Riding the Yield Curve

Riding the Yield Curve

What Is Riding the Yield Curve?

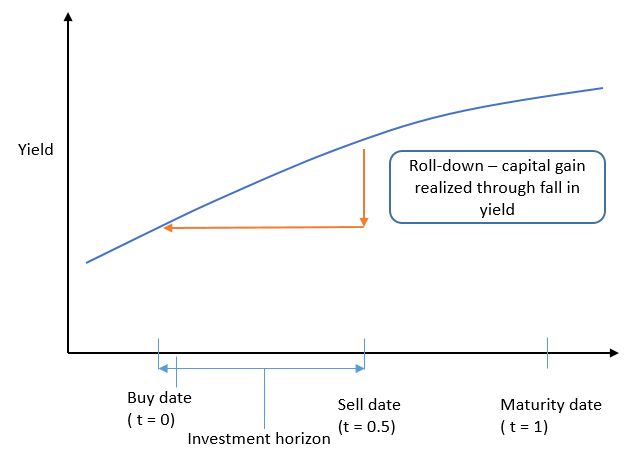

Riding the yield curve is a trading strategy involving buying a long-term bond and selling it before it matures to profit from the declining yield over the bond’s life. Investors hope to achieve capital gains through this strategy.

As a trading strategy, riding the yield curve works best in a stable interest rate environment where rates are not increasing. Additionally, the strategy only produces excess gains when longer-term rates are higher than shorter-term rates.

Key Takeaways

– Riding the yield curve refers to a fixed-income strategy where investors purchase long-term bonds with a maturity longer than their investment time horizon.

– Investors sell the bonds at the end of their time horizon, profiting from the declining yield over the bond’s life.

– For example, an investor with a three-month investment horizon may buy a six-month bond with a higher yield and sell it after three months.

– If interest rates rise, riding the yield curve is not as profitable as a buy-and-hold strategy.

How Riding the Yield Curve Works

The yield curve graphically illustrates the yields of bonds with different maturities. The curve slopes upward from left to right, indicating that short-term bonds have lower yields than longer-term bonds. An inverted yield curve implies low investor confidence in economic growth.

In bond markets, prices rise as yields fall, which often happens as bonds approach maturity. To take advantage of declining yields, investors can employ riding the yield curve by buying a bond with a longer term to maturity than their expected holding period.

Advantages of Riding the Yield Curve

An investor’s expected holding period refers to the length of time they plan to hold investments in their portfolio. While fixed-income investors typically purchase bonds with a maturity matching their investment horizon, riding the yield curve aims to outperform this low-risk approach.

When riding the yield curve, an investor purchases bonds with longer maturities than their investment horizon and sells them at the end of that period. This strategy aims to profit from the upward slope of the yield curve caused by liquidity preferences and greater price fluctuations at longer maturities.

In a risk-neutral environment, the expected return of a 3-month bond held for three months should equal the expected return of a 6-month bond held for three months and sold at the end of the three-month period. In other words, a portfolio manager or investor with a three-month holding period buys a six-month bond with a higher yield and sells it after three months.

Special Considerations

Riding the yield curve is more profitable than the classic buy-and-hold strategy only if interest rates remain unchanged. If rates rise, the return may be lower than the yield from riding the curve and could even result in a capital loss compared to a bond that matches the investor’s investment horizon.

Additionally, this strategy produces excess returns when longer-term interest rates are higher than shorter-term rates. The steeper the yield curve’s upward slope at the beginning, the lower the interest rates when the position is liquidated at the horizon, resulting in a higher return from riding the curve.