Loss Aversion Definition Risks in Trading and How to Minimize

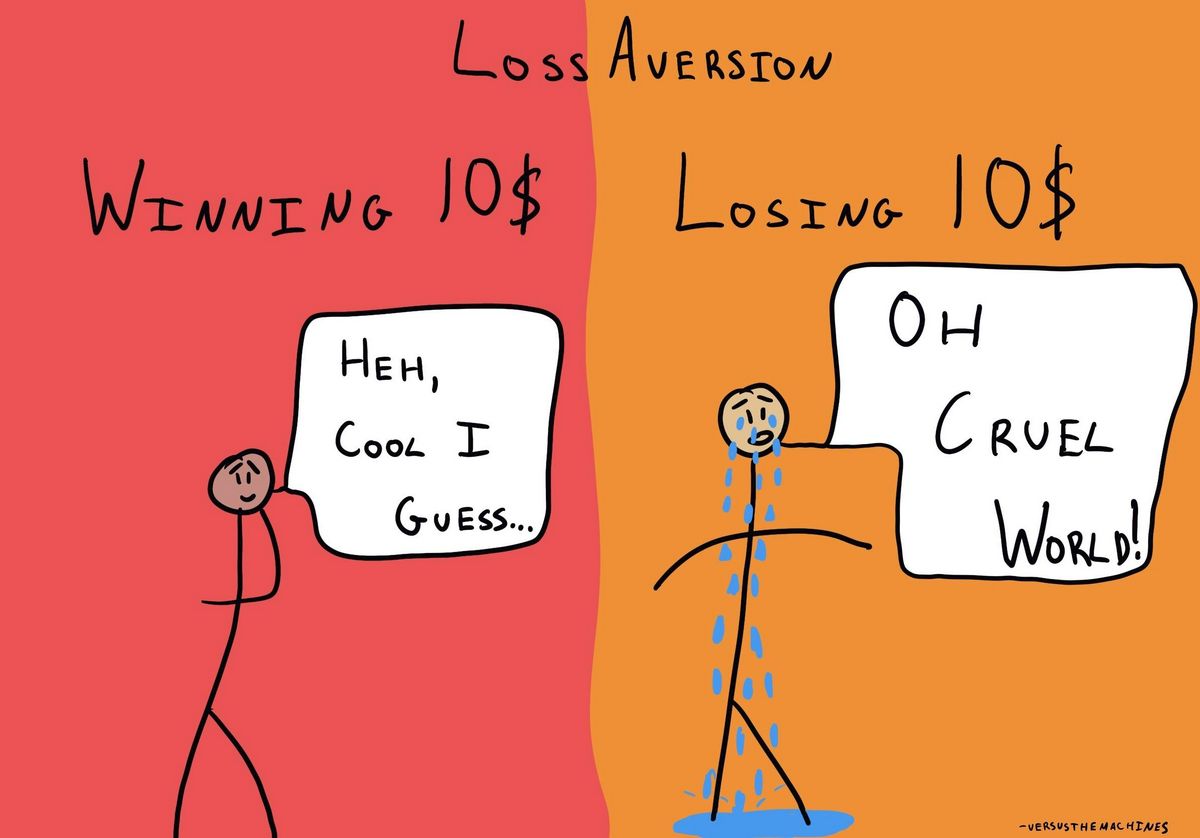

Loss aversion refers to the perception that a loss is more psychologically impactful than an equivalent gain. For example, losing $100 is often more painful than gaining the same amount. This perception of loss can lead to risk-taking behavior that further exacerbates losses. In the field of behavioral economics, loss aversion is one of many cognitive biases that can affect decision-making.

Some key takeaways regarding loss aversion are:

1. Loss aversion causes individuals to experience losses more severely than gains.

2. This fear of loss can lead investors to make irrational decisions, such as holding onto a stock for too long or selling too soon.

3. To avoid psychological traps, investors should adopt a strategic asset allocation strategy and think rationally, rather than being controlled by emotion.

Understanding loss aversion is important because it can greatly impact investment decisions. The fear of incurring a loss can cause investors to hold onto losing investments in hopes of a recovery, even in the face of evidence to the contrary. However, it is worth noting that some studies question the practical effect of loss aversion.

Loss psychology can also contribute to the asymmetric volatility phenomenon observed in stock markets, where market volatility is higher during declining markets than rising ones. This preference for avoiding losses rather than acquiring gains can lead to negativity bias, causing investors to focus more on bad news than good news and potentially missing out on bull markets.

To minimize loss aversion, investors can follow a strategic asset allocation strategy and periodically rebalance their portfolios according to a rules-based methodology. Formula investing, such as constant ratio plans, can help maintain portfolio weights and counteract momentum investing. Additionally, diversification, buy and hold strategies, and smart beta strategies like equal weight portfolios can be effective ways to mitigate market inefficiencies and risk.

While loss aversion can pose challenges, there are also positive aspects to loss psychology. By learning from losses and adopting rational trading strategies, investors can capitalize on stock and bond market fluctuations and become more aware of their decision-making process.

Loss aversion may be rooted in our brain’s wiring and our evolutionary history, as protecting against losses was advantageous for survival. Social conditioning also plays a role in our fear of losing, not only in monetary losses but also in competitive activities and interpersonal relationships.

Loss aversion can explain increased risk-taking behavior as individuals may take on greater risks in an attempt to recover losses rather than facing the psychological pain of realizing and accepting the loss.

While humans tend to be loss averse, the degree of loss aversion varies among individuals. Trained economists and professional traders tend to exhibit lower levels of loss aversion than others.

It is important to differentiate loss aversion from risk aversion. Risk aversion is rational and varies based on individual circumstances, such as income, assets, age, and investment time horizon. Loss aversion, on the other hand, illogically magnifies the impact of losses compared to gains.