in good faith.

Examples of Breach of Utmost Good Faith

A breach of utmost good faith occurs when one party fails to disclose material information that would change the contract’s nature. For instance, not disclosing that you are a regular smoker when applying for health insurance is a breach.

Difference Between Caveat Emptor and Uberrimae Fidei

Caveat emptor and uberrimae fidei are opposing principles. While utmost good faith requires full disclosure, caveat emptor places the responsibility on the buyer to uncover risks.

Major Reasons for Breach of Utmost Good Faith

Reasons for breaches include withholding relevant information and lying, both of which invalidate a contract of utmost good faith.

The Bottom Line

Uberrimae fidei contracts in the insurance industry necessitate the disclosure of all material information. Failure to do so can result in contract termination. This type of contract is particularly important in reinsurance.